features

Interview: Lee Matthews

New products, new motivations and a new vision. The MD of Fitness First UK speaks to Kate Cracknell about reinventing the business as a standalone enterprise

You’ve been at Fitness First since 2006, so have been on quite a journey…

I feel incredibly fortunate. Honestly, I feel like I’ve worked in lots of different businesses, albeit under the same name, and it’s been brilliant.

I joined as general manager, then moved to be regional manager, in a club company that at the time was the largest in the world.

The point came when the company began to shrink in size and we went through a CVA in the UK, but the strategic decisions that had to be made – the new ownership, the major global rebrand – I’d never been part of anything like that before and it was an interesting experience.

After the merger with DW Sports in 2016, I was one of two directors who were asked to stay on at the combined DW Fitness First Group and this brought with it my first real experience of retail. We had 121 gyms, 90 retail stores and an e-commerce business across three different brands: DW Sports, DW Fitness and Fitness First.

I did actually leave the business in 2018 – joining what was then WeightWatchers as it transitioned to become WW – a digital wellness business. But then Scott Best approached me with a new role at DW Fitness First and I re-joined the company in November 2019.

Less than a year later [DW Sports Fitness went into administration, with the assets being acquired by Mike Ashley’s Everlasting chain, while Fitness First continued to trade as a standalone business].

The lockdown had hit the company hard and the retail side of DW Sports Fitness had been hit hard. It also struggled with some of its historic rental agreements. This was ultimately what led to DW Sports Fitness going into administration.

How did Fitness First emerge intact when DW went into administration?

Although the public-facing brand was always DW Fitness First, the two businesses were run as entirely separate entities. We did have some centralised support functions and head office departments, so unfortunately these people were impacted when DW Sports Fitness went into administration in August 2020. But the Fitness First business itself – the 43 clubs and the people we employed – were unaffected.

Of course it was still tough, but looking on the positive side of things now, as a smaller business we can be nimbler, and more tailored. Clearly it’s difficult at the moment from a cashflow perspective, because we’re not back to where we were pre-COVID: we have to be very sensible about what we’re spending. But we can certainly move forward. There’s real energy and excitement in the business.

How has Fitness First been faring since the start of the pandemic?

Even though our clubs are mostly in London and the South East, it’s a ‘tale of two estates’ when it comes to our recovery and growth.

We split our estate into three categories: 21 residential clubs, where the majority of members live in the area; 18 city clubs, where a very high proportion of members work near the club; and six city & residential clubs – Baker Street and Camden, for example – where there’s a crossover of residential and corporate in the same area.

Our residential and our city and residential clubs are recovering well. They’ve been growing every single month since we opened in April last year – even now, during Omicron – and are getting back to a strong position. We aren’t back at pre-COVID membership in any of these clubs yet, but a lot of them are getting close and they’re all profitable again.

Unfortunately, in the other part of our estate – our city clubs – it’s been hard going all the way through. A lot of our city members are still on freeze. It means they haven’t cancelled of course, which is great, but we’re not getting any revenue from them at the moment and we obviously don’t know when they’ll come back.

Have there been any positives from the city?

There are pockets that have done well: a handful of city clubs where, for example, a local business has brought the whole office back. In those locations, we’ve seen decent returns and joiner numbers.

Last November was also really interesting for us. We saw a spike in September and October, which was fantastic and then November was a record month. It was our best ever November in the history of Fitness First, both in terms of returners and new joiners. Even in the city, we joined more new members in November than we did in September and October, which never happens. We thought this was it – that it was all happening again – then along came Omicron.

We do believe the city will come back, though. We just don’t know exactly when. Clearly there’s going to be some hybrid working, so we need to understand what that means for us – how we fit into workers’ lives if they’re only in the office two or three days a week. But we do genuinely believe our city clubs will be profitable again; some already are, by the way, although a number are not.

Have member motivations and behaviours changed?

Some people still don’t feel ready to go to the gym, and Omicron certainly didn’t help. However, in our residential and our city and residential clubs, our January 2022 sales figures are only 1 per cent behind where we were in January 2020. It seems caution among some is being offset by other people thinking more about health and fitness after the last couple of years.

People are joining who haven’t been a member before, and that gives us cause for optimism. None of us knows when we’ll see the end of COVID, but it does feel as though there might be a bigger market now than there was before and that’s really interesting.

We’re seeing an increase in visit frequency among our active members, too. Pre-COVID, we had some members who hadn’t been into the club for weeks, even months in some cases. We don’t really have that any more. A high percentage of our active members are using the club every single week.

Since we re-opened, we’re also averaging 10 per cent higher yield from our new joiners compared to pre-COVID, all from membership dues.

