features

Boutique fitness: Paying for expertise

Ray Algar reports on the rise of the small, perfectly-formed studio

It’s interesting how the narrative of an industry ebbs and flows. Ten years ago, media outlets were brimming with news of how brands such as LA fitness and Fitness First were bringing their conveniently located, affordably priced clubs to more consumers. BC Partners had acquired Fitness First for an enterprise value (the takeover price including a company’s debts, less any cash held on account) of US$1.5bn, and its new owners were excited about building on its base of 1.1 million members through its ‘value for money’ clubs.

Soon after this deal, low-cost gyms began emerging offering a narrower, stripped-back fitness experience at monthly fees that were more than 50 per cent lower than the national average price. An industry that once predominantly served the country’s more affluent households was evolving into something that was far more open and democratic.

In order to provide remarkably low monthly fees, gyms were super-sized, migrated to a self-service 24-hour operating model, and powered by abundant technology to drive down costs. They captivated the interest of consumers and journalists who found them refreshingly simple to understand.

Now the industry is turning again and embracing the power of the group, building a stronger sense of community and fostering a tribal following by creating signature fitness experiences that feel more authentic. Authentic because the ‘pact’ between the studio and customer, in my experience, seems clearer – you’re here because we’re a specialist and appreciate the effort required to reach your desired outcome. These are purposeful places with serious work to be undertaken.

A mature industry

The UK commercial health and fitness sector has evolved significantly since being kickstarted by David Lloyd with his first club in Heston, Middlesex, in 1982. These early private sector clubs whetted the appetite of the general public, which in turn encouraged new entrants. In 2015, however, the UK private health club sector is mature. There are high levels of merger, acquisition and restructuring activity. Competition is intensifying and private sector membership subscription income for 2010–2014 grew at an annual average rate of just 0.1 per cent – slower than annualised gross domestic product (GDP) – as it becomes more challenging for many operators to raise prices.

Given this competitive backdrop, you would assume the predominant conversation among gym consumers would be “how little I pay”. But in fact for a growing minority it’s becoming “how much I pay”, with a 45-minute boutique fitness studio class potentially costing more than one month’s membership at a low-cost gym. So what are these new specialist studios, and what’s driving this trend?

Defining a studio

Studios are known by many names – ranging from ‘microgyms’ to ‘boutiques’ to ‘stores’ – but regardless of the terminology, I believe they possess the following core characteristics:

• Intimate scale

• Narrow programme/activity offer

• Expert and guided instruction

• Schedule-driven

• Nurturing environment

• Group-powered

• Shared common interest

• Compelling mission

Many studios are founded by enthusiastic individuals with a compelling everyday mission to share their deep passion for a programme or activity. For example, when Hilary Gilbert moved to London from the United States she couldn’t find indoor cycling classes as good as the ones she had experienced in New York, so she decided to create her own studio and BOOM Cycle was born.

Being small in scale, studios need to operate efficiently and are therefore driven by scheduled classes using expert instructors who optimise the experience for all participants. The support and encouragement of others is transmitted through the class, bonded by a shared common interest to create a nurturing environment. It’s a powerful recipe that can be significantly different from a mainstream gym experience, and therefore very compelling from a customer perspective.

Popularity

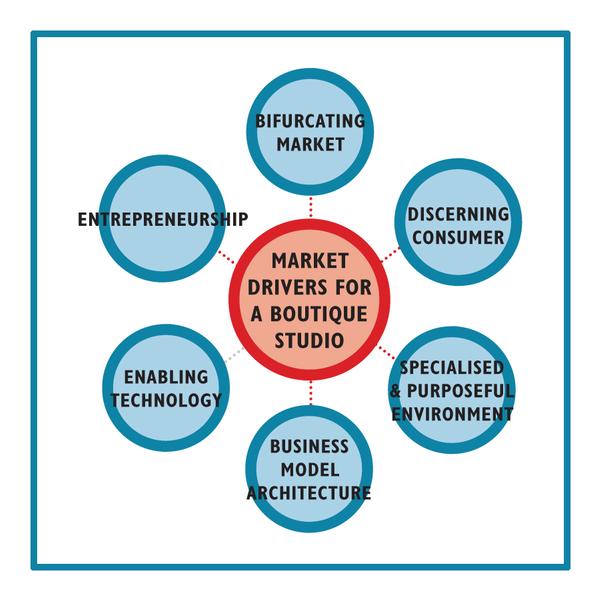

I see six key factors that are driving the popularity of boutique fitness studios (see Figure 1), which I discuss in my new report – 2015 UK boutique fitness studio report: A strategic investigation into an exciting growth segment.

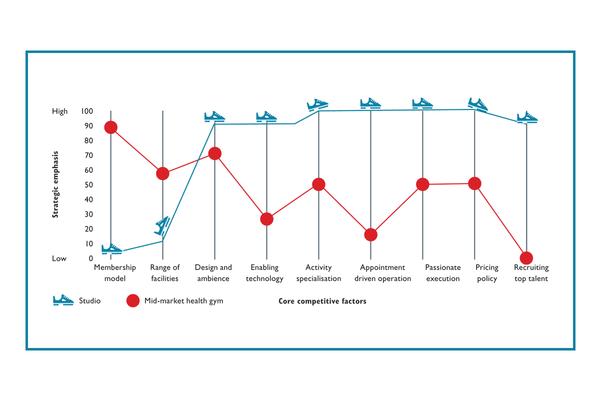

Meanwhile Figure 2 shows the distinctive way a studio will create value for its customers. It shows nine core factors on which a typical mid-market club traditionally competes. The red line illustrates the gym and the emphasis placed on each of these nine factors. A higher score means the club invests more to provide extra to members.

