features

Seasons of the Wolf

As Great Wolf Resorts – recently acquired by Centerbridge Partners in a reported $1.35bn deal – appoints a new CEO, former executive vice president and managing director Nikki Nolan looks back on the company’s history, growth and development and offers perspectives on the future

This August, Great Wolf Resorts (GWR) announced that Ruben Rodriguez, formerly of Carnival Cruise Line, will take the reins as CEO in September. The news came hot on the heels of the buyout by Centerbridge Partners, who in May this year finalised its reported $1.35bn (£867m, €1.23bn) acquisition of the company – one of North America’s leading brands and operator of indoor waterpark resorts.

The transaction represents the fourth iteration in Great Wolf’s rapid evolution from a privately-held, locally-focused company to its place of scale and dominance today.

GREAT WOLF 2000

My relationship with GWR really started in the summer of 2000, when I was director of global strategy and business development with the Tussauds Group.

I visited the Wisconsin Dells – a popular family tourism area in the upper Midwest, within driving distance of Chicago and Minneapolis – where I toured several properties with Chuck Neuman, founder of waterpark design firm WTI.

A standout property was Black Wolf Lodge, which had recently been acquired by GWR’s predecessor, Great Lakes Companies (GLC). Our hosts were Jack Waterman – who, with his brother Turk, had developed the property and other leisure facilities, including the nearby Noah’s Ark waterpark – and Bruce Neviaser, who co-founded GLC with Marc Vacarro.

At that time, Black Wolf Lodge had been expanded to comprise 309 rooms and a 40,000sq ft (3,716sqm) indoor waterpark, on-site dining and other facilities. When it opened in 1997, it had just 117 rooms and a 20,000sq ft (1,858sqm) waterpark.

As we walked through the impressive craftsman-style North Woods-themed resort – which may be modest by today’s standards – I knew these guys were onto something special. So much so, we at the Tussauds Group were inspired to invest in an integrated indoor waterpark resort of our own, opening Splash Landings and Cariba Creek at Alton Towers, UK, in 2003.

BRAND DEVELOPMENT & PHASE I EXPANSION

When Neviaser and Vacarro acquired the Black Wolf Lodge property and brand, they’d recognised the inherent scalability of the “staycation” model. Great Wolf set about refining its concept, operating systems and development model to enable rollout super-regionally – and, ultimately, to markets across the US and perhaps internationally.

During this initial phase of expansion, GWR grew its in-house team and solidified supplier relationships. New site development was supported by single site fundraising – including, in some cases, pre-sales of ownership units. Development was further supported by a rather buoyant financing market environment and incentives from local and regional authorities. Despite the heavy lifting required to realise the development of a $50m (£32m, €45m) resort property, GWR was successful in rolling out to new markets, including Sandusky, Ohio (2001), Traverse City, Michigan and Kansas City, Kansas (2003), and Sheboygan, Wisconsin (2004).

These initial properties, with the Dells flagship, came to be referred to as the Generation I resorts, characterised on the basis of scale (300 rooms or less) and market strength (located in smaller markets, primarily in the upper Midwest).

Although the Generation I properties went a long way towards both defining the brand and its operating model, and providing a runway for further expansion, the average project scale – at 270-300 rooms, and with indoor waterparks of 40,000sq ft to 60,000sq ft (3,716sqm to 5,574sqm) – seems modest when compared with the company’s current standards.

IPO & PHASE II EXPANSION

Great Wolf began to weigh strategic options and position itself for an IPO in 2004. Though it had just a handful of existing properties, several others were in the pipeline, including Niagara Falls, Ontario, in partnership with Ripley Entertainment / the Jim Pattison Group. Plans for resorts in the Poconos, Pennsylvania, and Williamsburg, Virginia, were perhaps most important from a strategic perspective, each representing drive-to destination tourism regions with feeder markets including greater New York and Washington DC, respectively.

John Emery, formerly of Interstate, was brought in as CEO by Neviaser and Vacarro. Together they lined up potential non-executive board members – myself included – from the hospitality, leisure and property industries.

