features

Fashionably fit

Analyst Leonor Stanton reviews Allegra’s Project Fitness UK report on the thriving domestic fitness market and its future prospects

The latest in-depth survey of the UK fitness club market, Project Fitness UK 2018 by Allegra Strategies, estimates the value of the total UK fitness club market at £5.1bn. It projects a compound annual growth rate of 8.5 per cent in value and circa five per cent in the number of gyms and health clubs over the next five years.

Given that the fitness club market should now be in a mature state of development, and taking into account economic forecasts for the UK, these are impressive estimates.

Growth trends to date

Allegra’s estimates are based on significant growth to date: 7.1 per cent in value terms over the last five years. Having increased its retail footprint by 15.1 per cent since 2012, the health and leisure centre sector is deemed to have been the UK’s fastest growing business over the last five years.

Between 2013 and 2018, private sector clubs increased from 3,269 to 4,400 facilities, although the public sector contracted from 2,750 to 2,680. During the same period, memberships of private health and fitness clubs increased from 4.7 to 6.9m and of public sector clubs from 3.2 to 3.3m. Together, there are now 10.2m health and fitness club members in the private and public sectors in the UK. However, these active membership numbers only represent 17 per cent of the active UK population.

The growth has been fuelled by increasing awareness, and actual experience, of the benefits of exercise on both physical and mental health.

The rise in obesity, heart disease and diabetes has further highlighted the need to alter sedentary lifestyles, and government initiatives and sporting events have given the industry a further boost, as have technological developments. Importantly, 93 per cent of respondents to Allegra’s survey think it’s fashionable to be fit.

All these macro trends will continue to provide a positive boost to the industry in the next five years. Most operators contacted by Allegra researchers think future prospects for trading are excellent.

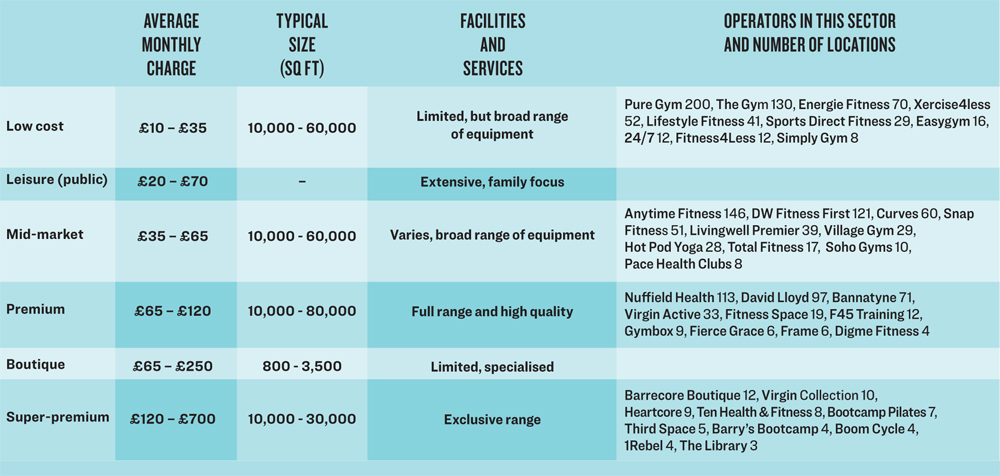

The market has experienced bifurcation between the low-cost and premium operators, resulting in an increasingly squeezed middle market. It’s forecast that the low-cost segment will continue to drive growth, as UK consumers are increasingly motivated by value and convenience.

The low-cost sector is opening an average of 75 new locations each year and attracting some 300,000 new members as a result. At the top end, the boutique fitness sector is expected to build on strong growth over the next five years, with further expansion concentrated in metropolitan areas.

However, whilst the boutique sector is shaping top-end market activity, it is only expected to remain a small niche market outside of London.

According to Jeffrey Young, chief executive and founder of the Allegra Group, there’s significant premiumisation in the market, with ever-more specialised and upmarket boutique offerings – and some of the value growth is likely to come from this top sector of the market.

Currently, 40 per cent of all UK health and fitness clubs are located in London and the South East. Not surprisingly, there’s a significant difference in average monthly memberships – members in the South pay an average of £41.07 per month, whereas those in the North pay £22.75 for their gym subscription; almost half.

