features

European market report: Fitness on the rise

The European fitness market continues its strong growth, according to the European Health & Fitness Market Report 2015

The European fitness market continued to grow at an impressive rate in 2014, as the total number of health and fitness club members increased by 9 per cent to 50.1 million. While in younger fitness markets such as Poland, Turkey and Russia an increasing percentage of the population incorporates fitness into their lives, the more developed northern and western European markets grow mainly through innovation and diversification of fitness offers.

In value, the European health and fitness market grew by 4 per cent to achieve total revenues of E26.8bn in 2014. This further strengthens its position as the largest fitness market in the world ahead of the US, which was valued by IHRSA at E16.9bn (US$22.4bn) in 2013.

These are some of the main findings of the European Health & Fitness Market Report 2015, published in April by EuropeActive in co-operation with Deloitte. “The higher membership growth compared to total revenues underlines the ongoing market trend towards broader fitness offerings, including in the discount segment,” says Karsten Hollasch, partner at Deloitte and head of the German Deloitte Sports Business Group. “For me, this is clearly a sign that the markets have matured and are reacting to their members’ various needs and demands.”

Budget boom

The ongoing trend of an emerging discount segment, offering memberships for monthly fees of €30 or less, is visible in the membership ranking of European fitness providers, which is again led by German budget operator McFit. After entering the Italian and Polish market in 2014 and growing in Germany, Spain and Austria, the company had around 1.3 million members across its 223 European clubs by the end of 2014. McFit charges €19.90 a month for a membership and €9.90 for its new concept – functional training studio brand High5.

Meanwhile Netherlands-based Leisure Group Europe managed to surpass the one million member mark in 2014 and comes second in the rankings by member numbers. While the company also runs a premium concept (HealthCity), its growth was clearly driven by its budget brand Basic-Fit, which operated 264 clubs in Europe by the end of 2014.

At the same time, UK-based companies Pure Gym and The Gym Group were among the fastest growing companies in the EuropeActive/Deloitte membership ranking. Had their aspired merger not been thwarted in 2014 after the Competition and Markets Authority (CMA) decided to enter a second phase in the approval process, the combination of the two companies would have ranked third in Europe with 720,000 members.

Membership and market share

With regards to competitive position, the Danish operator Fitness World retains by far the largest market share in any fitness market, with 450,000 members in Denmark – more than 56 per cent of the total Danish market.

Overall, the 30 leading operators by members increased their total memberships by 10.6 per cent to 10.2 million in 2014 – equalling 20 per cent of the total European market.

Revenue ranking

While budget operators strengthened their positions in the membership rankings, the revenue rankings are once again led by the major premium operators. Virgin Active, part of Richard Branson’s Virgin Group, remains the revenue leader with an estimated €498m in revenues across Europe, despite the sale of nine British facilities to fellow top 10 operator Nuffield Health in August 2014. Virgin Active is among the market leaders in Italy and the UK and also operates clubs in Spain and Portugal.

Another premium operator, UK-based David Lloyd Leisure (DLL), is second in terms of revenues (€403m) and fifth in terms of membership (450,000). DLL operates 86 clubs in the UK and a total of 10 facilities in the Netherlands, Belgium, Spain and Ireland.

Health & Fitness Nordic – which operates clubs in Sweden, Norway and Finland under the SATS ELIXIA, Fresh Fitness and Metropolis brands – comes in third in the revenue ranking with €363m, while also ranking fourth in terms of membership with 487,000 members across 188 clubs.

Fitness First and INJOY are present in the revenue top 10 list. While Fitness First’s club business declined slightly in 2014, the company entered the growing online fitness market through the acquisition of NewMoove last November. Meanwhile INJOY operates in the premium market; a 30 per cent share in the company was acquired last year by fellow top 10 operator Migros, the Swiss retailer which has the largest per-member revenues of any major operator at €1,000 annually.

Investor interest

The fact that the top 10 operators now account for revenues of more than E2.8bn and appear to be on track to reach the mark of E3bn within the next two or three years is also driven by the increasing interest of investors in the fitness industry, as eight of the top 10 operators were involved in merger and acquisition (M&A) activities in 2014.