You increased yield? Didn’t you lower your prices?

There was a bit of misunderstanding in the media over what we did with our pricing last year: all the headlines about us reducing our prices by 30 per cent and introducing a new, flexible monthly membership.

In fact, we always had a one-month membership, which could either be an upfront cash payment for a month – designed with people such as business travellers in mind – or else a recurring monthly membership with no contract. In our tier 1 clubs, our highest tier, both options previously cost £139 a month.

Since Q4 last year, the two options are now priced differently: the ‘one month and done’ option is still at £139, but the rolling monthly membership now only costs £109 a month. We recognise that people aren’t in a position to make long-term decisions over gym membership, as they still don’t know what their working patterns are going to be post-COVID, so we wanted to address that pain point and offer more flexibility.

This was also the reason for us introducing a six-month contract in April 2021 – priced at £99 a month – to sit alongside our 12-month option.

So, how have you increased yield?

Since April 2021, for new members only, we’ve looked at opportunities to increase prices tactically where we felt this was appropriate. For example, over the last couple of years of investment in our facilities, products and services, some clubs have moved up a tier. This has allowed us to increase prices for new joiners. We’ve also reviewed historical membership types that, for example, offered an unnecessary discount. Again, this has just been for new joiners – there have been no price rises for existing members.

But the biggest driver has been the change in our joining proposition, which has significantly enhanced the member experience. Fitness First always used to be very acquisition-focused, with employed membership consultants in every club. Those consultants have now gone. You can still join in-club, of course, but over 75 per cent of our members now join remotely. So there’s nobody tucked away in an office any more: you go into one of our clubs now and every single employee is member-facing. They’re also all fitness qualified, and there to provide a service to the member.

So, we’ve made some bold moves, but we’re not seeing a drop-off in conversion. People are seeing the value in what we do, which comes down to the priorities of our new core customer.

Who is your new core customer?

We’ve reassessed who we are as a brand, our values and purpose, what differentiates us and who our core customer is. Our business is very different now from when it was part of DW Fitness First, so we’ve reworked our entire strategy and involved the whole team in the process. The business has been reinvented.

We aim to be fully inclusive, obviously, but our core target audience is the fitness enthusiast who’s already active and interested in a wellness lifestyle. Lifestyle comes first for this group, price second. These aren’t people we need to coax into fitness: they just need to find the right product, service and brand.

For these individuals, if you get it right, they’ll come to you regularly, stay with you and refer their friends. To ensure we do get it right, we’re embedding a new member-centric ethos across our business.

Tell us about this new ethos

We have a new vision: to be the gym that puts members at the heart of everything we do, creating fitness-rich experiences wherever they train.

That vision breaks down into three parts, the first of which is putting members at the heart of everything we do – and I mean absolutely everything. Processes, systems, how people join, cancel or change their package, how we interact with members.

We’re trying to find and address every single possible pain point of our members, always putting them first and the commercial impact second; and in most cases, the latter comes naturally if you get the former right anyway.

‘Creating rich fitness experiences’ is where we can genuinely stand out and be different in our physical product, provided we define the areas that can be unique to Fitness First across our four product pillars: classes, personal training, unique equipment and workouts.

With classes, for example, we’ll create the right combination for each club. There may be some Les Mills in some clubs, but we also have amazing freelance instructors with loyal followings delivering their speciality, and we have our own signature classes: TraX, for example, our gym floor HIIT workout, launched last year and rolled out across our estate in September.

