features

Interview: Jon Canarick

Barry’s Bootcamp expansion, the Curves success story in Asia, and an at-home fitness market set to boom in the wake of Peloton’s success. The fitness lead at private equity firm North Castle Partners speaks to Kate Cracknell

Tell us about North Castle Partners

North Castle Partners is a lower- to middle-market private equity firm that’s focused on consumer brands, and within that, uniquely focused on health and wellness.

Back in 2001, we called it Healthy Living and Ageing. Today we call it Healthy, Active and Sustainable Living. But effectively we’ve been investing in the wellness movement for over 20 years. We’re raising our seventh fund now – a US$400m fund – and in a few years’ time should have close to US$1bn invested across the sector.

We have three areas of focus. The first is beauty and personal care. Second is nutrition, which we define as weight management, healthy foods, supplements and so on – we own the diet centre business Jenny Craig, for example. And finally, there’s fitness and active lifestyle, which along with nutrition has been our most active sector over the years since investing in Equinox in 2001.

I became involved in the fitness division in 2007, after North Castle had sold Equinox, and ultimately took on a leadership role in our fitness club efforts in particular.

What sort of deals do you get involved with?

Our primary investment type is small capital leveraged buyouts, where we enter an entrepreneurial business as the first investor and the majority shareholder.

We also do some growth sector investing, in cases where there’s significant revenue growth but not yet a profitable business – where the company needs capital to grow its business, for example.

Finally, we occasionally invest in turnaround situations where we feel we have relevant expertise to offer. Jenny Craig would be a good example of that, as we’d been successful in weight management before.

The smallest investment we’ll get involved with is US$10m – if we see opportunity and a chance for growth – but most commonly we invest in businesses with revenues of US$25–200m.

Tell us about Curves

We’ve recently sold our interest in Curves, which was another turnaround effort.

The thing no one knows about Curves, unless you live there, is that it’s an incredible brand and operation in Asia, and particularly in Japan where it’s the number one fitness brand, with close to 2,000 clubs and nearly 1 million members.

Why is that? Firstly, in Japan, compliance is easier to obtain. There’s also the fact that the typical Curves member is at least 55 years old, with a median age well into the 60s, and in Japan they do an incredible job of delivering an anti-ageing marketing message.

In the US and Europe, Curves has two primary consumer types: both of them are older, but one of them is also quite overweight. In Japan, they don’t have nearly the same obesity percentages as we have in the UK and US, or Australia for that matter. So, in Japan, Curves primarily focuses on an anti-ageing message and women go very loyally, year in year out, three days a week. Engagement is absolutely off the charts and average membership is over 450 per club, which is huge for Curves’ small format model.

So, women are getting the vital benefits of strength training – slowing down muscle ageing and maintaining metabolic rate – in a format that’s both effective and social. Really, Curves was way ahead of its time: a group of local women working out together, doing something that’s achievable, where there’s a lot of chatting and community. It covers off, in a meaningful way, most of the buzzwords in terms of today’s consumer needs.

However, in all honesty, our efforts to turn Curves around in the North American and European markets were unsuccessful. There are still very successful clubs in both markets, and incredible owners doing a great job – they will continue to be successful on a smaller scale. But the business became so heavily focused on Japan and Asia that it didn’t make sense for us to own it much longer. We weren’t the most value-adding investor and we were able to work out a deal to sell it to our tremendous partners in Japan, who do an awesome job of running that business. So, they are now the owners of the global franchise.

What are your best known fitness investments?

The most well-known fitness investment we currently have is boutique fitness brand Barry’s Bootcamp.

When we invested in Barry’s, it had 17 clubs – in New York City and southern California, plus franchises in San Francisco, Boston, Miami, Nashville, London (UK) and Norway. It had grown in a fairly unusual way, and CEO Joey Gonzalez and the other founders had finally decided it was time to bring everything together.

