features

Franchising: Fitness franchising

The UK’s franchised fitness sector is heating up, with more and more operators turning to this model to achieve ambitious growth plans. Tom Walker takes a closer look

In the 1950s, J Lyons & Co’s restaurant chain Wimpy arrived in the UK, bringing with it a new approach to business strategy: franchising.

Spanning sectors that include retail, food and automotive, it’s a business model that has enjoyed remarkable growth over the last 70 years. The fitness industry, however, has been a latecomer, waiting until 2003 to welcome its first franchise – énergie Fitness.

“When we launched in 2003, we were the market makers,” says Jan Spaticchia, co-founder and CEO of énergie Fitness. “The closest we had to a competing franchised fitness business was Rosemary Conley’s Diet and Fitness Clubs.”

In the 15 years since, however, the fitness industry has more than caught up. The sector is now teeming with franchised brands – ranging in size from niche operators with a handful of sites to Anytime Fitness, which has 140 clubs in the UK and Ireland

GROWING BUSINESSES

The pace of growth has been accelerating over the last five years, with both budget and mid-market operators entering the fitness sector with ambitious growth plans.

easyGym, which owns 16 clubs, recently revealed plans to sell 500 franchise licenses globally by 2022, while Snap Fitness is in the fourth year of an expansion push designed to raise its club count to 250.

As well as large operators, the franchising model has attracted smaller, independently-owned chains. These include Fitness Space, launched by former Olympian Tim Benjamin (see HCM February, p14), which has expanded to 22 sites in five years, and family-owned truGym, which offers franchises under two brands – the budget truGym clubs and truIntensity, a boutique HIIT concept.

The sector has also attracted a number of foreign boutique operators, keen to take advantage of the UK’s growing appetite for personalised and more intimate fitness experiences. One of these is Australian operator F45, which offers its members high-intensity circuit training classes in studios which are just 200 - 250sq m (2,150-2,690sq ft) in size.

“There are huge growth opportunities in the UK, due to the health and fitness boom right now,” says Rob Deutsch, founder of F45. “There’s also an, emerging demand for functional training. It’s a concept that many people are making a priority in their life.”

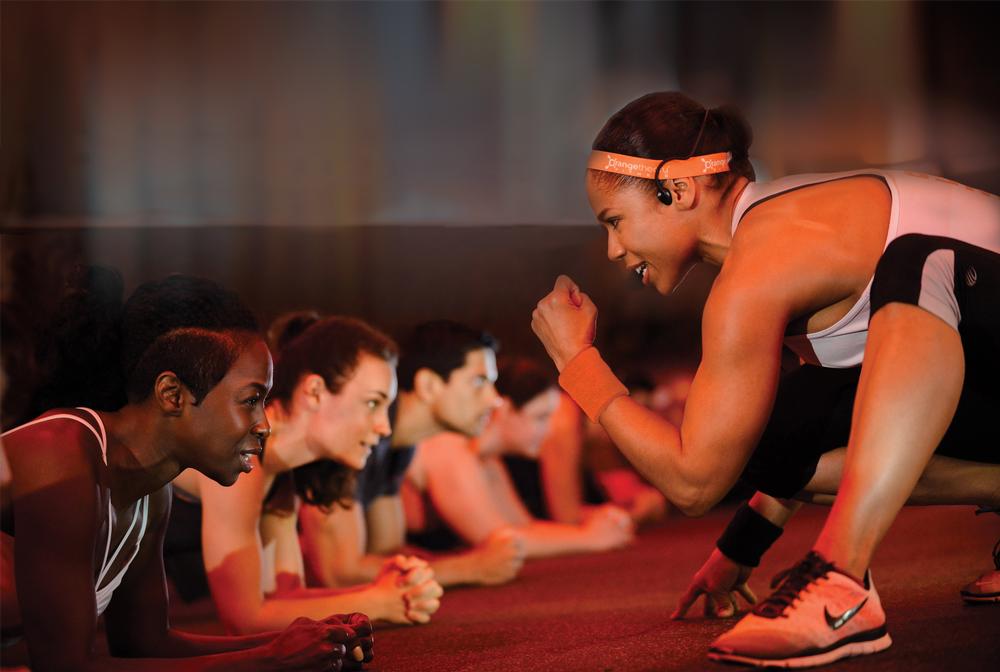

Another relative newcomer to the UK market is US-based boutique operator Orangetheory. Wildly successful in the US – where it has mushroomed from a single site in 2010 to more than 900 studios today – its concept is based on hour-long, group HIIT sessions that can accommodate up to 24 people.

Following a slow start in the UK – it initially signed a partnership deal with David Lloyd Leisure in 2013, but has so far opened just three sites – the brand reports that it’s now looking to accelerate its growth using franchisees and it has signed two master deals for a total of 110 sites across England.

“I definitely see the need for boutique fitness in the UK,” says Dan Adelstein, Orangetheory’s vice president of international development. “We just need to do a good job in growing our studios – and we are, with the ones we already have open – so it’s now a case of getting the next leases done.”

It isn’t just the newcomers to the market that have big plans. Established operators are also looking to ramp up their growth plans. Anytime Fitness is the UK’s largest fitness franchise operator – when measured by number of clubs – and the group is keen to keep its status. The company has a particularly strong presence in London, but is now ready to venture outside the capital.

“There’s potential across the UK, but we’d like to make greater inroads north of London and beyond,” says Stuart Broster, CEO of Anytime Fitness UK.