A total of 19 M&A transactions were registered in 2014, more than doubling the previous year’s total of nine deals. Of the 19 deals, 10 were conducted by financial investors.

“The large number of M&A transactions in 2014 is a strong indicator that the financial world sees the health and fitness market as an attractive sector in which to invest,” says Hollasch. “These investors will help the industry to continue its current growth, assist established operators in expanding their business, and support start-ups in entering the market with innovative concepts and offerings.”

Significant potential

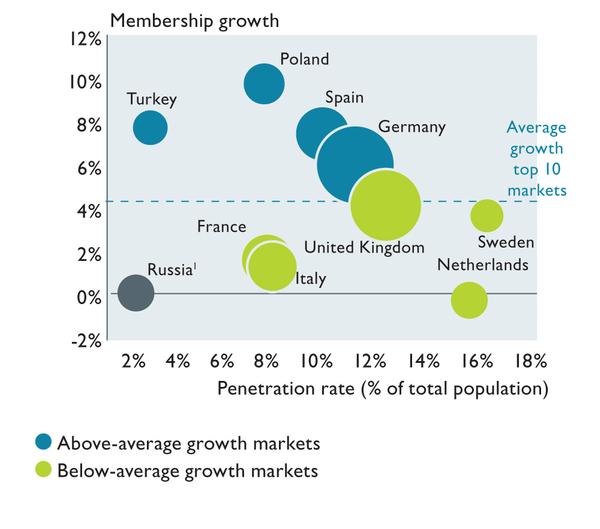

Despite the strong growth rate in 2014, plenty of future potential remains throughout all European health and fitness markets. In the two largest national markets – Germany (9.1 million members) and the UK (8.3 million members) – budget clubs and highly specialised operators are driving an expansion of the fitness market. Yet these markets still have relatively low penetration rates.

Most notably, less developed markets such as Turkey and Russia still display considerable market potential. There are around 47,000 inhabitants for every one club in these markets, with penetration rates of 2.3 per cent and 1.9 per cent respectively. By contrast, Norway is the most mature market with a ratio of 5,192 inhabitants per club and a penetration rate of 19.6 per cent.

Looking forward, the health and fitness market will be shaped by macro-societal drivers such as increasing obesity, ageing populations and a growing middle class, as well as recent technological advances such as mobile applications, networked equipment, wearables and cashless payments. With major operators and suppliers already reacting to these trends, it’s hopeful that they will be able to use them to their advantage.

“Last year, we announced ‘80 million members of health and fitness clubs in the European region by 2025’ as our industry goal,” concludes Herman Rutgers, board member at EuropeActive. “With the growth in 2014, we’re well on our way to reaching that goal. It shows the increased consumer enthusiasm for our industry’s products and services.”

SOARING SUPPLIERS

2014 was a year of strong growth for equipment manufacturers, with the estimated global market size increasing by 10 per cent to €5.5bn. After notable falls in revenue in 2008 and 2009, due to the global economic situation, most manufacturers have recovered and partly exceeded their pre-crisis sales levels.

The eight leading manufacturers analysed in the European Health & Fitness Market Report 2015 – which account for 40 per cent of the total market – achieved a growth rate of 10.6 per cent globally in 2014. US-based Life Fitness remained the largest fitness manufacturer with global net sales of €562m, followed by Italian company Technogym (€465m) and Johnson Health Tech (€411m).

Figure 1

Top 10 European fitness markets by revenues in million EUR and share of the total European market (2014)

Source: European Health and Fitness Market Report 2015 (EuropeActive/Deloitte)

Figure 2

Total membership, membership growth and penetration rate of top 10 European fitness markets (2014)

General note: Bubble sizes correspond with total membership

As no Russian market data as of 2013 is available, the change in membership is stated as 0%

READ ALL 145 PAGES…

A hard copy of the European Health & Fitness Market Report 2015 can be purchased via the EuropeActive website – visit www.health-club.co.uk/europe2015

The report costs €95 for EuropeActive members, or €195 for non-members, plus delivery.