Barry’s was something special – an incredible workout and an aspirational brand – and we saw an absolute tonne of opportunity to expand. We always have fad/risk conversations internally, and boy did we have them here, but Barry’s has been around since 1998, and its methods – running and weightlifting – aren’t fads. It puts together two time-tested ways to exercise together in a way that’s unique and fun.

I would also argue that, if you compare it to the quality of a personal training session – as far as really getting results out of that hour – Barry’s is tremendous value. I personally would rather spend US$30 on a class than US$90 on a personal training session.

So, I think there’s quite a bit of room to run. We’ve just opened in Manchester in the UK and will be opening in Seattle, US, soon. We’re going to open in Calgary in Canada and will open in Houston, Texas, alongside the existing stores in Dallas. We’ve already opened in Toronto, Stockholm, Sydney, Milan, Dubai and we’ve just announced a Paris opening for May. Meanwhile, back in the US, we think Los Angeles, New York and San Francisco can probably each support around 10 locations. We’re very rapidly growing our global footprint.

What else is in your fitness portfolio?

We’ve also invested in a much smaller, pilates-style boutique business called SLT, which uses Lagree Fitness equipment [see HCM June 18, p66].

We’re Lagree’s largest licensee, with a very strong focus in the north-east: New York City and its premium suburbs, plus Boston and Philadelphia. The thing that’s interesting about the Lagree Fitness model is that you own your own brand: SLT is our brand and we can do with it as we please, within the territory we’ve acquired. That’s important to us.

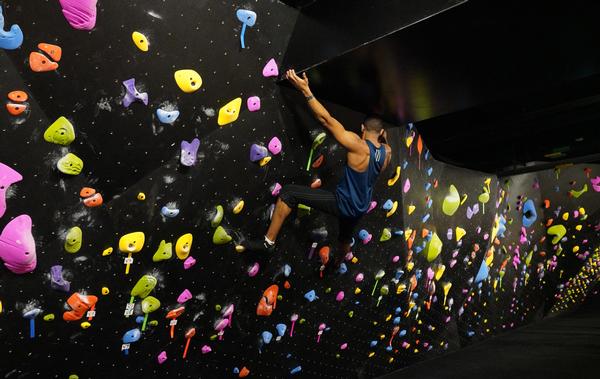

To complete the list, we have a climbing business called Brooklyn Boulders – a very cool, urban, hip brand and an incredible way to work out. It currently operates four large format climbing gyms, plus a unique, smaller format adventure centre that includes bouldering. We’ll be opening sites five and six this year, with seven and eight to follow probably in the next 12 to 18 months.

What defines all your investments?

We tend to focus more at the premium end of the market, although not deliberately. I’m a big believer in mass market businesses and there’s nothing at all that would prevent us from investing in a lower-cost brand. In fact, Planet Fitness was always interesting to us. However, it was very quickly a very large business, so larger private equity firms were also keenly interested in it.

So, it may simply be that the mass market is a bigger market and tends to attract larger investment firms, whereas premium brands tend to be a little bit smaller – and we’re a smaller firm. That said, we’re also very focused on brand, and we very often find the stronger brands are in the premium space. Where we never want to get caught, of course, is in the middle.

Is there anything you’re less likely to invest in?

We’re open to pretty much anything, as long as the growth opportunity is there. That said, given the increasing convergence of technology and club-based experiences, I’d stress that we’re not a pure technology investor. Our focus is on bricks and mortar and physical products, rather than on tech/software only.

I’m not saying we’d never do it if the right combination of brands existed, but we’re not a Silicon Valley-style investor who’s willing to make deep losses to gain market share and eventually get to profit 10 years later. That’s just not how we’re structured.

What’s your role in each investment?

We have two primary roles, and then of course many ancillary roles. The first thing we do is to work on the strategy in partnership with the CEO: we’re very thoughtful around what makes the business special and how we think it should grow. This forms the basis of a living, breathing, flexible five-year plan.