THE NEXT STAGE

By late 2004, GWR was trading on the NASDAQ under the ticker symbol WOLF. Buoyed by the fervent property and tourism markets of the time, the IPO valued the company’s shares aggressively. Proceeds were used to consolidate the property portfolio, complete projects in development and fund improvements and new projects.

Fuelled by its successful IPO and a fertile development environment and project pipeline, GWR continued to expand its footprint and foster its internal systems, competencies and management team. This included a development and construction management team; in-house business development and legal resources.

On the operating side, CEO Kimberly Schaefer – who steps down from the position in September this year to transition to the board in 2016 – became the primary caretaker of the brand. Tim Black, formerly of Six Flags and now GWR’s COO, was also appointed at the property management level.

There were key challenges and areas of uncertainty during the post-IPO phase in Great Wolf’s evolution, involving questions around customer segmentation, geography – would the concept resonate in areas outside the upper Midwest? – and, from a market / valuation standpoint, around costs and (lack of) direct comparables.

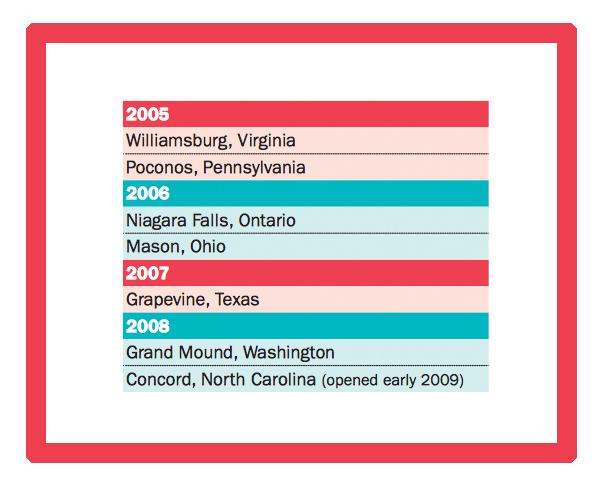

But, with its team in place and mission clear, challenges were addressed head on. The period from 2004 to 2008 represented a real step-change in company scale, market reach and the product offer, including a number of new openings (see Table 1).

2004 - 2008 KEY DEVELOPMENTS

• Scale: Introduction of the 400-600 room resort prototype, a vastly expanded indoor waterpark footprint and – in selected locations – significant conference facilities.

• Product offer: Significant expansion of resort amenities and secondary revenue centres, including both self-branded and third-party branded F&B; and multiple non-waterpark attractions and activities including the Cub Club, Scooops children’s spa and the Northern Lights arcade.

• Operations: Increased operation efficiencies through improvements to the development model, coupled with investments in new standards and systems, including early adoption of RFID technology, green technology and more.

These radical improvements at company and resort level significantly boosted not only operating margins, but also key customer metrics including revenue per occupied room (RevPOR), guest satisfaction and repeat visitation. However, by 2008, Great Wolf – like many fast-growing companies involved in ground-up real-estate development – was caught out.

In addition to macroeconomic challenges, the company’s property portfolio was exposed to many of the hardest-hit markets in the industrial heartland of the US. That included the upper Midwest and Ohio Valley, and core markets which had been over-developed with competitive offers during the market and sector boom: by 2009 the Dells had no fewer than 16 other resorts and hotels with some type of indoor water-related activity or amenity.

Facing strong market and investor headwinds, GWR shifted away from expansion and development, hunkering down to focus on its balance sheet. Cost savings were made from central office overheads, operating efficiencies were made at the resort level and non-core assets – such as the Blue Harbor Resort in Sheboygan, Wisconsin – were sold.

Many properties and brands wilted during the economic downturn, but GWR soldiered through, further solidifying its position as market leader and by 2011 – with brighter skies on the horizon – it was exploring a reverse-privatisation to better enable its continued growth and development.

The Apollo Era

In April 2012, following a well-publicised bidding war with KSL Capital, Apollo Global Management agreed to acquire GWR for $798m (£511m, €734m). At $7.85 a share, the deal valued the company’s equity units at a significant discount to the 2004 IPO price, but it came as a relief to many who had seen shares trade in the low single-digits during the economic crisis.

