features

Fitness trends: Trending now

Stephen Tharrett and Mark Williamson of ClubIntel summarise the key trends identified in the 2016 International Fitness Industry Trend Report

redicting trends takes more than asking people’s opinion. It requires digging down and understanding the behaviours of an industry over time by measuring the actual practices that take place, how those practices are adopted, and how those adoption rates change over time.

It’s also important to understand the difference between a fad and a trend – indeed, this is critical to sustainable business profitability.

Fads are short-term phenomena that rise quickly, take the world by storm and just as quickly fade into obscurity. In business, they have been known to create mercurial success and protean failure.

Trends, on the other hand, are events that evolve into wider movements. The power of a trend can manifest itself in the attitudes, values and behaviours of its audience. Consequently it is trends, not fads, that industry leaders must focus on in order to map out strategies for their businesses.

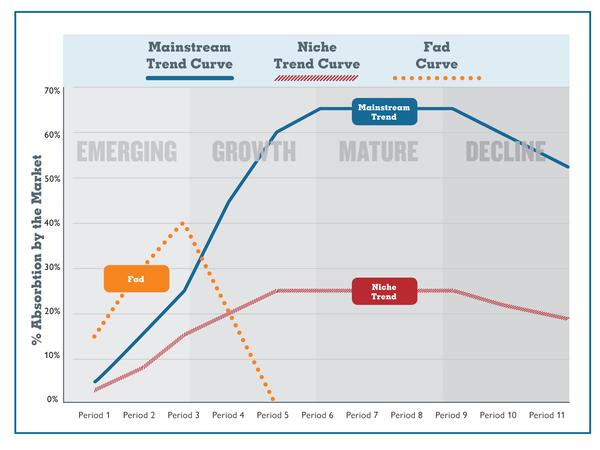

The lifecycle of a trend begins with a period of emergence – a period when a trend first makes a noticeable presence. Emergence is followed by a growth stage: a period of rapid evolution and market adoption. Following the growth stage, maturity arrives, when a trend achieves a highly developed stage of life – growth takes a back seat to the trend’s status as an important bellwether in its respective industry. Finally there’s decline, when a trend typically loses ground or possibly even becomes extinct.

Layered onto this, by looking not only at growth but also at adoption levels, we can also determine if it’s a niche trend or a mainstream trend (see Figure 1).

Technological trends

So, what are some of the insights garnered from the 2016 International Fitness Industry Trend Report in terms of the trends currently being adopted by operators from across the fitness sector?

Technology within the health and fitness industry remains in its infancy, but over the past three years has demonstrated the greatest absolute growth of any trend category.

Only one area of technological innovation – social media – has this far been adopted by over 50 per cent of the industry. However, other tech-based practices – such as club-based mobile apps, cloud-based registration and scheduling platforms, virtual group exercise classes and fitness wearables – all fall among industry practices that have shown the greatest relative growth over the past three years. These are all categorised as ‘emerging’ trends.

Our prediction is that these technology trends will continue to evolve over the next few years to the point where leveraging them will be a competitive necessity, not a point of differentiation.

Meanwhile, online pricing and online membership sales present a huge opportunity. In 2016, 40 per cent of respondents said their facilities showed their pricing / fees online, but only 28 per cent actually sold memberships online; growth in these trends remains slower than average, putting them into the ‘niche’ category at this stage.

While the growth in these practices over the past few years has been considerable (more than 100 per cent relative growth), they still fall well behind the percentage of consumers who make purchases online more generally. If the industry is going to remain relevant to tomorrow’s consumers, it will need to adopt these practices more readily.

Reaching a peak

In 2016, we saw a migration of trends into either the ‘mature’ category or the ‘niche’ category. This means these trends experienced changes in adoption and growth percentages that indicated they had reached their peak, whether that meant being a trend the masses had adopted, or a trend that spoke to a niche audience.

Bootcamp-style classes, personal training and bodyweight resistance training are examples of programming trends that reached maturity in 2016 – their growth is slowing as they are adopted by the majority of operators.

Thus far, however – and in spite of excellent market visibility – programmes such as health/wellness coaching and online self-directed fitness training (i.e. services you can use online via a computer or mobile device, both at home and at a gym, using a virtual trainer rather than a PT) appear to be heading towards a niche in terms of adoption levels by the industry, and therefore by consumers.

Here to stay?

Another key point is that, when it comes to programming, services and training – the classes and other forms of training offered in health clubs around the globe – fads are more prevalent than true trends. Indeed, approximately 50 per cent of the themes emerging in this category are classified as niche trends (i.e. low adoption levels), while another 34 per cent are classified as either ‘emerging’ or ‘growth’ trends.

There has also been a decline in adoption levels for several forms of programming over the past three years – and in some instances over the past year. For example, over the past three years, dance-related classes, exotic dance-orientated classes and suspension training classes have all seen adoption levels decline versus three years earlier.

These cyclical shifts in adoption show how fleeting some trends may actually be. From an operator perspective, it’s important to know when to go with them and when to let go.

Specialist or generalist?

The type of business you operate (boutique fitness studio, commercial fitness club, non-profit, etc) reflects considerably on the types of trends witnessed within the facility.

For example – and perhaps unsurprisingly – non-profits demonstrate higher adoption levels for socially-driven programmes, sports-related programmes and programmes that are targeting young people and seniors.

Interestingly though, commercial fitness clubs seem to be adopting a model that’s trying to be everything to everybody: there appears to be no outstanding trend, but rather an across-the-board adoption of most trends.

FIGURE 1:

LIFESTAGES OF TRENDS AND FADS

About the report

Stephen Tharrett and Mark Williamson are the co-founders of brand insights firm ClubIntel.

In the third quarter of 2016, ClubIntel and its partners facilitated the fitness industry’s second behavioural trend study – the 2016 International Fitness Industry Trend Report. The study measured adoption and growth rates for over 90 fitness practices across multiple categories (programmes, services and training protocols, equipment, facilities and technology) and industry segments (region, size of business, business model, etc).

The full report can be obtained for free from: www.club-intel.com