features

Research: Strong recovery

The results from the first Moving Communities Customer Experience survey present a positive picture of overall satisfaction with local authority facilities, explains Mike Hill

The Moving Communities Customer Experience Survey is the one of the largest consumer surveys ever completed in the public leisure sector in England. Conducted during April and May 2021, it was commissioned by Sport England to measure the impact of a £100m grant provided by the government via Sport England’s National Leisure Recovery Fund to support leisure centres in dealing with the impact of the pandemic.

The survey featured responses from over 50,000 individuals who visited at least one of the 1,183 local authority gyms, pools or leisure centres across 158 local authorities in England since reopening in April 2021.

The data suggests that customer expectations have been met, with overall satisfaction levels at an all-time high and a strong customer response.

The Net Promoter Score – an indicator of satisfaction and loyalty – has increased to 52 from pre-COVID industry averages of 40-45 and there’s an appreciation of greater levels of cleanliness in both activity areas and changing rooms.

Most importantly returning customers have higher levels of confidence in COVID-secure measures put in place by operators, compared to previous surveys.

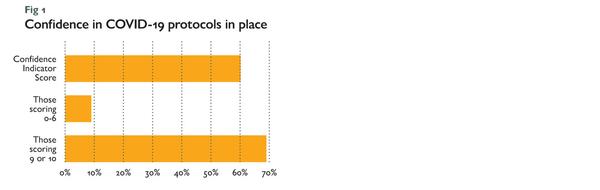

The Confidence Indicator Score is a metric that has been introduced during the pandemic to measure customers confidence and comfort levels when returning to their leisure centres.

Confidence in the product

Findings from the survey suggest those who’ve seen the new industry protocols in action are generally pleased with both the processes and the ways in which they’re being implemented – 69 per cent were extremely confident in their leisure facility, with only 9 per cent not at all confident in COVID-19 protocols. This resulted in an overall Confidence Indicator Score of 60 (See Fig 1).

This compares favourably with results from previous reopenings after lockdowns one and two, when scores were typically lower – between 50 per cent and 60 per cent throughout 2020. The Confidence Indicator Score is a calculation based on the question ‘During your last visit to the centre, how confident or not did you feel in the COVID-19 related protocols in place?’.

Activity levels and patterns

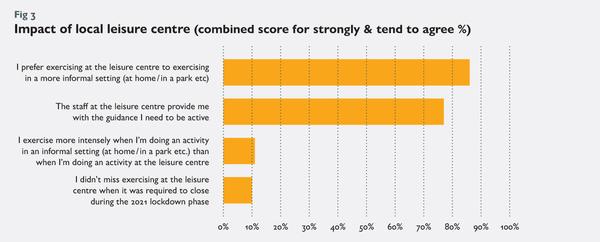

The findings of the survey also provide an insight into how much of users’ physical activity takes place in leisure facilities as opposed to other settings.

Interestingly, it appears that those completing moderate intensity activity one to three times a week have a greater reliance on public sector facilities than those who are exercising more than this.

People also reported they are more engaged when exercising in a facility, with 89 per cent saying they exercise more intensely in a leisure centre than in an informal setting.

Wider measures

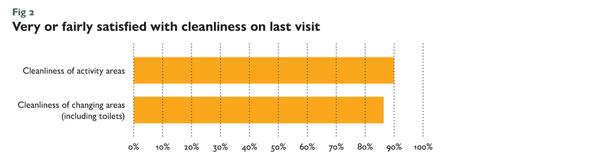

The survey looked closely at the customer experience of cleanliness, confidence in the COVID-19 secure procedures and practices, overall satisfaction and the value team members bring to the experience.

A key driver of positive performance will likely be the cleanliness of facilities. An encouraging 90 per cent reported satisfaction (very satisfied or fairly satisfied) with the cleanliness of the activity area itself, and 86 per cent said they were satisfied with the cleanliness of the changing areas and toilets (see Fig 2). These figures are considerably higher than pre-COVID cleanliness scores – as reported by the National Benchmarking Service (NBS) in 2020 – when activity area satisfaction was at 80 per cent and changing/toilet area satisfaction was only 70 per cent.

Role of local authorities

One of the most striking findings to emerge from the survey is the engagement people have with their local authority facilities – 86 per cent of respondents said they prefer exercising there compared to a more informal environment, such as at home or in a park.

