features

Global research: Growing up

Wellness is now a US$4.2tn global industry, and spa was the fastest growing sector from 2015 to 2017, according to the latest research from the Global Wellness Institute

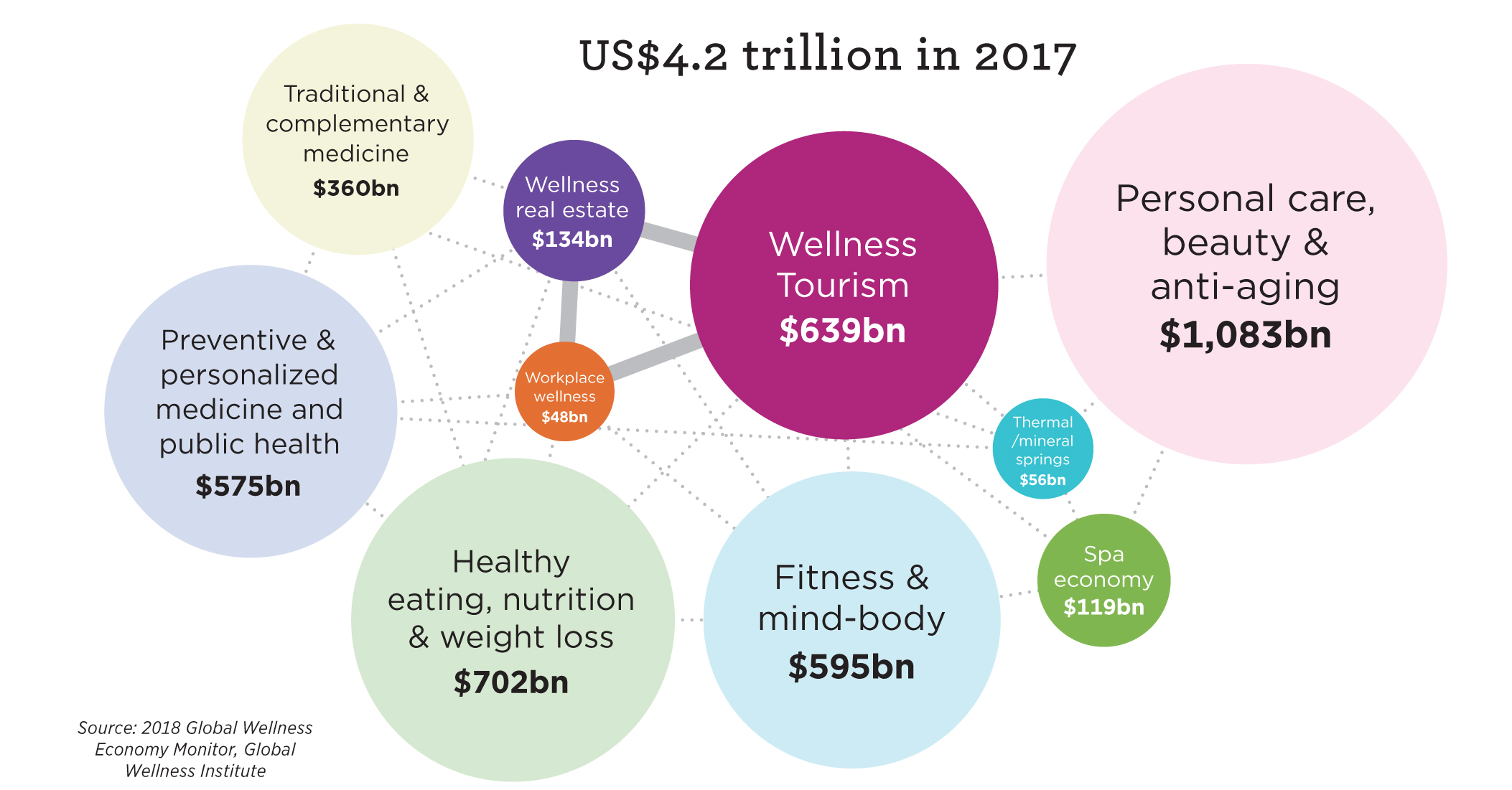

The global wellness industry has grown 12.8 per cent, from a US$3.7tn (€3.2tn, £2.8tn) market in 2015 to US$4.2tn (€3.6tn, £3.2tn) in 2017, according to the 2018 Global Wellness Economy Monitor.

