features

Marketing: The evolution of aggregators

The aggregator market is developing, diversifying and changing in response to market demand. We talk to suppliers and operators about their collaborations

The world is changing and the fitness industry must evolve to understand and meet the needs of consumers. Behaviour is altering; customers want more choice, expect more control and don’t necessarily have the same degree of brand loyalty.

“A proportion of people want to exercise but don’t want to belong to a single facility, so as operators, we’ve got to find a way of working collaboratively with aggregators,” says industry stalwart, John Oxley, who worked with MoveGB, Incorpore and Hussle during his time at Active Nation and Places Leisure.

“Some operators view aggregators as a threat – they’re concerned about a possible impact on margin and yield. While this may be true in some cases, it’s important operators calculate the cost per acquisition of new customers through existing channels, including the cost of discounts – which can be significant – and compare this to what can be achieved through aggregators. We need to move away from emotional decision-making and start looking at evidence-based arguments.

“Ultimately aggregators have the same objective as us all – they want more people in every community to be more active. They’ve also invested substantially in digital platforms to ensure customers can find them, something operators have traditionally found difficult to do on their own.

“It’s taken us 30 years to appeal to just 15 per cent of the population, so embracing change and working together seems a sensible way to grow the market,” says Oxley. “Collaboration with aggregators should be seen as just another strand of an operator’s marketing or lead-generation solution.”

We see ourselves as a network rather than an aggregator; connecting clients, employees and gyms to facilitate a growth in exercise levels in the corporate market.

Since 2001 we’ve built a network of 3,700 gyms, leisure centres, health clubs, yoga studios and bootcamps, including David Lloyd, Pure Gym, Nuffield, Virgin Active, The Gym Group, GymBox and Bannatyne, as well as local authority operators and independent gyms across the UK. We offer corporate rates to client employees wherever they live and work.

We represent 1,700 corporate clients, reaching six million employees and generating 300k gym memberships a year. In addition to creating footfall for clubs, we enable our network to talk directly, generating marketing at local and national level, so employees and clubs can maximise seasonal offers and promotions.

The biggest recent change for us is the alignment of health and wellbeing with fitness. When gym memberships were the front runner, 20 per cent take up was considered good. But evidence from wellbeing programmes enable employees to make more informed health decisions than the age old adage, ‘exercise is good for you’. So we’ve created products under four pillars of wellbeing – personal fitness, physical health, mental wellbeing and active lifestyle, which see a 70-80 per cent engagement.

While we’re now a wellness network, these pillars deliver more leads for our gyms than they have previously.

Medicash has been using Incorpore for more than 10 years and has 140,000 employees with access to its network. Despite the impact of Coronavirus, we’ve recently received leads into 57 of our clubs from them.

Understandably, Medicash wants to make sure employees can choose the right gym for them, based on location and price point, as they recognise employees are more likely to work out regularly in the club they feel most comfortable at.

The geographical solution David Lloyd clubs offer is complemented by Incorpore’s great work in providing centralised messaging for Medicash. It’s about working together to help as many people as possible achieve their fitness goals.

ClassPass has expanded the addressable market for studio fitness since its inception in 2013. We’ve acquired millions of customers over that time and more than 50 per cent self-identify as having never attended a studio fitness class prior to joining ClassPass.

Our value proposition to our partners is we help them sell inventory they wouldn’t have otherwise sold, to customers they otherwise wouldn’t have attracted, while completely protecting their direct business.

Since the pandemic started, we’ve helped more than 5,000 studio partners connect with our membership base around the world through their digital offerings. We also waived our commission for five months, given the extremely difficult circumstances.

As we look to the light at the end of the tunnel, we’re focused on the comeback story for our industry, including getting members re-energised to get back to classes and having revenue flowing to our partners again.

Our relationship with aggregators has definitely changed over the years. When we started out we saw them as dangerous, a threat to our business. As time passed we realised that, if managed correctly, there can be useful synergies.

We now partner with ClassPass and have developed a great relationship, working with them digitally and across all our sites.

For me, the key is to have a strong underlying business that attracts its own solid customer base. If you have that, opening up spots on ClassPass allows you to fill empty spaces. This incremental revenue can make a real difference to the profitability of a site, particularly in the early years before it reaches full maturity. Additionally, it can be useful for giving a new site a buzz in those early days while you build your customer base.

I definitely see it as a positive relationship; for most studio owners it makes sense to work collaboratively with aggregators.

Our platform was founded in 2012 to help corporate and private customers discover activities and live healthy, active lives.

We connect customers with more than 50 types of activity through 10,000+ partner locations across six European countries, enabling our partners to tap into new target groups not otherwise accessible to them, such as corporate clients, commuters or multi-sporters.