Broster was appointed to the role in August 2017 and tasked with making Anytime the largest in the country – by reaching 400 clubs by 2020.

“The majority of our clubs are currently in London and the south, and there are a lot of opportunities for our offering to thrive beyond that,” he says. “Convenience and 24/7 access are increasingly important to today’s consumers and we have the platform to deliver that model anywhere in the UK.”

MARKET PENETRATION

Broster adds that while the growth plans are formidable – not just for his group, but for the industry as a whole – they’re also based on a healthy outlook and genuine market trends.

“The fitness industry is absolutely a growth market and continues to be attractive to franchisees,” he says.

“According to the 2017 State of the UK Fitness Industry Report, health and fitness is the sector to invest in. Market value has increased to £4.7bn and membership has exceeded 9.7m. Penetration is also at an all-time high of 14.9 per cent, meaning that one in every seven people in the UK is now a gym member.”

Isaac Buchanan, CEO of Snap Fitness, agrees and adds that, while more people are visiting gyms than ever before, there’s plenty of room for growth. “If you look to the US and Australian markets membership penetration rates are up to 7 per cent higher than the UK,” he says.

“Looking more locally to some European markets, the penetration rates are almost double that of the UK. I think the next 10 years will see a significant increase for UK penetration rates and that will be great for the sector.”

FINDING FRANCHISEES

But with so many franchise operators looking to expand, could the recruitment of suitable franchisees and the availability of suitable sites become problematic?

For énergie’s CEO Spaticchia, the answer is twofold.”It’s tougher now and we need to work harder,” he says. “But as the market has grown, so the number of people looking to get involved in franchising has also significantly increased.”

Spaticchia adds that when it comes to an “ideal” énergie franchisee, although there’s no set profile – there’s one element that connects them all.

“Our franchisees come from all walks of life,” he says. “Some have worked in fitness before but others haven’t – there are doctors, people with an IT background and club managers. The only thing that connects them is that we recruit people who are passionate about providing fitness for others.”

At Snap Fitness, the profile of potential franchisees is more defined and is heavily focused on entrepreneurial skills – as the strategy is to help each grow beyond a single site. “We look for small business experts,” says Buchanan. “Previous experience owning or operating a business is compulsory in our network and we’re looking for people who want to grow with us and learn along the way as they expand beyond a single location.

“All but six franchisees in our network are currently multi-site operators. Of those six, three have purchased additional territories already and we’re actively finding them sites as we speak.”

FUTURE VIEWS

It seems the future for the franchised sector looks bright. While competition is increasing, the consensus is that there’s still plenty to go around – both in terms of market penetration and the number of potential franchisees ready to pick up sites.

“We feel very lucky because we’re on the cusp of two very hot markets,” says énergie’s Spaticchia. “The budget fitness space is very hot from an investment point of view, but equally, fitness franchising has never been hotter.

“So while we have to deal with the environment getting more competitive, I think the fact that so many international franchises are heading for the UK has really shown that this is very fertile ground for growth.”

Adelstein says that a big reason for international companies, such as Orangetheory, arriving in the UK is the friendly business environment. “The franchising laws are easier here,” he says. “There are less regulations for franchisors than there are in the US or Canada, which makes the UK environment conducive to brands like us coming in.”

The trend of new companies entering the market is likely to continue too, says Buchanan. He doesn’t see any signs of a limit being reached: “I don’t think we’re anywhere near saturation point,” he says. “When the market is still as attractive as it is, brands will just keep on coming.”

LOCATION, LOCATION, LOCATION

How do you identify potential locations?

Isaac Buchanan, CEO, Snap Fitness

We invest quite significantly in our GIS (Geographic Information System) to ensure that we have the most up-to-date and thorough information available for our franchisees. We spend a lot of time segmenting our existing members and searching for look-alike audiences across UK towns to offer a best match against our high performing clubs. Our property team target these areas first and foremost.

Dan Aldestein, VP of franchising development, Orangetheory

We use a mapping programme called Buxton, which overlays potential members, based on who they are, where they are and what their habits are.

We have that same programme available in the UK and we’ve been able to look at the masses of areas which could potentially be the best for us for business growth and match our potential members by type.

We know who our members are in London – what Mosaic group they are – and also who our members are in the US and Australia and in many other places, and they’re all very similar.

Q & A

Rosenberg currently owns three clubs – Cambridge Heath (opened 2011), Canning Town (2013) and Worcester (September 2017)

Fitness4Less franchisee

How did you get into fitness franchising?

My background is all fitness and I’ve been in the industry for 20 years. I started as a graduate trainee at Holmes Place back in 2000 and worked my way up to become manager at Holmes Place Hendon. After that I worked for Top Notch Health Clubs – looking after London Bridge and Blackfriars – and then Greens Health and Fitness for five years before setting up my fitness franchising business with Fitness4Less.

What’s the toughest thing to tackle?

The main challenge is the property aspect. Unless you’re “in the know”, it’s really hard to find a decent site. Our Cambridge Heath club is 14,000sq ft, Canning Town is 13,000sq ft and Worcester is 16,000sq ft – so these aren’t small clubs. You need strong property expertise to find sites like that.

What are the fitness sector’s biggest strengths, when it comes to franchising?

It’s still an emerging market, with penetration around 15 per cent, so there’s a huge opportunity for the market to grow. It’s also something that you can be passionate about and you see that in this industry – there are passionate people working in fitness and they enjoy what they “sell” and what they do every day.