features

Research: Growth study

David Lloyd Leisure takes the top spot for revenues in Europe, according to the European Health & Fitness Market Report 2018 from EuropeActive and Deloitte

ealth and fitness offerings continue to attract more and more Europeans according to the European Health & Fitness Market Report 2018 by EuropeActive and Deloitte.

Four years ago, EuropeActive adopted a goal of achieving 80 million members of European clubs by 2025 – with about 46 million members reported at the time.

The industry remains on track to reach this target and Deloitte found total membership within the EU, Norway, Russia, Switzerland, Turkey and Ukraine increased by 4.0 per cent in 2017 to about 60 million at the end of the year.

In terms of market size, Europe continues to be the world’s largest market, with total revenues of €26.6 billion in 2017, ahead of the USA at €24.9 billion in 2016 (IHRSA Global Report).

At constant foreign currency exchange rates, the European market size increased by 3.8 per cent in 2017 compared to 2016, largely driven by strong growth in the UK market of +6.8 per cent.

At actual foreign currency exchange rates, year-on-year growth in Euros amounted to 1.9 per cent, due to negative exchange rate effects.

While the low-cost segment continues to grow in most markets, there are also an increasing number of, premium-priced boutique fitness clubs and growth in offerings such as functional fitness, personal training and small group training.

These are some of the main findings of the Deloitte report, which was presented at the European Health and Fitness Forum in Cologne in April.

McFIT Group and Basic-Fit

“The importance and popularity of health and fitness continues to grow throughout Europe and the stationary fitness market meets this demand with innovative concepts and an increasingly dense network of clubs,” explains Karsten Hollasch, partner and head of consumer business at Deloitte.

“The leading players continue to drive market growth, as evidenced by the fact that the 30 largest operators managed to increase their membership by 9.5 per cent to 14.1 million. However, many smaller chains and independent fitness club operators can distinguish themselves with excellent service and individual customer support.”

Among the leading operators, German discount chain McFIT Group retained its top position in terms of membership, with an estimated 1.73 million members, an increase of 110,000 over the previous year.

The total number of McFIT-branded clubs increased by six from 241 to 247, the group also operates 15 clubs under the High5 brand and 18 under the John Reed brand, following 12 openings in 2017.

John Reed, which was launched in 2016, has a slogan ‘Not your average gym’, and combines elements of a classic McFIT gym with unconventional interior design and a strong focus on music at monthly membership fees of €25 to €40.

After expanding the John Reed concept to Budapest and the Prague in 2017, the company plans to enter the Swiss market in 2018, with a John Reed in Zurich.

In addition, the group’s North American subsidiary 1UP, is expected to open two clubs in Los Angeles and San Francisco by the middle of 2019.

Ranking second in size is Netherlands-based low-cost chain Basic-Fit with 1.52 million members, which generated by far the highest organic membership growth of all operators with 310,000 additional members. This was largely due to the opening of 87 clubs in France.

British low-cost operator Pure Gym ranks third after increasing its membership by 103,000 to 923,000 in 2017. In February 2018, the Leeds-based company, which was acquired by North American private equity firm Leonard Green & Partners in November 2017, became the third European fitness operator to reach 1 million members.

Seven of the top 10 operators by membership can be considered low-cost operators. Following the three market leaders are German franchise operator Clever Fit (fourth), UK-based The Gym Group (fifth), German up-and-comer FitX (eighth) and the Danish market leader, Fitness World (ninth).

Two other top 10 operators – Health & Fitness Nordic and Migros Group – have a low-cost brand in their portfolios.

DLL is revenue leader

While five low-cost operators (McFIT Group, Basic-Fit, Pure Gym, Fitness World and Clever Fit) also rank among the top 10 in terms of revenue, the UK-based premium operator David Lloyd Leisure (DLL) tops the ranking with revenues of €483 million. DLL took the lead from fellow premium operator Virgin Active, from whom it acquired 14 clubs in the UK in June 2017.

In addition, DLL expanded its international presence in 2017 with the opening of a second Spanish club in Madrid in February, as well as the acquisition of the Malaspina Sporting Club in Milan. At the end of 2017, DLL operated 112 clubs in six countries – including 99 clubs in the UK – with a total of 580,000 members.

Ranking second in Europe with revenues of €388 million is the Swiss fitness conglomerate and social enterprise, Migros Group.

At the end of 2017, the Migros cooperatives operated 311 health and fitness facilities with 466,000 members in five different countries.