The new data, by the Global Wellness Institute (GWI), shows that the wellness economy increased by 6.4 per cent annually, nearly twice as fast as global economic growth at 3.6 per cent.

The research is based on 10 markets (see Diagram 1) and all of these – from fitness & mind-body to wellness tourism – gained much traction. The GWI says this “provides fresh evidence that wellness remains one of the world’s biggest and fast-growing industries.”

Global spa economy

Valued at US$119bn (€103.1bn, £90.6bn), the global spa economy comprises spa facility revenues, now worth US$93.6bn (€81.1bn, £71.3bn) yearly; and also spa education, consulting, associations, media and event sectors, now US$25.2bn (€21.8bn, £19.2bn). While the spa economy is the third smallest out of all wellness markets, it’s grown the fastest in the last two years, with revenues increasing by 9.8 per cent. This is significantly higher than the 2.3 per cent pace of growth from 2013 to 2015.

The number of spas jumped from 121,595 in 2015 to more than 149,000 in 2017, with spas employing nearly 2.6 million workers. Interestingly, hotel and resort spas brought in the most income and have now surpassed day spas and salons as the industry’s revenue leader.

Speaking at the summit, research: “Since 2007, the number of spas and spa facility revenues have doubled,” says co-author Katherine Johnston. “Spa revenues have gone up by 7.2 per cent annually, and that’s more than double the GDP growth rate in that time. And this growth is especially remarkable if you remember that this decade began with years of recession.”

The main drivers of the spa industry, according to the report, are rising incomes, the rapid growth of wellness tourism, and an increasing consumer propensity to spend on all things related to wellness.

Where in the world?

