features

Stats: Future gazing

Deloitte has produced a report in partnership with EuropeActive, analysing the impact of COVID-19 on the European health and fitness market, as Karsten Hollasch reports

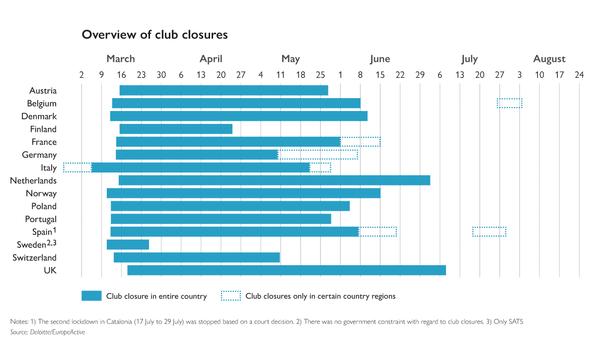

When the coronavirus hit the European health and fitness market in March and governments enforced the closure of gyms across Europe, there was no manual on how to handle the situation.

As it turned out, initial club closures lasted anywhere between eight and 18 weeks, depending on how severe the impact of the virus was in the country in question. Some regions suffered a second lockdown and some look likely to experience further disruption.

Although governments were quick to provide financial help, the financial damage for operators and other actors in the fitness industry is still massive. In fact, it’s still unclear how high the losses really are.

For this reason, Deloitte and EuropeActive launched a study to examine the business impact of the crisis on the sector, in both the short- and the longer-term.

The fieldwork took place in August and a total of 17 European key operators were interviewed, covering around 10 per cent of all members in the European health and fitness market.

Key findings

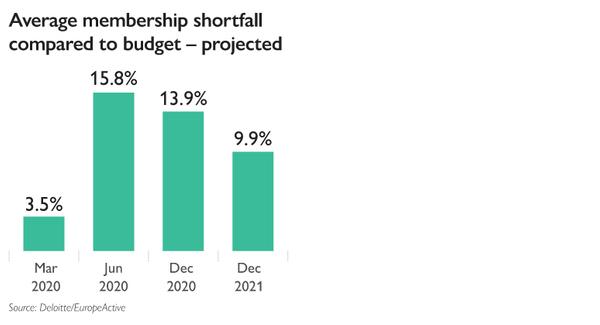

As of 31 March 2020, the surveyed operators experienced an average membership shortfall of around 3.5 per cent compared to their original budgets. By comparison, by 30 June 2020, these shortfalls reached their highest point, at 15.8 per cent, primarily through a combination of membership cancellations and the absence of new membership inflow during closures.

The average shortfalls compared to budget in respect of the number of clubs amounted to 2.5 per cent by 30 June 2020, as clubs reopened across Europe.

In the medium- and long-term, both average membership shortfalls and average club shortfalls are expected to decrease. As of December 2020 and December 2021, European operators said they expect average shortfalls in memberships to be 13.9 per cent and 9.9 per cent respectively. Looking at clubs, the average shortfalls compared to budget are expected to be 1.8 per cent by December 2020 and 0.6 per cent by December 2021.

Overall, the shortfall could be higher in the European fitness market, especially for single club operators, who could face greater financial difficulties than chain operators.

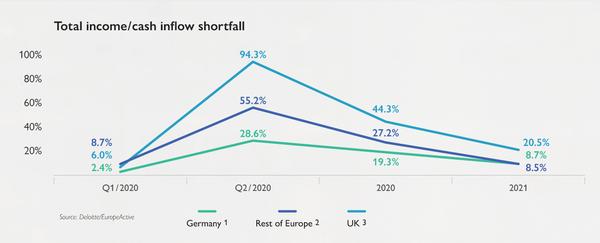

The pandemic-related closures in Q2 also impacted finances, primarily due to the absence of membership fees. European fitness operators experienced an average income shortfall of about 65 per cent compared to budget. Discrepancies in income shortfalls between operators in the study can be explained by different approaches to the handling of membership fees during the period of club closures.

