features

Interview – Shirin Gandhi: Shirin Gandhi

The partner at investment firm Encore Capital talks to Kate Cracknell about its plan to create London’s leading group of premium, holistic health clubs

We have a strategy to be the leading luxury health club operator in London, owning and operating premium health clubs in iconic locations across the capital,” says Shirin Gandhi, partner at London-based investment firm Encore Capital.

And certainly this bid has started off strongly. Using the springboard of its existing ownership of the Reebok Sports Club London, late last year the firm acquired both of The Third Space clubs – in Soho and Marylebone – as well as the 37 degrees club in Tower Bridge.

That in itself puts the newly formed group immediately on the map, but it’s the way Gandhi speaks about these deals that sets his firm apart from other investment vehicles operating in the fitness market. “We don’t even use the term private equity, because there are two fundamental differences in the way we operate,” he explains.

“First of all, the five partners who are part of Encore have all invested a significant amount of our own money into the fund. We wanted to demonstrate to the people we work with – the investors we have on board – that we’re taking as much risk as they are.

“Secondly, we describe ourselves as a permanent capital vehicle – PCV – which we also describe as an ‘evergreen’ approach. It means we have no end date by which we need to return money to investors, so we’re able to be open-minded about the investments we make. We can stay invested in a business for as long as we feel it’s right for the business.”

A foothold in fitness

He continues: “Reebok is a case in point. We first invested in 2006, which was an interesting time: Ian [Mahoney – then MD] and Diane [Kay, sales and marketing director] had already done a great job at turning the business around, but it still needed to build its membership base. That’s tough in a location like Canary Wharf, where there’s a lot of fluidity in employment, and in a club that has a policy of not tying people in to annual contracts.

“From day one we were clear we would never discount, as that just undervalues the offering. Instead we set out to give members more for their money, and we worked very hard on improving service levels and driving retention. We became a lot more proactive with members, making sure they understood the importance of fitness as part of their routine, and encouraging them to attend regularly enough that their membership represented good value.

“Our retention improved significantly, membership started to grow again, and average member visits rose – from an average of 1.5 visits a week to over two a week – and remained at a high. We now average more than 70,000 visits a month from a base of around 8,500 members.

“We then had a decision to make. With any asset we own, at some point we consider selling it – that’s the whole purpose of what we do – and we had potentially reached that point with the Reebok club. However, because of the way our fund is structured there’s no pressure to sell, and we’d realised this was a robust business. It had gone through a very tricky time in 2008 due to the recession and the uncertainty in the financial markets – really the biggest stress test you can imagine – and it came through with flying colours. Even more importantly, the management team learned a lot and came through strongly.

“We took the view that this – health and fitness – was a good space to be in, and we already owned probably the best club in the country with a fantastic management team. So we decided to stay in the sector for the longer term.

“We knew that would require building scale, but first of all we wanted to improve the facility we already had, making it a bit more contemporary without losing the soul, the feeling, it’s always had here. We started by refurbishing the spa in 2011, followed by the restaurant, and then spent a good 18 months going through the fitness floor, moving things around and making the whole member journey much more pleasurable and more sensible. That project was completed last year.

“We then knew we really did have the best club in the country, but there’s a limit to how far you can take a single club. So we decided, if we were going to stay in this sector, that we needed to build a group of clubs that met our criteria: very high-end, in iconic locations across London, with a genuinely holistic approach to wellbeing.

“Because that’s our real vision. If someone just wants to come to us to get fitter or stronger, that’s fine, but we want to create a 360-degree approach to wellbeing: where it isn’t just about the type of exercise you do, but also how and what you eat, the precautionary steps you can take, what to do if you become injured or unwell. Our vision is to offer the best facilities, the best people, the best nutrition – all in a luxurious environment – to help members lead a much better, healthier life.”

Building the portfolio

Which brings us full circle to the acquisition of 37 degrees Tower Bridge and The Third Space’s two clubs. “The Third Space has just gone through a pretty material refurbishment programme,” says Gandhi. “There’s still work to do – some sharpening of the offering to be done – but in terms of location, in terms of quality, in terms of the brand, they’re a fantastic couple of clubs.

“And 37 degrees in the More London estate has a very similar dynamic: a fantastic location with good people in the club. There’s now an opportunity for us to take that club to another level, to a Reebok standard, and generally improve the performance of the business.