When our partners in Europe were put into lockdown in mid-March 2020, we set up a new online offer within two weeks. By introducing live online courses we were able to offer our partners an alternative platform and a lockdown source of income.

Digitalisation presents opportunities for studios to launch new courses, try new software and test out a hybrid offer. Our co-operations are based on success, which means we pay out member visits without monthly fees.

Our goal is a win-win situation and a long-term partnership – we want to help studios increase visibility, find new customers and fill courses that aren’t otherwise heavily attended.

As part of this vision for a strong European network, we’ve distributed a solidarity fund of €1.4 million since lockdown began; this involves keeping 20 per cent of our income and allocating the other 80 per cent to our partners.

Our cooperation with Urban Sports Club has been very enriching. In the beginning we were sceptical – we didn’t know if Urban Sports Club members would fit with us, our approach and our own members. But our concerns quickly dissipated; the collaboration is a perfect fit and has not only revitalised our gym, but also filled it with nice people, whom we treat like our own. An important factor in our success has been the positive collaboration with the Urban Sports Club team, who understand our spirit, react quickly to requests and have contributed good ideas. Their words are always followed by actions, a quality rarely seen in the market, and we can feel that our success is close to their hearts.

Hussle was formed in 2009 based on two key principles; increasing participation in physical activity and generating revenue for operators.

We target three groups, all of which don’t currently engage with traditional memberships: customers requiring multi-venue workouts that no single operator can provide and typically using at least two facilities around six times a month; occasional users who may also exercise outdoors or use digital platforms, but still represent a valuable share of a club’s wallet and; ‘try-before-they-buy’ customers.

In the last 18 months we’ve turned more than 30,000 of these into direct club members. Data for this period also shows we’ve brought 66,000 disengaged ex-members back and 14,000 brand new customers to gyms.

Hussle attracts consumers through partnerships with big brand names such as Vodafone and Premier Inn, as well as via employer staff benefit schemes with companies including Facebook, CBRE and Decathlon.

We believe operators should maintain leverage over their marketing partners and never ask for exclusivity. To give our partner operators further confidence, we’ve launched a Member Conversion Service (MCS), which proactively encourages users to directly join clubs they’re attending regularly.

3d Leisure began working with Hussle 10 years ago to bring in additional revenue and membership leads at no extra cost.

The Hussle team assists us in setting up each new site and optimises our exposure on their platform, to ensure we get good market share of their clients. They’ve created a bespoke report so that, month-on-month, we have insight into the overall performance of our partnership. In the past two years our revenue through Hussle has grown by 250 per cent. An average club takes £6,000 more income through day pass users and we take another £10,000 per annum in Hussle-generated memberships.

Organically five per cent of Hussle day and monthly pass users convert to a club membership, so we’re excited to see how the new MCS model – which will work to proactively drive member sales – will boost this further, post-lockdown.

What’s crucial for us is Hussle doesn’t tie us into an exclusive partnership. Working in partnership with them ensures us hassle-free income with no upfront costs.

Aggregation has always been about using technology to keep people active.

We knew from our own research that the convenience and variety inherent in our technology meant customers not only become more active, but stayed active for longer.

To find out more, we partnered with DataHub and ukactive this time last year to create the ukactive Research Institute Member Choice Report.

This showed customers using Move’s technology are twice as active and stay active for twice as long as customers who use single venue options.

Over the last two years, our offering has developed to include digital and virtual components; a trend the pandemic has accelerated. We now license and white-label the tech we’ve spent 10 years developing, for operators who need digital-virtual products with built-in mechanics that drive engagement and retention.

By integrating their platforms with Move, our partners can remotely re-engage members frozen out by COVID-19 and drive revenues by attracting new customers from all over the world. It’s been a lifeline for our partners during the pandemic and also equips them for the hybrid future.

Astley Sports Village worked with Move, Gladstone and Myzone to set up and deliver online classes during the lockdowns.

Our membership base is a highly active one: it boasts about 900 members, of which a significant number are Myzone users, so it was especially important to take rapid action when the pandemic struck and closures were enforced.

We’ve made 30 online classes available every week to livestream through Gladstone’s MoveAnywhere platform (powered by Move), integrated with Myzone’s MZ-Remote screen.

The integrated platform has been a lifesaver for our business during the pandemic – members have stayed active, loved the classes and it’s kept additional revenues coming in.

The results

• More than 20 per cent of our membership base is engaged

• Over 200 new digital member sign-ups happened in the first six weeks

• We’ve had 1000+ attendances to date

• We logged three attendances per customer during the week commencing 9th Nov 2020 – a higher frequency attendance than in-club.