While some operators continued to collect membership fees unless customer objections were received, there were also companies that stopped collecting membership fees altogether.

Operators were able to achieve cost savings of 43 per cent compared to budget in Q2, mainly due to paying less rent and fewer people and other reductions in operating costs.

Additional savings were realised when personnel costs were subsidised by local governments.

Income shortfalls vary considerably between regions. Operators with a UK focus expect the highest financial shortfalls when compared to the initial budget and the income shortfalls of UK-focused operators were especially high in Q2 2020 (-94 per cent).

This is in part attributable to UK operators’ heavy reliance on monthly cancellable contracts, in contrast to Germany and most of the other European markets, which mainly offer longer-term contracts.

Published H1 reports of listed European key operators also show the significant impact of COVID-19 on financial results. Due to an approximately 18-week lockdown in the UK, total revenues of UK operator The Gym Group decreased by around 50 per cent in H1 2020, compared to H1 2019. Similar results have been published by PureGym for its UK business (-49 per cent in H1 2020, compared to H1 2019). In comparison, Dutch operator Basic-Fit, which operates in various European countries, recorded an overall decrease in revenues of 24 per cent compared to H1 2019.

Measures taken

To counter the crisis, operators have undertaken a wide range of monetary and non-monetary measures. Among the monetary measures, short-time work, government grants and loan application were the most popular.

Other popular non-monetary measures introduced by operators include frequent scenario analyses – introduced by all operators surveyed – the creation of emergency plans and the introduction of early warning indicators.

The use of digital fitness offerings increased during the lockdown.

Survey results suggest that consumers’ interest in digital offerings is not a one-off, but rather that COVID-19 is serving as an accelerator for increasing demand for digital sports offerings (apps, videos, etc.).

By providing relevant content through digital channels and engaging with customers via their websites and apps, operators have been able to keep in touch with members during the crisis.

Basic-Fit, for example, actively increased member engagement through its already existing social media channels and mobile app, by offering additional services and contents.

The company-own mobile app was also temporarily made available to the general public.

According to Virtuagym’s COVID-19 impact study, the number of fitness app users more than trebled to reach its first peak in March, when COVID-19 started in Europe. However, the highest peak was reached in July, when clubs started reopening. This indicates that in-person club visits and use of digital offerings can coexist (and accelerate each other) rather than cannibalising each other.

Future outlook

As an overall result, major European club operators consider their existence only partially threatened, assuming no further forced club closures: None of the operators stated that their existence was or will be either severely or highly threatened in the future. However, single club operators, which represent the majority of fitness clubs in the European market, appear to be more threatened in their existence than larger operators, due to limited resources and refinancing possibilities.

The fact that fitness club operators are looking confidently into the future can be proven not only by the lower expected shortfalls, but also by further studies: more than 60 per cent of Spanish operators surveyed in the FNEID/Valgo COVID-19 impact report believe revenues will return to previously expected levels by the third quarter of 2021.

This could be supported by the fact that the behaviour of some consumers in the fitness market has barely changed. Eight-eight per cent of consumers in the ukactive/4Global COVID-19 impact report stated that after the reopening of public sector clubs in the UK they would visit the gym as often or even more often than before the pandemic.

Confidence in the future of the fitness market is reflected in the number of M&A and financing activities that have taken place in the last couple of months. For example, RSG Group expanded its investments by acquiring the US-operator Gold Gym for US$100 million, as well as 35 per cent of the shares of Gym80. Furthermore, other players such as PureGym, BASIC-FIT and The Gym Group were able to raise large sums of capital during this period.

Herman Rutgers, co-editor of the report noted: “It’s not possible at this stage to predict what the full impact of this crisis will ultimately be, due to the increasing number of cases and the uncertain future of policy decisions. However, the study shows the impact on membership and financial losses, and also that – assuming there are no further club closures – the industry can recover quickly and is still confident of achieving the long-term goals of 80 million members by the midpoint of the decade and 100 million by 2030.”

Get the report: www.HCMmag.com/Deloitte