The transaction was a reset for Great Wolf. The company stood to benefit not only from escaping the burdensome glare, costs and requirements of a public company, but also from having a supportive ownership capable of assisting with key strategies. Those included capital improvement projects at existing properties and re-engagement of high-priority (and long-dormant) new developments and opportunities.

Strategic milestones

Noteworthy strategic milestones under Apollo’s ownership include:

• The company’s first acquisition and conversion project. In early 2013, GWR acquired Coco Key Water Resort and Convention Centre in Fitchburg, Massachusetts. A year later, and following significant expansion, rebranding and investment, Great Wolf New England opened – a market GWR had long considered to be underserved and thus a strategic priority.

• Re-engagement in Southern California. After several years in pre-development – a result of both financial markets and the State of California’s budget crisis – GWR, together with local joint venture partner McWhinney and the City of Garden Grove, revived plans to build its largest resort – down the road from Disneyland. Set to open early in 2016, it will feature a 120,000sq ft (11,148sqm) indoor waterpark and 603-room hotel and conference centre.

Centerbridge & the Future

In early 2015, after just three years of Apollo ownership, Centerbridge Partners – a New York-based private equity firm – acquired GWR in a transaction representing a significant premium to its 2012 valuation.

I recently met with executives from both Centerbridge and Great Wolf, and gained some insight into possible pathways for future growth, which will almost certainly involve continued new development projects to strategic markets, supported – for now, at least – by relatively favourable credit markets, increasing consumer confidence and leisure behaviour, moderating energy prices and other industry-positive trends.

The appointment of Rodriguez, who joins GWR from cruise operator Carnival, underlines this new chapter for the indoor waterpark brand. William Rahm, a senior managing director with Centerbridge Partners, recently praised the brand and business model created under the leadership of outgoing CEO Schaefer. In the same statement, Rahm said Rodriguez’s “varied experiences, including most recently at Carnival Cruise Line, will be tremendously valuable as GWR enters the next phase of its growth strategy and expands its footprint to new markets.”

Despite its overwhelming lead in the sector, GWR needs to be mindful of the impact of a beneficial development environment on emerging competition in key markets. Most notable is the Poconos, where two new destination indoor waterpark resorts – Camelback Lodge and Aquatopia, which opened in May 2015, and Poconos Kalahari Resort, which opened in July 2015 – will add significant tension to one of Great Wolf’s most profitable markets.

However, GWR is occupied with a host of conversion and pipeline projects (including the recently announced Great Wolf Lodge Colorado Springs, opening 2016). With its growing pack of a dozen resorts and two decades of operations under its belt – from the outset of the industry, through a number of micro- and macro-market challenges, including four iterations of ownership – it’d sure be hard to bet against the Wolf.

INDOOR WATERPARK RESORTS:

THE FACTS BEHIND THE FIGURES

“It’s fascinating to see the way the scale and growth of the ‘indoor waterpark resort’ (IWR) market is often reported. Sources claim the US waterpark resort market comprises about 360 properties in 2015. At first glance, that would lead one to believe the market is saturated and potentially overbuilt. While this may to some extent be true in selected micro-markets in the US, this ‘total industry’ figure can include all sorts of offers, such as properties with outdoor waterplay features or adjacent outdoor waterparks, and even cruise ships. When one dives deeper into the numbers, it’s clear that of the 130 or so US properties that can accurately be categorised as indoor waterpark resorts, only a fraction – roughly 50 – are of sufficient scale and quality to be characterised as destination IWRs. Even on the basis of a generous definition of the destination IWR sector, Great Wolf Resorts – with its portfolio of 13 properties (including the upcoming Garden Grove resort in California) – is far and away the market leader.”

Table 1

GWR Openings 2005-2008

Nikki Nolan has over 25 years’ experience in business development, planning and analysis. She is founder and principal of Nolan Consulting Services. Nolan served as non-executive board member following Great Wolf’s 2004 IPO, and subsequently as executive vice president and managing director of Great Wolf Resorts.