features

INDUSTRY TRENDS: What's hot in fitness? Key findings from a recent industry study

Stephen Tharrett and Mark Williamson of brand insights firm ClubIntel share the findings of the 2015 International Fitness Industry Trend Report

Over the past decade, several fitness industry-serving organisations have put out studies that proclaim to have identified the fitness trends to watch.

Unfortunately, predicting trends takes more than asking people’s opinion – it requires digging down and understanding the behaviours of an industry. The American Council on Exercise (ACE), the International Health, Racquet and Sportclub Association (IHRSA) and ClubIntel therefore decided a ‘true trend’ report was needed – one that measured behavioural practices, looking at what the health and fitness industry was actually adopting and how adoption rates were changing over time.

Our collective goal was to identify what was ‘all the rage’ – in other words, what it is that currently occupies the pinnacle of popularity in our sector.

This article provides a brief glimpse into the work and the resulting outcomes which appear in both the executive summary and full report entitled 2015 International Fitness Industry Trend Report – What’s All the Rage.

Fad versus trend

It’s important to understand the difference between fads and trends.

Fads are short-term phenomena that arise quickly, take the world by storm and just as quickly fade into obscurity. They span every aspect of human culture. In business they have been known to create mercurial success and mercurial failure. In social spheres, fads have created short-term changes in social consciousness that were just as quickly forgotten.

Fads are a virus that can quickly take over business thinking, sometimes generating short-term profit but more often than not causing permanent harm.

Conway Twitty, a singer from the 50s and 60s, said about fads: “Fads are the kiss of death. When the fad goes away, so do you.” It’s vital to see fads for what they are and not incorporate them as a central point of your business strategy.

Meanwhile, trends are events that evolve into movements. They have the ability to gain momentum and create long-term societal and business impact. Trends have vitality, often ingraining themselves within the cultural roots of society, whether it’s a social or a business trend. The power of a trend can manifest itself in the attitudes, values and behaviours of its audience.

Consequently it’s trends, not fads, that industry leaders need to focus on as they map out strategies for their businesses. As Bill Clinton, former US president, said: “Follow the trend lines, not the headlines.”

Rise and fall

Understanding what’s ‘all the rage’ required us to conduct a two-dimensional analysis looking at the interplay between a trend’s level of industry adoption and its absolute level of growth. Where a trend falls in that matrix tells us if it’s emerging, growing, mature, in decline, or if it’s a niche trend rather than mainstream.

So what are the insights garnered from the study? For the purposes of this section, we’ve used the word ‘trend’ to define a specific practice of the industry; over time we will be able to establish whether they are actually trends or fads.

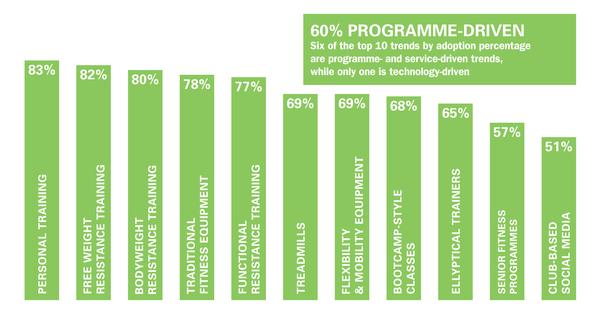

Among the top 10 trends by level of industry adoption, six are programme-driven, three are equipment-driven – and just one is technology-driven. In essence, what this speaks to is the health and fitness industry’s heavy reliance on programming, as well as its snail-like pace when it comes to adopting new technologies to enhance its value proposition.

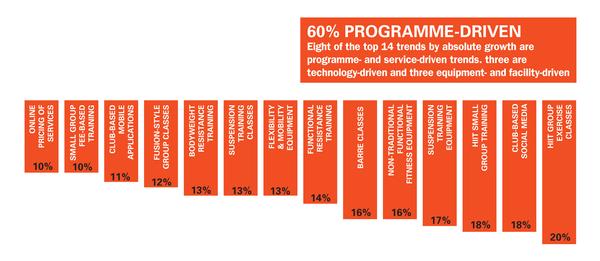

Among the trends with the greatest absolute growth over the past two years, 60 per cent are programme-driven – for example, HIIT classes, HIIT small group training, barre classes and suspension training. Three (21 per cent) are technology-driven: the use of social media, offering transparent online pricing of memberships and services, and the development of fitness club-based apps.