“Once we’ve settled those investments down, I think we’ll have a fantastic core of clubs in very prime locations in London, with approximately 17,000–18,000 members across the group. And then it will be time to drive through the next phase of our plans: building brand new sites.

“These new sites will be around 40,000sq ft clubs, and we’re already in discussions with landlords about three or four sites. The brief is the same as for the four existing clubs: the right mix of residential and commercial, in iconic locations, and with a single landlord with whom we can build a relationship and who understands the value we can bring to the overall development.

“Nothing is imminent – it’s all at least 12 to 24 months away yet – but in my mind, if we can get to seven or eight clubs in total, that will really be the core of the group we want to create.

I don’t think we’d grow bigger than that, or go outside of London.

“However, we are looking at other options such as microgyms. We’re assessing the model and if we feel it’s here to stay, it may well be that we complement those seven or eight large clubs with a number of microgyms across London. There’s a possibility those may happen sooner – conversations are ongoing as we speak – but it’s still very fluid at the moment.”

All of which sounds like Encore is becoming an operator in its own right, I suggest. “That’s probably right in some ways, but not in others,” says Gandhi. “We’re not the guys who are in it every single day, making sure it all happens, but we are very proactive in all our investments. I’d describe it as a partnership approach: we identify opportunities together, agree the strategy together and then work together to execute it. Some things only the management team can do: we don’t have the experience to get involved. In fact, if we’re the ones having to tell management how to run any business we’ve invested in, we’ve probably got the wrong management team.

“But there’s other stuff we can bring to the party: negotiating with landlords and potential vendors of clubs, stepping back and looking at the bigger picture and the bigger opportunities, bringing the commercial perspective and in fact also the consumer perspective.

“And of course we’re putting our own money into this, and we’re viewing it as a long-term strategy. I’d say five years is the absolute minimum timeframe, after which we’ll sit down and review again.”

Branding matters

So for now, what will the new group of clubs be called? “Brand is a big issue at the moment and we’ll be reviewing it as part of the long-term, broader strategy over the next six months or so,” says Gandhi.

“We have a vision that we’re trying to create – a holistic, high-end wellness offering – so what brand reflects that best? Is it Reebok, The Third Space, 37 degrees, or something completely different? Alternatively, do we let the clubs carry on under their existing brands, with one management team and an umbrella brand that sits quietly behind them all, but where each site is slightly different to fit its specific location? There are lots of different ways we could go with this and we’ll take our time over it.

“Ultimately we just need to ensure we have one eye on our end game, remembering that it’s about delivering our very rounded approach to health and fitness and communicating that through our brand and messaging. We’re not just building a group of clubs in London.”

ABOUT ENCORE CAPITAL

Encore Capital is a London-based investment firm focused on backing entrepreneurial growth businesses. It has over £60m of committed funding and actively seeks to invest between £1m and £10m in buy-outs and development capital opportunities.

Encore Capital is opportunity-driven, with a structure and approach that allows it to make informed decisions quickly and to invest in situations which others may find challenging.

The firm is owned and managed by its five partners who take an active role in building and supporting strong management teams, working closely with these teams to develop strategic plans, enhance organic growth and increase operational efficiencies.

www.encorecapital.co.uk

A PREMIUM PORTFOLIO

Encore Capital acquired the Reebok Sports Club London from Barclays in 2006. Following an extensive refurbishment which was completed in 2014, the investment firm sought to grow its foothold in the premium fitness sector with the acquisition of further clubs: The Third Space in October 2014, and 37 degrees Tower Hill in November 2014.

There will be just one management team overseeing all clubs within the group, with Ian Mahoney – chair of the Reebok Sports Club London – continuing his involvement with Encore Capital and effectively acting as the fitness industry insider within the growing portfolio, as well as being a minority shareholder in the business.