More than three quarters of respondents (77 per cent) said they felt staff gave them the guidance they needed to be more active and 97 per cent of respondents said they intend to exercise at least once a week in their local facilities in the next six months. Conversely, only 9 per cent of respondents said the leisure centre ‘did not’ play a significant role in the lifestyle they wanted to live (see Fig 3).

Targeting those that need it most

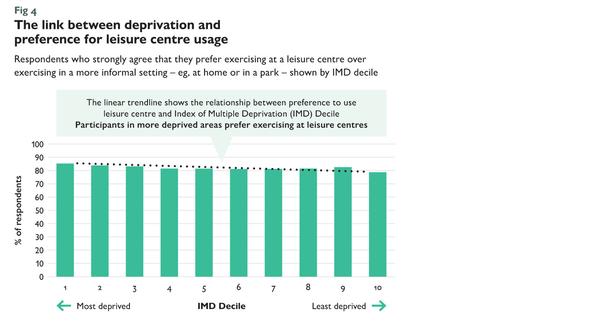

Although people from more affluent areas are still in the majority when it comes to facility usage, the data shows that the more deprived an area is, the more people prefer exercising in a leisure centre.

This is perhaps unsurprising given the lower quality of workout space that’s likely to be available to people from more deprived areas – whether at home or outdoors in public spaces.

Simply put, it appears that the less affluent someone’s postcode, the more likely they are to want to use a leisure centre for their activity.

This reinforces the important role local authority leisure centres play in communities and may also explain why a higher proportion of those returning to leisure centres are from more deprived areas, compared with 2019.

Data from other sources within Moving Communities confirms this trend, showing the strong return of participants from more deprived areas and a more balanced distribution of participation across deprivation groups.

To identify this trend, researchers looked at responses to the Customer Experience Survey and analysed them against the Index of Multiple Deprivation (IMD) – a measure of relative deprivation. The analysis revealed a direct correlation between level of deprivation and people’s preference for exercising in a leisure centre, compared to more informal settings, such as at home, as shown in Fig 4.

An encouraging start

These results also show the key role played by public sector leisure centres, particularly among people living in more deprived areas.

The proportion of customers from IMD groups 1-3 (most deprived), using leisure centres during 2019 was 23.9 per cent – when customers returned in April/May 2021, it was up to 26.1 per cent.

The Moving Communities Customer Experience Survey provides valuable insight into the role that public sector facilities play in local communities. The role of the local leisure centre appears to be essential in providing physical activity opportunities, while the sector’s approach to COVID-related cleanliness and protocols appears to be a key part of the return of customers.

The insight and data collected from the survey will complement the rest of the Moving Communities dataset, informing future strategic decisions that need to be made about where time, effort and money are best invested in order to most benefit local communities, with the next Moving Communities survey scheduled for September 2021.

Mike Hill is director of Leisure-net Solutions

• 86% prefer exercising in a local authority gym or leisure centre compared to at home or in a park

• 69% are extremely confident in COVID protocols, compared with 50-60% in 2020 Net Promoter Score has increased to 52 from pre-COVID averages of 40-45

• 89% say they exercise more intensely in a leisure facility than in an informal setting such as home

• 90% are very satisfied or fairly satisfied with the cleanliness of the activity areas

• 86% of people are satisfied with the cleanliness of changing areas and toilets in leisure centres compared with 70% pre-COVID

• 77% of respondents say staff give them the guidance they need to be more active

• 97% say they intend to exercise at least once a week in their local leisure centre in the next six months

• Only 9% say leisure centres ‘do not play’ a significant role in the lifestyle they wanted to live

Moving Communities is a Sport England initiative delivered by four partners – Leisure-net, 4global, Max Associates, Right Directions and Sheffield Hallam University’s Sports Industry Research Group (SIRG).

Moving Communities tracks participation at public leisure facilities and provides new evidence of the sector’s performance, sustainability and social value to assist local authorities, leisure providers and policymakers in supporting the recovery of public gyms, pools and leisure centres and taking informed decisions to keep people active.

The new platform represents an evolution of the Moving Communities report which has been produced annually by the ukactive Research Institute since 2017, building on ukactive’s work with its public sector leisure operator members.

The Moving Communities Customer Experience Survey was carried out over a seven-week period during April-May 2021. The survey was designed in conjunction with Sport England’s Insight team and builds on previous similar surveys carried out by the National Benchmarking Service. It used an online survey, distributed by participating local authorities and operators via email. The sample was, therefore, self-selective and the results have not been weighted in any way.