features

IHRSA Update: Planet fitness

The global health and fitness markets reached an all-time high in terms of memberships in 2018. IHRSA’s Melissa Rodriguez highlights the topline numbers for HCM

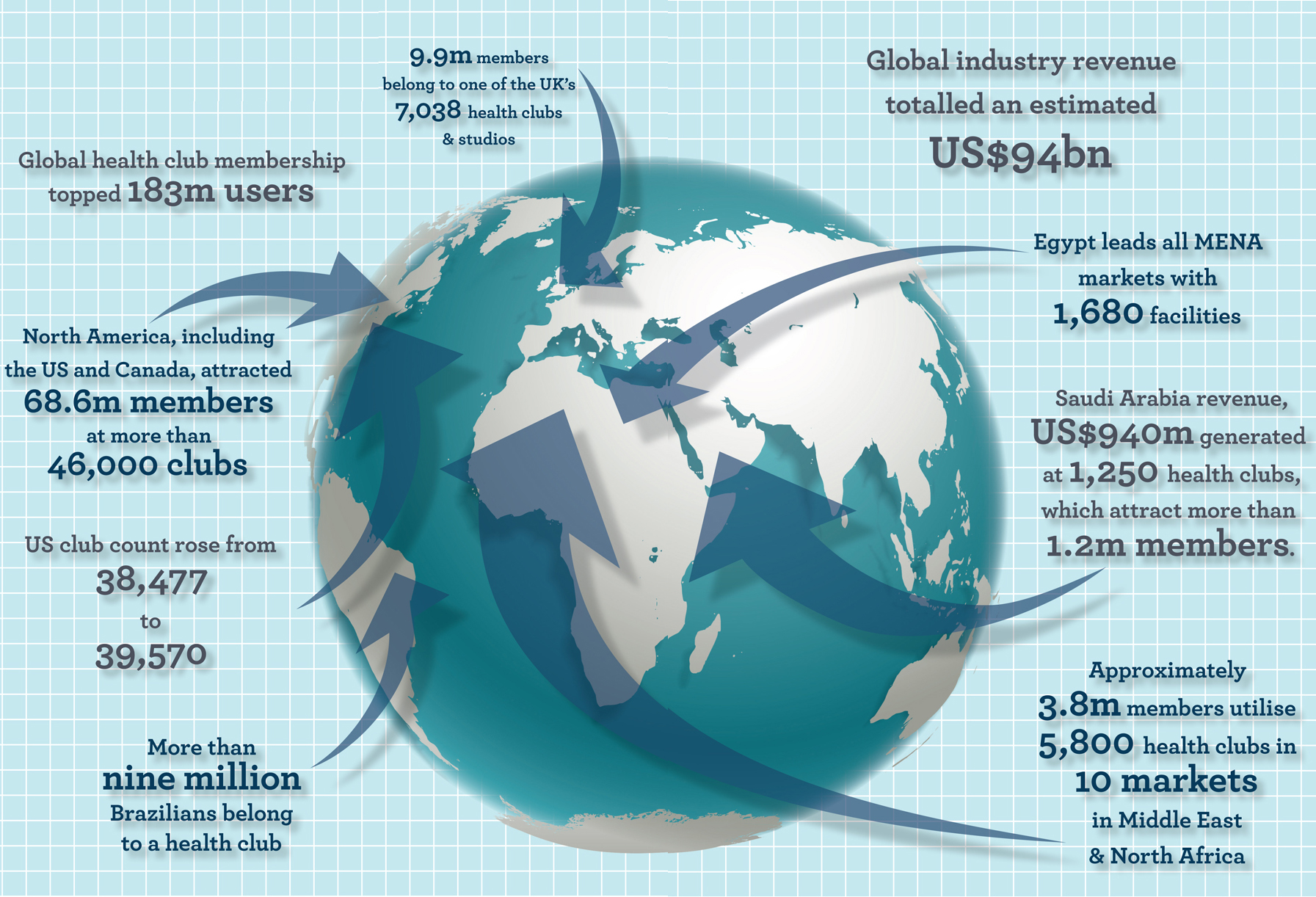

In 2018, health club membership had its best year ever, topping 183m users around the globe. Industry revenue totalled an estimated US$94 billion, and the club count exceeded 210,000 facilities. Leading markets also continued to show growth in the Americas and Europe.

The Americas

In total, the industry across North America, including the US and Canada, attracted 68.6m members at more than 46,000 club sites in 2018. Revenue, membership numbers and the total number of clubs all increased in the US from 2017 to 2018. Revenue grew from US$30 billion in 2017 to US$32.3 billion in 2018, while membership numbers increased from 60.9m to 62.5m.

The US club count rose from 38,477 to 39,570 facilities. The membership penetration rate in the US was 20.8 per cent in 2018, while Canada’s was lower at 16.7 per cent. Roughly 6.1m Canadians belonged to one of approximately 6,500 fitness facilities in the country.

