features

TEA/AECOM Theme Index 2016 - Rising Star

Effective marketing campaigns, smart reinvestment and facility upgrades drive growth in Asia-Pacific, but it’s not all plain sailing. AECOM’s Chris Yoshi looks at the successes and the hurdles still to leap

For the Asia region, 2016 was a year of contrasts, with some parks marking record-breaking success and others experiencing sharp declines and losses. The biggest event was the successful opening of the Shanghai Disney Resort, which not only set the attendance record on a pro rata basis for a park in mainland China, but also set the highest admission prices.

On the other hand, major theme parks in Hong Kong (Ocean Park and Hong Kong Disneyland) suffered sharp declines and recorded losses for the year. In between, there are stories of success and challenges worth noting as the industry matures.

The outlook is for a boom in development of new “theme parks”, waterparks and indoor entertainment centres. We estimate more than 100 projects are due to open in the next five years. Most of these are in China, although there is rising interest in Indonesia, Malaysia, Philippines and India.

The big get bigger

By and large, theme park group operators had a strong year with an overall increase of 4.3 per cent, well ahead of the average. The big are getting bigger. The Asia group operators had a strong year with substantial growth from OCT, Fantawild and Chimelong. These operators opened new locations and saw some growth in park attendance.

Some parks offered cheaper nighttime tickets and pay-as-you-go (PAYG) tickets, boosting attendance at older attractions. There was a new trend for nighttime tickets that include a show and a few rides. Also, a number of Asian theme park companies are entering management agreements with scenic areas and smaller attractions to extend their operations and business mix.

Songcheng Worldwide is a successful operator with a growing number of properties. However, its focus is on large performance shows with small supporting areas. For consistency, we are no longer considering these shows in the same category as full-day, large-scale theme parks. Therefore, Songcheng is not included in the 2016 report and standalone performance shows have been excluded from group operator attendance estimates.

Mixed bag

The Asia theme park industry had mixed results, with a few parks having a standout year and some experiencing attendance declines. Universal Studios Japan had another strong year with over 14 million visitors as Harry Potter continues to provide an attendance boost. Attendance at theme parks in the rest of Japan was largely flat.

China was generally a growth market with new parks opening and attendance rising at existing parks. Shanghai Disney Resort had a strong first half-year of operation, exceeding expectations. It opened with six themed lands and a number of first-ever attractions. Overall, the length of stay is a very high 9.5 hours – visitors are arriving early and staying late to get the full experience. Disney’s largest castle is the backdrop for a dramatic evening spectacular show, keeping people in the park. The main complaint is long lines (four-hour waits) for a few attractions. The most popular ride is Soaring Over the Horizon.

Fantawild’s several new parks resulted in large increases in attendance. The company also added new attractions and shifted to a flexible pricing system, including general admission tickets at their older parks, helping drive attendance growth. OCT experienced growth in many parks due to new investments, more entertainment programming and cheaper nighttime tickets.

Both Hong Kong Disneyland and Ocean Park experienced sharp visitation declines, largely as a result of reduced tourism from China and regional competition. Increasing competition is a worrying issue – as more parks open in Mainland China, there’s less need for tourists to Hong Kong to visit a theme park. Hong Kong Disneyland has approved a $1.4bn (€1.2bn, £1.1bn capital investment plan for 2018-2023, with new attractions and lands opening nearly every year. New hotels and a waterpark are under construction at Ocean Park.

In South Korea, Lotte World benefited from increased foreign tourists, but recent political troubles between South Korea and China have caused a sharp drop in Chinese arrivals, which will have a negative impact on South Korean parks in the coming year.

Riding the wave

Waterparks performed well in 2016, with 6.9 per cent overall growth. Chimelong retained its position as the world’s most attended waterpark, with solid attendance growth thanks to more entertainment programming and a longer operating season. The summer nighttime programme has been successful, with China’s wealthy, urban millennials enjoying this offering.

Waterparks in other Chinese cities generally experienced growth or flat performance despite many new smaller waterparks and waterplay areas opening. It’s estimated that more than 60 waterparks and waterplay areas are currently under construction in China.

In South Korea, Caribbean Bay had a standout year with strong growth while other waterparks were flat. In Southeast Asia, Sunway Lagoon in Kuala Lumpur introduced a Nickelodeon waterplay area, resulting in strong results. In Thailand, there are reports of a flood of waterpark and waterplay areas opening up, creating intense pricing competition in the market.

The culture side

Museums in Asia had a good year with 3.1 per cent attendance growth. The National Museum of China in Beijing became the world’s highest attendance museum for the first time. The trend in Asia is for more “free” entry museums, which is great for consumers, but challenging for operations.

Science museums continue to be a popular format, with travelling shows and temporary exhibits being very popular. However, there are challenges. There is a lack of essential components like collections, exhibitions, trained curatorial, conservation and other museum professionals, education programmes, business planning and operating funds.

Road ahead

In summary, Asia’s theme park industry is booming. Well planned and well executed projects are achieving critical and financial success. However, increasing competition is raising the bar in terms of quality and the need for continual reinvestment.

We’re seeing more innovation in terms of product and format in Asia than anywhere else. This innovation has a cost and not all parks will be successful. Guest experience is still the most important factor in the success of theme parks and waterparks.

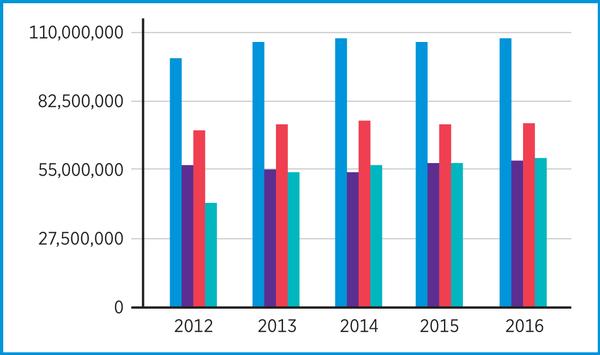

Graph 1:

Attendance at top theme parks/amusement by region

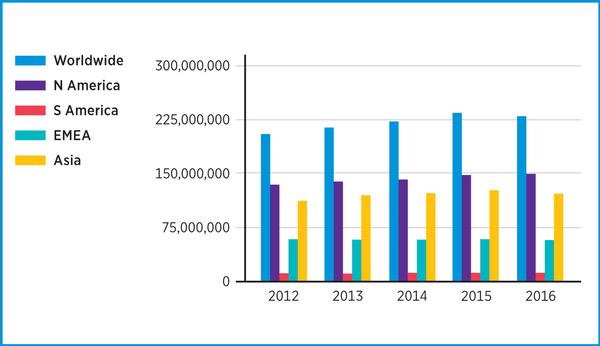

Graph 2:

Attendance at top waterparks by region

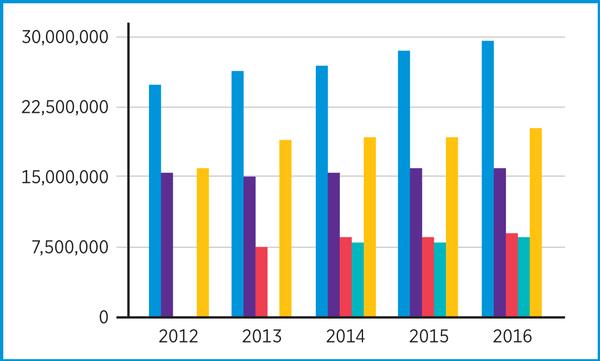

Graph 3:

Attendance at top museums by region