features

Worldwide trends

What are the opportunities for refinement and growth in the global fitness sector in 2015?

‘‘While the economy continues to present challenges for many countries, European health club operators still see opportunities, and many of the region’s leading players are planning for continued growth.” This was the conclusion of Jay Ablondi, IHRSA’s executive vice president of global products, at the end of an IHRSA European Congress panel session featuring the CEOs from three of Europe’s leading health club companies. So what did the panel believe lies in store for the sector in 2015?

Growth opportunities

Valerie Bönström, CEO of women-only franchise Mrs.Sporty, pointed to the likelihood of continued growth in the budget sector. “The competition is increasing on the low-cost side, with more companies opening smaller, low-cost clubs,” she said, noting that budget trailblazer McFit continues to thrive. “In a market that’s increasingly price sensitive, higher-end operators will have to provide a more powerful brand with a strong positioning.”

Meanwhile Olav Thorstad, CEO of Scandinavian chain Health & Fitness Nordic – which operates the SATS, Elixia and Fresh Fitness brands – noted the importance of instructors when it comes to capitalising on the profitability of the functional training trend. “We also need to look at outdoor opportunities, because people don’t necessarily want to go to the club,” he added. “This segment of the market is growing more rapidly than the traditional club market. We have a big opportunity here, but we have to do more to catch the potential members who are interested in exercising outside of the four walls of our clubs.”

For Irina Kutina, CEO of the Russian Fitness Group, the focus will be on driving social connection. “We will continue to work closely with our personal training team, because it’s a good indication of how well the clubs are doing in terms of engaging members,” she said. “We’ll also look at small group training, yoga, cycling and so on, because these activities bring people together.”

Small is beautiful

All three panellists identified the boutique model as an important trend. In addition to the women-only Mrs.Sporty clubs, Bönström already operates some small, co-ed functional fitness training studios under the LOVFIT brand, and noted the potential of these clubs to attract new segments of the population who might not be interested in joining a more traditional gym.

“There’s a market for it and we should be in it,” agreed Thorstad. “The margins and profits are bigger, and it will be positive for members” – this thanks to a highly results-focused, member-centric, interactive and experiential formula.

When speaking with European Congress attendees, Alison O’Kane Giannaras, IHRSA’s associate vice president of international development, consistently heard views on the growth of this boutique model. “Mid-market and higher-end clubs are looking at the boutique models and trying to incorporate the concept into their existing model,” she says.

“The general consensus at the Congress was that the mid-market club is not dead, and that the growth in budget and boutique clubs is only making traditional clubs refine their value proposition – that there’s space in the market for all.”

According to delegates, one key to refining the value proposition will be a greater emphasis on staffing and the importance of human resources among the traditional mid-market health clubs. “As budget clubs continue to grow in number – with brand new offerings, equipment and concepts – a key element most are still missing is staff. The mid-market clubs are therefore increasingly realising the power a great staff member can have in retaining members,” says O’Kane Giannaras.

These predictions of the continued growth of the boutique sector are consistent with the findings of The IHRSA Health Club Consumer Report, published in September 2014 and looking in-depth at the US market, but with an eye to global trends: one of the most significant of its 11 overarching insights relates to the rise of new business models, particularly boutique clubs and fitness studios – specialising in barre, indoor cycling and CrossFit training, for example – and a movement away from the traditional multi-purpose model the industry has embraced for the past 20 years.

According to the report, more than 20 per cent of all members of multi-purpose clubs now hold more than one membership, and as many as 90 per cent of the clients of studios also attend classes or have a membership at another club. This trend could bode well for the industry in the months and years ahead: club operators might consider partnering with select niche studios to offer reciprocal discounts or joint memberships, for example, or even to trade client/marketing lists.

A new vision

The report also documents the decline in traditional fitness equipment use over recent years. The most frequently used items – treadmills, resistance machines and free weights – remain strong, but the data shows overall usage has decreased: in 2013, consumers used traditional equipment less than at any time in the past four years. Indeed, in some cases, use fell by as much as 20 per cent.

That’s not to say equipment has lost its importance: there’s still a greater share of members using equipment than there are participating in group exercise. However, operators whose business model is dependent on equipment may want to consider taking inventory of equipment use, and look at reintroducing members to how specific equipment can help them achieve their health and fitness goals.