The Latin American health club market is robust, with potential for growth. Based on data gathered in The IHRSA Latin American Report (Second Edition), Brazil’s 34,000 health clubs rank the country second only to the US among global fitness markets in terms of numbers. More than nine million Brazilians belong to a health club.

With more than 12,000 facilities, Mexico ranks second in Latin America and third worldwide in terms of number of clubs. Opportunities for growth are abundant in Latin America, as member penetration rates remain low across 18 countries.

Middle East & North Africa

Based on findings gathered by The FACTS Academy, approximately 3.8m members utilise 5,800 health clubs in 10 markets in the Middle East and North Africa. These 10 markets collectively generate roughly US$2.3 billion in industry revenue. Saudi Arabia leads all markets in this region in revenue, with approximately US$940m generated at 1,250 health clubs, which attract more than 1.2m members.

In terms of club count, Egypt leads all Middle East and North Africa (MENA) markets with 1,680 facilities.

Despite conflicts in several MENA countries which is disrupting day to day life, there’s a demand for fitness, as consumers seek to exercise and reap the benefits of an active lifestyle.

Successful international fitness operators, including Fitness First, Gold’s Gym, and World’s Gym, have expanded into the Middle East.

Fitness Time, based in Saudi Arabia, has more than 160 facilities in the Middle East, highlighting the opportunity in this region.

The outlook of the health club industry is bright and promising. As leading economies continue to improve, the industry is expected to thrive in the global marketplace, serving consumers with a variety of health and fitness needs. Offering access to fitness amenities, instructors, trainers and coaches, club operators are well-positioned to lead a healthier world.

Europe

Roughly 64.3m Europeans belonged to a health club or studio in 2018, as the industry generated an estimated US$32.1 billion in revenue at 63,955 facilities.

The UK and Germany continue to lead all European markets.

In the UK, according to research by the Leisure Database Company, 9.9m members belong to one of the nation’s 7,038 health clubs and studios. Germany attracts more than 11m members at 9,343 locations and generates US$6.3 billion in annual revenue.

According to The European Health & Fitness Market Report, Europe has strong prospects for growth considering not only the mature, solid markets in Western Europe, but also the potential in Eastern European markets: while the overall penetration rate in Europe was 7.8 per cent in 2018, Turkey and the Ukraine had the lowest penetration rates at 2.6 per cent and 2.9 per cent, respectively.

China

The health club market in China is among the largest in the world. On Mainland China, the combined revenue from the top 10 cities ranks fourth among all global markets at US$3.9 billion in annual revenue, while the number of club members ranks ninth in the world at 4.5m.

Opportunities for growth and development remain for the industry in China, as the market has one of the lowest penetration rates among developed countries. Only 2.98 per cent of people in Greater China belong to a health club.

Although the concept of modern fitness clubs first appeared in China over three decades ago, large-scaled marketisation only began after the year 2000.

Prior to that, average Chinese consumers had neither strong awareness nor sufficient disposable income to take out a fitness club membership and fitness clubs were mostly designed as small gyms which were used by athletes.

After over 15 years of evolution, the fitness club market in China has become diversified, with large chains, small studios, and new business models such as O2O – or Online to Offline – co-existing dynamically to address consumers’ various needs.

China’s rapid development in the past three decades has brought tremendous improvement to living standards, but also undesirable health issues such as chronic fatigue and sleep disorder. Meanwhile, the national government has been actively increasing public awareness of sports participation and personal fitness by promulgating the Outline of Nationwide Physical Fitness Program in 2016.

As a result, domestic awareness of fitness has been significantly improved, especially in the past five years, and the fitness culture has become a symbol of a modern lifestyle in China. Currently, the penetration rate of fitness clubs in China is estimated to be 2.98 per cent in the top 10 cities.

India

Home to one of the global economic powers, the health club market in India is among the largest in the Asia- Pacific region. India ranks fifth in market size among Asia-Pacific health club markets, at US$821m in annual revenue. The number of health club locations ranks third in the region at 3,813 sites, while the country’s two million members ranks fifth among observed markets.

The fitness club market in India is highly fragmented. Chained top-10 organised players comprise only 15-20 per cent of the overall market in terms of number of clubs. Independent players that are mostly low-end ‘mom-and-pop’ shops make up the rest of the market. Even with considerable growth over the past decade, the fitness club market in India is still relatively immature compared to other countries in the Asia-Pacific region.

Opportunities remain for the health club industry in India, as the country has the lowest member penetration rate in the Asia-Pacific region. Only 0.15 per cent of the Indian population between the ages of 15 and 64 currently belongs to a health club.

In efforts to grow the industry in India, the United Health & Fitness Forum (UHFF) was formed in 2016. Led by the top club operators in India, UHFF and its members organise events such as training workshops, boot camps, walkathons, and group exercise classes, along with other health and fitness initiatives.

Melissa Rodriguez is senior research manager at IHRSA.

Visit www.ihrsa.org/publications to access resources mentioned in this article