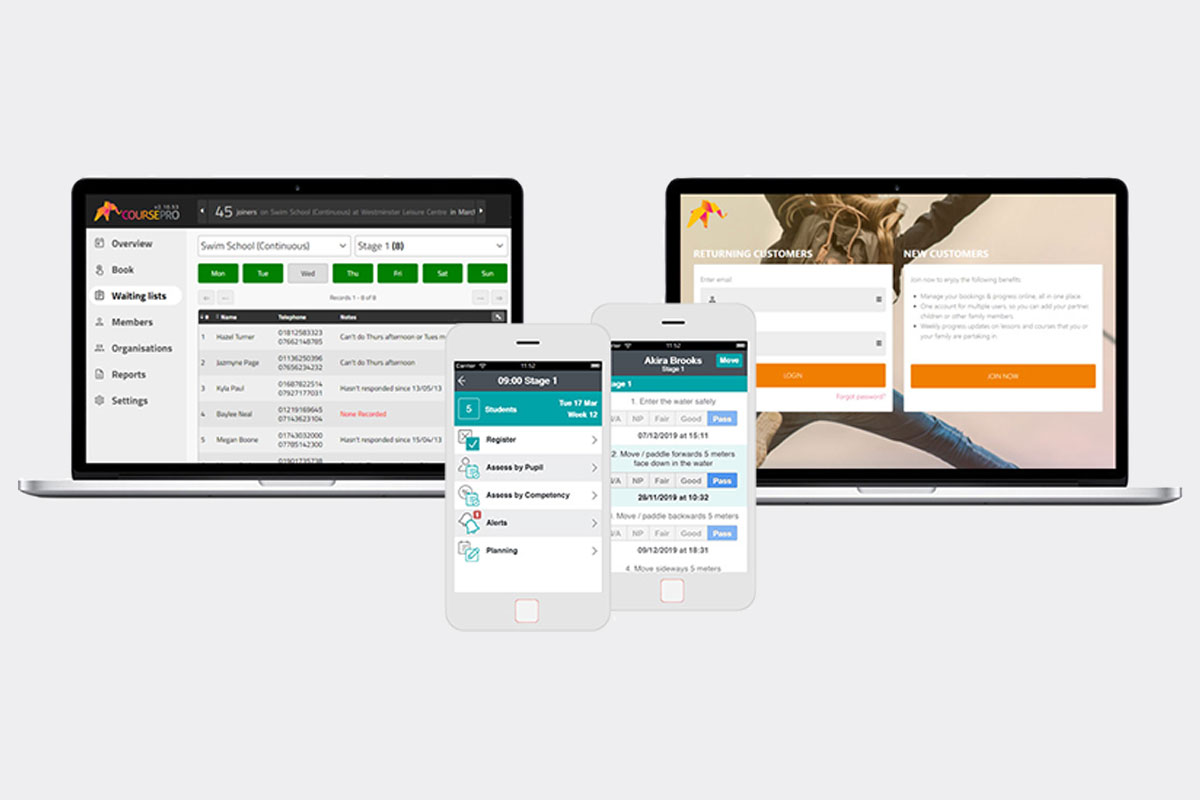

• Reebok Sports Club London

With over 8,500 members and occupying 100,000sq ft over three floors, The Reebok Sports Club in Canary Wharf is Europe’s largest luxury health club. It offers a huge free weights area, more than 500 pieces of equipment, five studios offering over 200 classes a week, a 13-metre climbing wall, competition-sized boxing ring, 23-metre swimming pool and an indoor sports hall.

Every member receives a personalised programme with a focus on holistic wellbeing; alongside the extensive fitness facilities, the club also offers high-end spa services, nutrition and sports medicine clinics.

www.reebokclub.co.uk

• The Third Space

The Third Space comprises two London clubs – in Marylebone and Soho – and was one of the first brands to acknowledge that true health is an integrated affair, bringing together the best experts and facilities to cater for all requirements in exercise, health, medicine, nutrition and fun.

The 40,000sq ft Soho club opened in 2001, offering a medical centre alongside an extensive gym, while the 15,000sq ft Marylebone site opened in the Marylebone Hotel in 2011. The two clubs have a combined membership of over 5,000 members.

www.thethirdspace.com

• 37 degrees Tower Bridge

37 degrees is a premium 28,000sq ft club located on the River Thames within the More London Estate, encompassing a gym, swimming pool, studios, spa, medical centre and associated retail operations.

The club has over 3,500 members and serves tenants including Ernst & Young, Norton Rose Fulbright, PWC and Terra Firma Capital Partners.

tower.thirtysevendegrees.co.uk