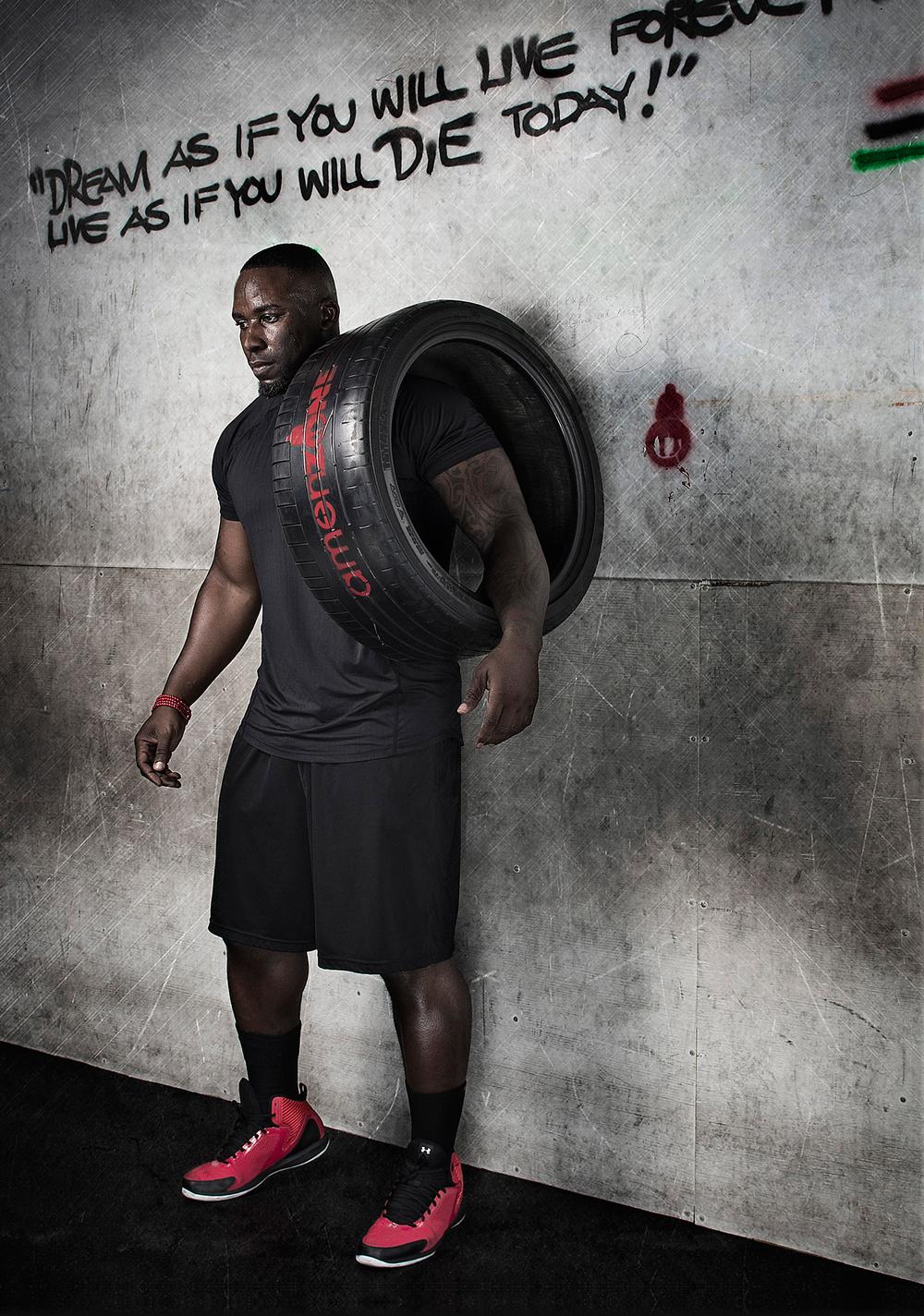

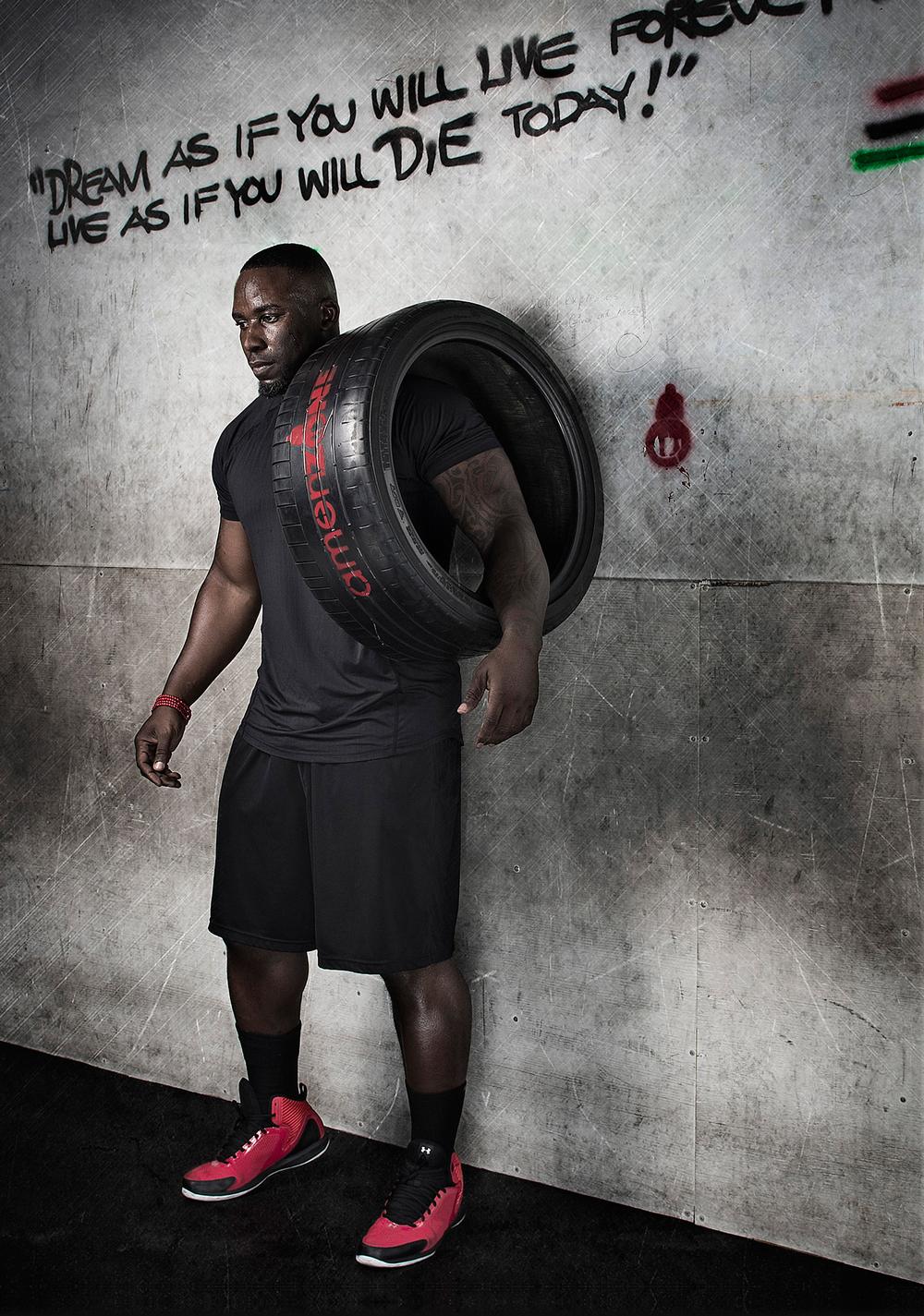

“This might be a symptom of the rise in boutiques or microgyms, which offer specialised training with activity-specific equipment,” suggests the report. It no doubt also has to do with the growing popularity of extreme exercise offerings that use unorthodox workout tools such as truck tyres and obstacle courses.

As Rick Caro, president of US-based consultancy Management Vision, concludes: “Clubs have an opportunity to ask themselves: ‘What do we want to be known for? What are our points of differentiation?’ They need to discover their strengths, capitalise on them, and make their strengths even stronger.”

FIND OUT MORE

Kristen Walsh is IHRSA’s associate publisher and can be contacted via email at [email protected]

Please visit www.ihrsa.org/research-reports to access

The IHRSA Health Club Consumer Report, The IHRSA European Health Club Report, The IHRSA Global Report, and many other IHRSA publications.