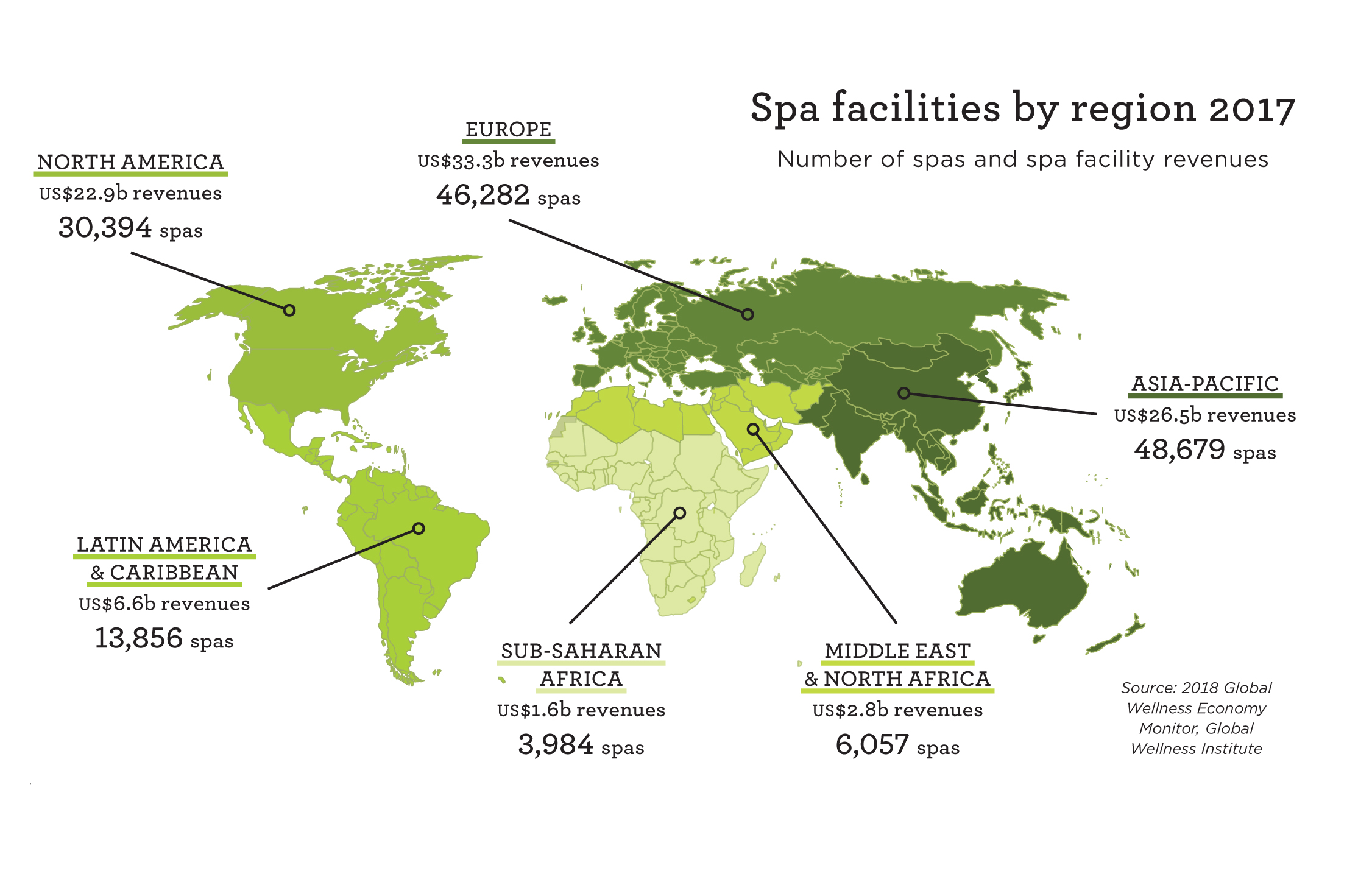

Asia-Pacific is home to the largest number of spas, the report shows, and also added the greatest number of new facilities from 2015 to 2017. Europe led in total spa revenues in 2017 (see Diagram 2).

Across the world, the spa industry remains quite concentrated in five countries – the US, China, Germany, Japan and France – which, when combined, account for 48 per cent of global revenues. Meanwhile, the top 20 countries represent 77 per cent of the global market. However, the industry is becoming slightly more dispersed over time. In 2017, 18 countries had annual spa revenues exceeding US$1bn, and Indonesia and Australia each surpassed the US$1bn threshold for the first time.

Thermal & mineral springs

The thermal/mineral springs market continues to develop as more people turn to water for stress relief, healing and community, the report says. Market revenues increased by 4.9 per cent, from US$51bn (€44.2bn, £38.8bn) in 2015 to US$56.2bn (€48.7bn, £42.8bn) in 2017, making it the fourth-fastest growing sector out of the wellness markets. The number of facilities jumped from 27,507 (in 109 countries) to 34,057 (in 127 countries) – employing 1.8 million workers.

The thermal/mineral springs industry is heavily concentrated in Asia-Pacific and Europe, “reflecting the centuries-old history of water-based healing and relaxation in these two regions”. Together, these two world regions account for 95 per cent of industry revenues and 94 per cent of establishments.

The majority of thermal/mineral establishments worldwide are rustic and traditional bathing and swimming facilities. “They target local markets and charge relatively low admission. About a quarter of establishments are higher-end, targeting tourists and offering value-added spa services,” the report states. Those that offer spa services account for a much greater share of industry revenues (66 per cent) than those without.