The mid-market club invests in a range of facilities and programmes, built on the traditional membership model. It aspires to be a competent and consistent generalist.

The strategic profile for a studio is very different. It chooses to eliminate the membership model, which it believes to be unnecessary in forging engagement with customers. The range of facilities is reduced so that all peripheral areas and their associated costs are removed from the business.

Next, it raises its strategic emphasis in six factors on which the studio wishes to build its reputation. First, more resources are invested in design, because the studio aspires to create a distinctive brand image – one that communicates to customers that they’re stepping into an environment that looks and feels more retail store than gym.

The use of enabling technologies is increased, providing customers with a greater sense of autonomy that’s very empowering – check online for class availability, select a preferred bike or place in a class, book, pay and charge ancillary items such as rental items, food and water to a stored payment card, creating a simple, cashless experience.

Activity specialisation is critical, because the studio’s long-term success is dependent on it developing a deep expertise that’s difficult for others in the industry to imitate.

Unlike most gyms, the studio is appointment-driven, which drives efficiency but also forms part of its purposeful environment – customers are here to experience some meaningful activity. Passionate execution is driven from the reality that whether someone returns is based on their next hour’s experience – there’s no safety net from selling minimum-term memberships.

Finally, studios have created a new competitive factor around the recruitment of top talent, recognising that the instructor is a vital component in creating the difference between a mediocre and a remarkable experience. Many top studio instructors have ‘rock star status’ both in studio and online, having stretched themselves to reach the top of their profession (commanding higher fees or salaries).

The result is that a very different strategic profile is created, which allows the studio to break free of low prices, discounts and year-round promotions. This is because it exudes a confidence in its ability to make a meaningful difference in the lives of its customers.

Apply a neutral lens

Were you aware that, when a business comes along with a disruptive and novel consumer proposition, it can sometimes be left unchallenged for more than 10 years? Often this is because the ‘lens’ used to evaluate the disruptor is clouded by assumptions and pre-existing bias. It has happened before in the UK fitness industry, when the first low-cost gyms arrived and were greeted by incumbent operators with ridicule and scepticism – “they are not viable”, “they are unsafe” and “they will not be around for long”. They were wrong.

This myopic thinking is unhelpful and commercially damaging; so much more intelligent to apply a neutral lens when assessing the emergence of boutique studios and other fitness concepts that are vying for the attention of consumers. You may not buy into or believe in the operating model, but the very least you must do is understand it.

FIGURE 1

MARKET DRIVERS FOR A BOUTIQUE STUDIO

FIGURE 2

STRATEGY CANVAS FOR A STUDIO VS MID-MARKET HEALTH CLUB

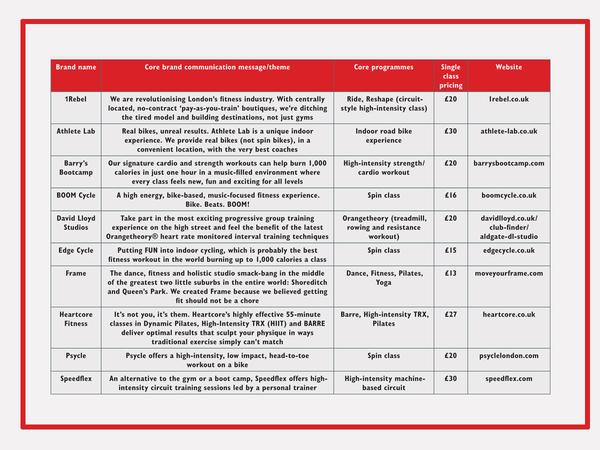

Boutique offerings

All studios allow ‘pay as you train’ access, with single class pricing shown in Table 1 below. Repeat visits are incentivised by packaging classes into bundles. Barry’s Bootcamp, for example, has a 50-class package costing £700, equivalent to £14 per class (prices at April 2015). Some studios like Athlete Lab offer a membership as well as ride packages. ‘Peloton membership’, for example, costs £129 a month and offers unlimited rides, but does require an initial six-month commitment. David Lloyd’s Orangetheory studios offer an unlimited studio session membership for £99 a month.

My report also includes an extended case study on SoulCycle, which I believe is an essential brand to understand for those with an interest in this sector, not least because it’s demonstrating how to grow a brand (45 studios open as at June 2015) while retaining the essence of what makes a studio experience so remarkable. It exemplifies what many of the UK studio brands now need to prove, so they can also successfully scale from one or two studios into a credible network capable of extending beyond London and the south-east of England.

Table 1 UK

STUDIO BRANDS – MARKETING AND PRODUCT FEATURES

ABOUT THE AUTHOR

Ray Algar is the managing director of Oxygen Consulting, a company that provides strategic business insights for organisations connected to the global health and fitness industry.

The 2015 UK Boutique Fitness Studio Report is a collaboration with Matrix Fitness UK, whose unconditional support was essential.

The full 43-page report can be purchased for £175 + VAT from: http://bit.ly/BoutiqueReport