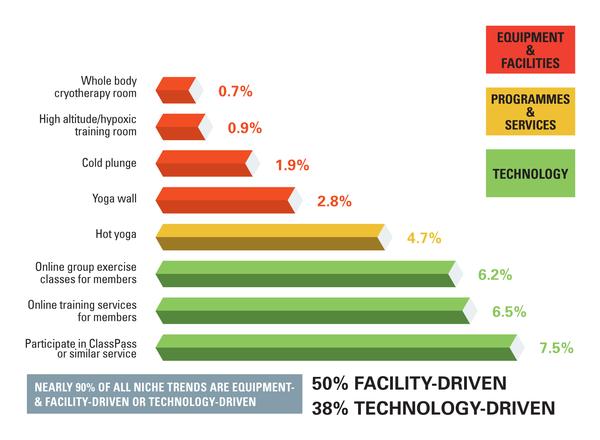

Among the eight trends that have captured less than 10 per cent of the industry – making them niche trends – three are technology-driven (such as online training offerings and the use of internet middlemen) and four are equipment-orientated (cold plunge, yoga wall, high altitude training rooms and whole body cryotherapy). Interestingly, only one programme trend – hot yoga – would fall into this segment.

Over the past two years, more than 20 trends have seen a decline in market penetration. Of the trends whose decline was more than 4 per cent, 80 per cent are programme-driven. When you factor in this statistic alongside the fact that 60 per cent of the fastest-growing trends are also programming trends, in our opinion this sector may be fad-driven more than it is trend-driven. We’ll be able to establish this once we have additional years’ data.

Notably, non-US markets have achieved considerably higher levels of adoption for technology-driven trends. This suggests the world market has been quicker than the US to adopt technology as part of its value proposition and operating platform.

Group cycling, traditional yoga and recumbent bikes were the only trends to be classified as mature. A large majority of the 90-plus trends measured fell into either the emerging or niche categories, indicating that in most cases, these trends may not evolve into mainstream trends.

PRACTICES SERVING NICHES IN 2015

Percentage adoption by health and fitness industry

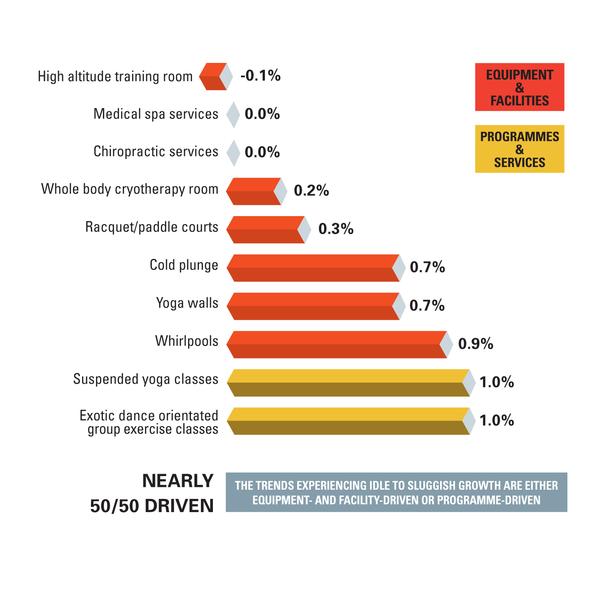

PRACTICES IN NEUTRAL FROM 2013-2015

Trends with less than 1% absolute growth from 2013–2015

TOP 10 INDUSTRY TRENDS BY ABSOLUTE PERCENTAGE GROWTH 2013–2015

TOP 10 INDUSTRY TRENDS BY

PER CENT ADOPTION 2015

WANT TO KNOW MORE?

During the second quarter of 2015, ACE, ClubIntel and IHRSA commissioned a fitness trend study among global health and fitness professionals. The study measured adoption rates and growth rates for over 90 fitness practices across multiple categories (programmes, services and training protocols, equipment and facilities, and technology) and industry segments (region, size of business, type of business model, and so on).

Special thanks go to Melissa Rodriguez of IHRSA, Todd Galati of ACE and Jim Peterson of Healthy Learning.

For further detail, please download the executive summary from ACE (acefitness.org), IHRSA (IHRSA.org) or ClubIntel (club-intel.com)

The full report can be purchased from the ClubIntel store (club-intel.com) or Healthy Learning (healthylearning.com) for US$99.95