In Switzerland, Migros Group expanded its market-leading position in May 2017, with the acquisition of Silhouette Wellness (22 gyms under two brands). At year-end, Migros Group had roughly 230,000 members across 123 clubs under twelve different brands in Switzerland, of which 98 were part of the Migros FitnessCard network.

The Silhouette clubs will be re-branded and join the network in 2018 as well. Notably, Migros Group entered the low-cost market in 2017, with the launch of its “Only Fitness” brand in the Swiss capital of Bern.

Meanwhile, Virgin Active dropped to third place in the revenue ranking with estimated revenues of €356 million following the transaction with DLL in the UK, as well as the sale of its entire Iberian business (eight clubs in Spain and four clubs in Portugal) to Holmes Place in October 2017.

At the end of 2017, Virgin Active still operated 76 clubs in Europe – 43 in the UK and 33 in Italy. However, the company remains one of the largest chains in the global fitness industry with about 1.4 million members and more than 230 clubs across eight countries in Europe, Southeast Asia, Southern Africa and Australia, according to public records.

The major acquisitions undertaken by Pure Gym, David Lloyd Leisure, Migros and Virgin Active are just some examples of recent mergers and acquisitions in the European health and fitness market.

In fact, 20 major M&A deals were recorded in 2017, the highest number since the European Health and Fitness Market Report has been published and an increase of three transactions when compared to the previous year.

“The consistently high number of mergers and acquisitions underlines the notion that health and fitness remains a highly attractive sector for strategic and financial investors alike,” says Karsten Hollasch. “By supporting the expansion of fitness operators, these investors also help the health and fitness industry to achieve further growth.”

With regards to investor types, twelve of the 20 transactions involved a sale to a strategic investor, ie, another market participant. In addition, six businesses were sold to financial investors, indicating the interest of financial investors in the fitness industry, while one company was listed on the stock market (Actic Group at Nasdaq Stockholm) and one changed hands between private investors.

The large number of transactions involving the movement of assets from founders to strategic investors indicates an increasing market consolidation. However, consolidation in the operator market remains low compared to the commercial fitness equipment market, where the four leading companies – Life Fitness, Technogym, Johnson Health Tech and Precor – account for an estimated 72 per cent of global and 85 per cent of European commercial equipment sales.