Capitalising on growth

Consumers cite location as the most important factor when choosing a gym: 56 per cent of respondents chose their health club due to its location. In the South, this rises to 59 per cent.

Around 22 per cent of respondents use more than one gym or multiple locations of the same brand. Some are prepared to buy multiple memberships or pay more to have the option of working out at varying locations. This is partly due to convenience (midweek closer to work and weekends closer to home). Other reasons may be to do with the range of equipment and the classes. Convenience is rated as more important than affordability (41 per cent of respondents cited this as a reason for joining their club), while variety of classes came third (19 per cent). Also important are provision of all-weather training, access to equipment and community atmosphere.

the potential

While only 23 per cent of UK consumers regard gym membership as a prerequisite to staying fit, the researchers at Allegra believe gyms can still attract the other 67 per cent of respondents by providing access to equipment not available at home or outside the gym and by providing a variety of classes with expert guidance.

Gym members are more likely to achieve their fitness objectives by exercising regularly than those who choose to exercise outside a gym setting.

Those who have allowed their membership to lapse cite membership being too expensive (39 per cent) and not having enough time to go to the gym (26 per cent) as the two most important reasons for their decision. Those who have never had a membership also believe that expense is the biggest barrier (57 per cent) followed by the joining fee (27 per cent).

Key sectors to pursue

Demand for support for both physical wellbeing and mental health issues will be continuing trends, and related to this will be varying opportunities. The researchers identify corporate wellness as an interesting sector for the health and fitness industry to explore over the next two to five years.

In addition, with an ageing population, they believe older baby boomers are a relatively untapped market and that integrating primary healthcare service into clubs and vice versa provides a convenient and valuable service to consumers with age-specific health and fitness needs.

Weight loss is likely to continue to be the main fitness goal for all age ranges, bar those in their 60s and over. Achieving better health and feeling better are the joint top motivating factors to exercise, according to 41 per cent of consumers.

The study points to further opportunities in the female market. Their findings suggest that millennials are the most likely to experience barriers to exercise, due to self-consciousness. This offers a major opportunity for smaller boutique gyms, which are able to give more reassurance. It could also be broadened to incorporate other groups such as members from different racial and social backgrounds – chains like OMNoire are already capitalising on this in the US.

Location

Competition for sites has and will continue to be a challenge for the health and fitness industry. Project Fitness UK 2018 identifies an opportunity for development where there are high street closures.

It also concludes that market saturation is possible in built up urban areas, unless brands manage to achieve sufficient differentiation in their offering.

Jeffrey Young believes the development of the industry is likely to follow population growth along with the trend towards greater urbanisation. Growth at the top of the market is expected primarily in London, slowly percolating to the other big cities throughout the UK.

The researchers suggest that an integrated health and wellbeing model with a core fitness proposition is required to maximise growth opportunities.

Existing and future improvements in technology need to be continuously incorporated into the management of the businesses, in sales and marketing, in understanding each member (data platforms) and thus motivating them to exercise so as to reduce attrition.

Rising use of online and digital technology will continue to drive growth across all market segments by impacting consumer trends and revolutionising the way consumers engage with fitness clubs.

Opportunities

Looking at the bigger picture, a number of Allegra’s findings point to strong growth opportunities – 81 per cent of all respondents feel that it is important to be fit, but only 39 per cent of respondents are happy with their current fitness levels and only 17 per cent of the active UK population has club membership. The opportunities for the industry are clear.

The industry will continue to face challenges, such as the state of the economy, which will always be a major factor influencing consumer demand.

Other key challenges, such as price sensitivity and increased competition, will continue to be factors, while the need to invest in new facilities and equipment and rising expectations as a result of better informed, more demanding, value-seeking consumers will continue to challenge operators when it comes to funding.

Challenges

Allegra says that development and operational challenges will also shape the future direction of the sector, highlighting the task of finding optimum sites for new club development, as well as recruiting and retaining qualified and quality fitness professionals to deliver increasingly higher levels of service: these two challenges are expected to continue to challenge the health and fitness industry.

Leonor Stanton is an HCM analyst and independent consultant. She previously worked at Deloitte.