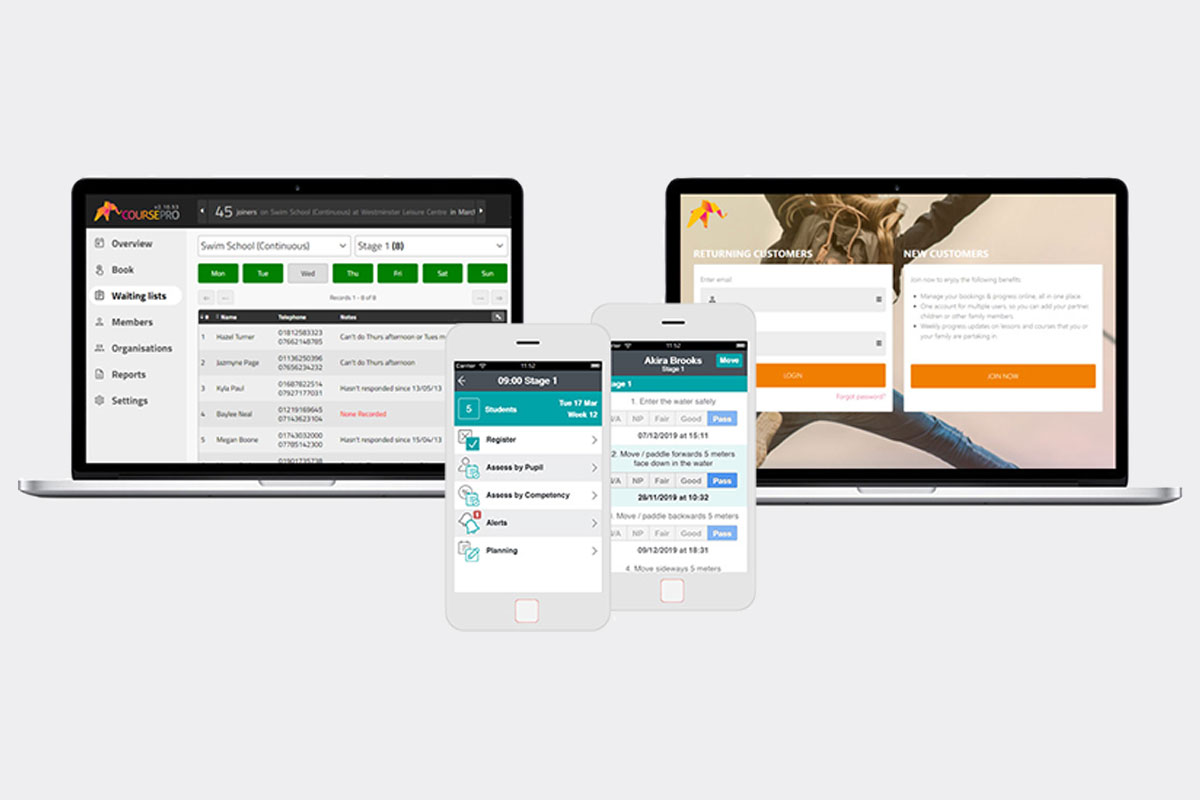

Finally, ‘wherever they train’ is recognising that things have changed, and that in a hybrid world we have to support members training outside of the gym as well as in it. So we launched a new FFX-branded app in May 2021, which is our ‘everything’ tool for members.

It includes access to the club, class and PT booking, instruction on how to use equipment in the gym, challenges, tips, news, member comms and so on. It also includes on-demand content: all video-based for now, but we’re looking at developing some audio content too.

Any other trends shaping the way you do things?

Aside from digital, the two key trends for me – and these are both in-club trends – relate to free weights and classes. Everybody’s using free weights these days, to the point that free weight areas almost can’t get big enough. Our solution has been to blur the boundaries on our gym floor: between the open spaces of our Freestyle functional training zones, for example, and our free weights areas.

Squat racks, dead lift platforms and Olympic lifting platforms are as popular as ever, but they take up a lot of space. In some clubs, we’ve therefore moved them into Freestyle – where they logically fit very well – and made space for more dumbbells and benches in free weights.

We could probably cut down slightly on traditional cardio equipment if we needed to, because it’s being used for shorter bursts of HIIT. Not so many people are doing 20 minutes or half an hour on a treadmill any more.

And then the second trend is the surging demand we’re seeing for experiential classes. Traditional group exercise still has its place in some clubs, but in others it hasn’t really any more. People are looking for boutique-style experiences in-club, whether that’s Trax, Rox – our running plus boxing concept – or holistic classes such as yoga and pilates.

What are your growth plans?

It’s hard for me to definitively answer this, because the owners of the business – still the Whelan family – will determine our growth plans. We already opened two fantastic new clubs in 2021, in Bangor and Milton Keynes, bringing our total estate to 45 locations.

Both were former DW sites that came back as an opportunity, so we acquired, rebranded and re-opened them as Fitness First. We also spent £900k transforming our Wigan club, which again had originally been DW-branded but owned independently by the Whelan family, so it wasn’t taken into administration.

It could change in the future, but certainly for the next few years I expect growth to be focused on organic openings where there’s a real opportunity, specifically in areas of London where we can open tier 1 clubs that showcase all our new products.

“Last year, we signed up for the Kickstart initiative, the government’s scheme to try and bring young adults into certain industries,” says Matthews.

“There was no cost to us – for a six-month contract, the government refunded 25 hours’ pay per trainee per week – but we did have to show what we could do in terms of qualifications and skills. There were very strict criteria.

“The qualification we offered was Level 2 instructor, and we partnered with two training providers to deliver it. We had no idea if people would stick with it, but of the 46 young adults who came onboard as fitness experience trainees, 42 completed their Level 2 qualification by the end of the six months.

“Even better, all 42 have stayed on with us, some part-time and some full-time. We’re incredibly proud of that.”