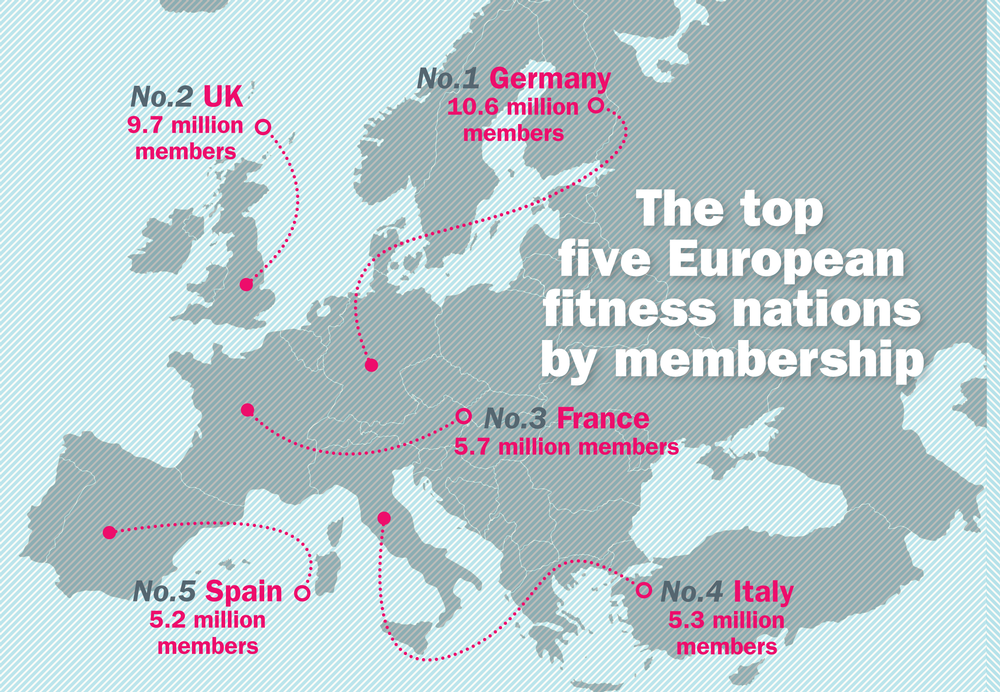

Germany is biggest market

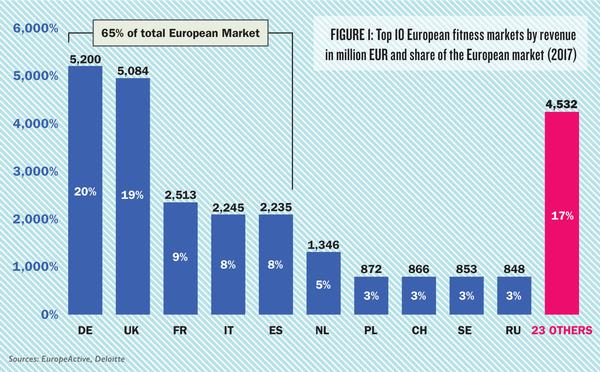

With a membership growth of 5.3 per cent to 10.6 million members, Germany strengthened its position as the country with the highest membership ahead of the UK (9.7 million), France (5.7 million), Italy (5.3 million) and Spain (5.2 million). At the same time, Germany took over first place in terms of revenue for the first time in 2017, with total revenues of €5.2 billion according to research conducted by DSSV, DHfPG and Deloitte. However, this was due to negative exchange rate effects in the United Kingdom, as the UK market grew by 6.8 per cent at constant currency compared to a 3.0 per cent growth in the German fitness industry.

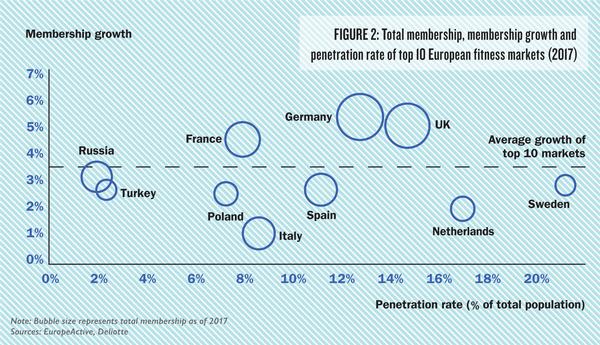

Together, the top five countries represent nearly two thirds of the entire European market in terms of both membership and revenues. With penetration rates (ratio of the number of fitness club members to the total population) of about 8-15 per cent, these countries generally offer further market growth potential and are expected to be major drivers towards 80 million total members in Europe by 2025. While Sweden (21.4 per cent), Norway (20.9 per cent), Denmark (18.3 per cent) and the Netherlands (17.0 per cent) have the highest ratio of fitness club members relative to the total population, Ukraine (2.6 per cent), Turkey (2.4 per cent) and Russia (2.0 per cent) have relatively low penetration rates, which could – in combination with their large populations – indicate potential for future growth.

“Further growth in the fitness market will be driven by favourable macro-trends such as increasing health awareness, but even more importantly by innovative fitness concepts and business models that meet customer needs,” explains Karsten Hollasch. “The definition of the fitness industry as a purely stationary fitness market is over: existing fitness concepts are being augmented by digital offerings and new market participants are developing entirely new, purely digital concepts.”

Thus, technological innovations such as mobile fitness applications, wearable tracking devices and online gyms, as well as offline activities like outdoor group workouts, provide opportunities to be physically active outside a brick -and-mortar gym and continue to gain popularity in many European markets.

While these offerings might be considered a threat by some fitness club operators, many traditional fitness providers also see opportunities in these trends and have already started to incorporate non-stationary concepts into their own business models.

With regard to EuropeActive’s ambitious goal of 80 million members by 2025, Herman Rutgers, board member at EuropeActive and co-author of the report, remains highly optimistic, saying: “2017 was another year of strong growth in both membership and market value. This shows the products and services of our sector remain highly attractive to consumers across Europe and makes us confident of reaching the industry goal of 80 million members by 2025.”

FIGURE 1:

Top 10 European fitness markets by revenue in million EUR and share of the European market (2017)

FIGURE 2

Total membership, membership growth and penetration rate of top 10 European fitness markets (2017)

Get the report

A hard copy or digital version of the

Health & Fitness Market Report 2018 by Deloitte and EuropeActive can be purchased via the EuropeActive website at www.europeactive.eu

The website also lists all other available publications from the organisation.

Prices: €149 for EuropeActive members, €299 for non-members plus P&P