Secondly, we work with the CEO to make sure they have the right management team and other resources in place to deliver the plan as laid out.

Layered on top of this, there are two key elements to our approach that I believe drive our success: the relationships we build and the opportunities these bring; and our genuine integrity and devotion to our values in an ethical sense. Yes, we exist to add value and create value for our investors, otherwise they won’t invest in our subsequent funds, but we do it while being good people and living with a set of values.

A final point, but another major term we use internally is ‘full potential partnership’. If you have a strong, trust-based relationship with your CEO partner, they should never be afraid to call and deliver bad news. It’s the only way to truly know what the problems of the business are; the people in our network can then help solve those problems.

When it comes to our exit strategy, while our funds do have a lifecycle, we try to be flexible. Sometimes we extend our plans and have longer ownership times; sometimes something opportunistic comes along. We’re also very proud of our record in selling a significant number of our portfolio companies to strategic buyers, as opposed to just another private equity firm. We like the idea of creating great brands and great companies that larger businesses then have a strong desire to own. We then make our return by helping to grow businesses and build beautiful brands.

Do you only invest in US-based companies?

We’re a relatively small firm and our resources are very North America-focused. We, therefore, invest in businesses headquartered in the US and Canada. We then secure international partners to expand them overseas.

For example, Fitness & Leisure Group (FLG) is our partner in Australia for Barry’s – the first time Barry’s has partnered with a company rather than an entrepreneur. FLG has rights beyond Australia and we’re excited at the prospect of them helping us reach new markets – Asia, for example, where Barry’s has no presence.

What will the market look like in 15 years?

In some ways, a continuation of the same: there’s no question in my mind that HVLP – high value, low price – will continue to have deep penetration. Within HVLP, we’re seeing the development of a 2.0 model, certainly in the US, where a lot of value is being put in.

Specifically, I’m talking about group exercise, which I believe is a better way to work out for many of us.

Meanwhile, in the boutique segment, there’s a lot of content out there with the growth of competition – specifically with the proliferation of boutique franchises. At some point, we’ll see some closures of boutiques in urban markets where property rates are very expensive.

Then there’s Peloton, which has completely re-shaped what it means to do fitness at home. Connecting hardware to content is just in its early stages in this market and Technogym has already announced it’s getting into this game. I imagine SoulCycle will eventually do something too.

That premium market is going to get competitive, and over the next five years there’ll be a battle for number two: Peloton is so far ahead, I can’t imagine anyone being a threat to its business, but it won’t be as easy any more.

So, the competition is now here… and who’s to say it always has to be at a premium price point? Why shouldn’t someone also come in with a cheaper at-home option?

All that said, I believe we humans still desire ‘live’ experiences – whether it’s because we work out with friends or because we need motivation and accountability.

The club market is, therefore, okay – Peloton just ups the ante, especially for the premium-end facilities. They have to do a better job at making customers want to come in now. They have to deliver a better experience: if it’s the same thing people can get at home, they’re probably not going to bother going to a club.

For now, though, I think Peloton is just increasing the average number of times people work out a week. When they can’t get to the gym, they do a 30-minute class from home, and that’s just awesome for health and wellness.

Favourite workout

Barry’s Bootcamp!

Favourite holiday destination

I truly don’t have a go-to spot. We change it up from visiting the parents in Florida to exploring the Grand Canyon, and from beach/pool lounging to a visit to see Mickey Mouse with my eight- and 10-year-olds

Favourite restaurant

Babbo Italian Eatery (NYC)

Favourite book

I Know This Much is True

Favourite film

Shawshank Redemption

Favourite app

Podcast aggregator (I love podcasts)

The person you’d most like to meet

If I had to choose, I’d be super psyched to meet Bruce Springsteen

The best piece of advice you’ve ever been given

To not spread myself too thin – it’s so important to focus on fewer things and do them well. I’m working on it!

What you’d like to be known for

Empathy and kindness