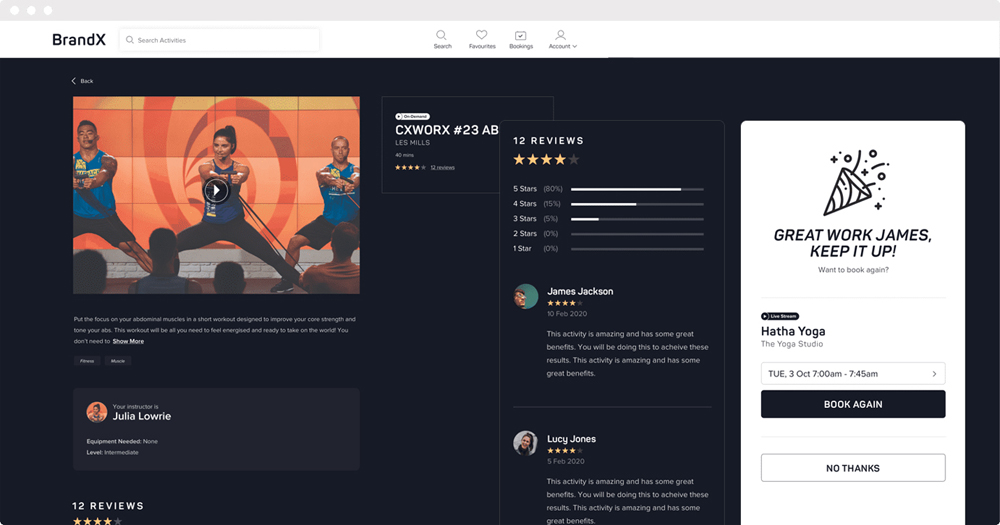

Gympass is active in 12 countries including the UK, US, Spain and Brazil. Working with some of the UK’s largest employers, including Tesco, Santander and Bupa, we offer partners’ employees access to gyms and studios, live-stream classes, virtual personal training and wellness partner apps through one platform.

Our UK network of 2,200 partners includes Anytime Fitness, Everyone Active, Bannatyne, Barry’s, Frame and Rowbots and our collection of 30 wellness apps includes Calm, Yogaia and Synctuition.

Wellness apps were introduced last year – brought forward as a result of the pandemic – to support our users and fitness partners and allow operators to take bookings and stream sessions through the live classes module, as well as book virtual one-to-one PT, yoga, Pilates and wellness coaching appointments.

This 360-degree wellness solution provided an essential revenue stream for operators while gyms were closed or restricted.

Ultimately, employers are looking for more than just fitness from their corporate wellness partner and by delivering this, our results drive the best return for our fitness partners too.

Since partnering with Gympass in 2020, we’ve been helping employees across the UK to get active through our network of over 170 clubs.

With people’s working habits dramatically changing in the past year, our strong geographical spread has provided accessible training opportunities for a wide range of employees and we’re seeing our clubs engage traditionally hard-to-reach corporate employees.

Anytime Fitness clubs pride themselves on their community feel. The Gympass partnership has attracted repeat visitors to clubs and established brand loyalty. Such is the extent of their positive experience that many Gympass users are referring friends to join Anytime Fitness.

With all Anytime Fitness clubs individually owned, the partnership has provided ancillary revenue opportunities for franchisees, as well as new member leads throughout the COVID-19 pandemic.

The sector should stop using the blanket term ‘aggregator’; it provides little value in decision making. Aggregators are simply marketing channels: different ways to reach and engage customers.

Activity providers must evaluate each marketing channel on its own merit and not all will suit everyone.

What isn’t immediately obvious in the aggregator space is the number and variety of marketing channels now available. This is due in part to the success of the sector’s open data initiative – OpenActive – and our work on everything from EMD’s Classfinder to Decathlon’s PLAY brand and initiatives such as Westminster City Council’s ActiveWestminster platform.

Marketing channels range from these free-to-use examples, through to fee- or commission-based models. The imin platform helps activity providers navigate these options and connect their activities and offers to those that best complement their offering.

No longer is it simply a case of deciding whether or not to work with the ‘big aggregators’. Through imin, operators can strengthen leisure contracts by directly supporting local authority initiatives and diversify their marketing reach by connecting with audiences from sports brands or startups to NGBs and beyond.

ActiveWestminster is a ‘one-stop-shop’ for residents to find local physical activity opportunities – a website and app where customers can find and book any activity, from leisure centre-delivered group exercise to community walking groups. It’s one example of the many projects made possible by OpenActive.

ActiveWestminster’s search and booking functionality is powered by the imin platform, which connects with the booking systems of local activity providers, including the council’s leisure operator, Everyone Active, and outdoor provider Our Parks, to deliver live, up-to-date information about available opportunities.

This is potentially a blueprint for how local authorities could work with partners to deliver digital services and increase access to physical activity for residents.