Growth projections

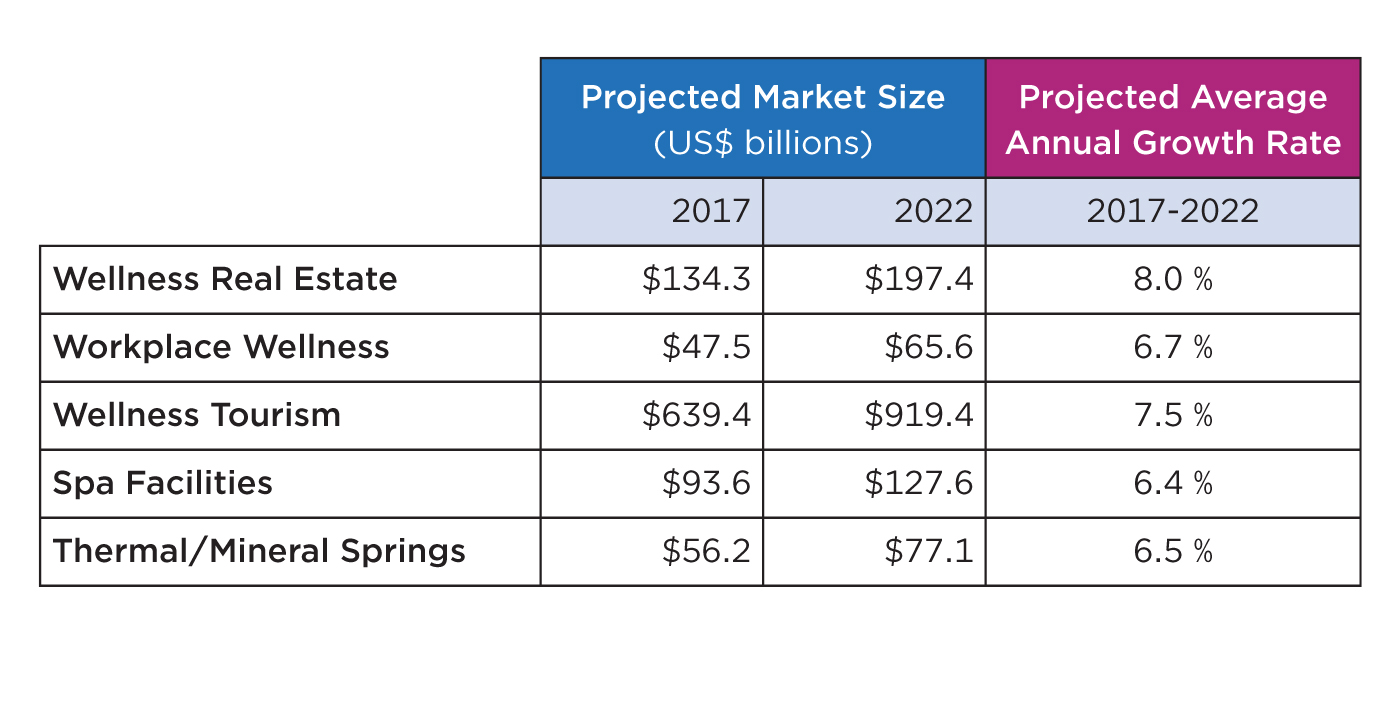

The GWI worked on original research for five of the 10 wellness markets and used secondary sources for the others. Johnston predicts that all five of the sectors it worked on “will continue to grow faster than GDP over the next five years”. As wellness begins to permeate society even more deeply, however, the strongest markets will be those relating to how we live, work and travel – the core spheres of life – namely wellness real estate, wellness tourism and workplace wellness (see Table 1).

“In the last few years, wellness has become a dominant lifestyle value that’s profoundly changing consumer behaviour and the workplace,” says report co-author Ophelia Yeung. “Our interaction with the wellness economy is also becoming less episodic and more intentional, more integrated and more holistic.”

In short, there’s an overlap between the different wellness markets. The trend of wellness bedrooms/hotels, for example, is a convergence of spa, fitness, nutrition and travel (see pages 92-99), while hot springs in China that have traditionally focused on recreation and leisure are now mixing wellness tourism and workplace wellness. Yeung notes: “Wellness markets will become less siloed and more interconnected, converging to offer solutions and experiences in the places where people live, work and travel.”

Johnston adds: “Everyone here [including spa operators] should be looking for opportunities to bring the wellness services and products into these three core spheres of people’s daily lives, in new, innovative and creative ways.”

Addressing inequality

While the 2018 Global Wellness Economy Monitor findings sound promising for both the spa sector and wider wellness market, Yeung and Johnston are also keen to give a reality check.

“Ultimately, it’s not the size of this number, but the quality of wellness in the world,” says Yeung. “Can the wellness economy continue to thrive if it follows the trend of global income inequality? Are people totally well if only those who can afford it continue to save for their wellness?”

Johnston adds: “The challenge is this: Can the wellness economy touch a larger slice of the world, especially people who need it the most but can afford it the least?”

■ Download a free copy of the report at globalwellnessinstitute.org

Global wellness economy

Wellness Sector Growth Projections, 2017 to 2022*

*Source: 2018 Global Wellness Economy Monitor, Global Wellness Institute