features

Finance: Get funded

Alicia Whistlecroft from Deloitte asks if the UK boutique health and fitness sector is capable of attracting the funding it needs

he UK health and fitness industry has developed and evolved rapidly over the last 35 years into a relatively mature yet still attractive, growing market. The Leisure Database Company published ‘The 2019 State of the UK Fitness Industry Report’ in May 2019, which estimated that the fitness market is valued at £5.1bn, an increase of 4.2 per cent on 2018. Moreover, it projects a compound annual growth rate of c.8.5 per cent in value and c.5.0 per cent in the number of gyms and health clubs over the next five years.

However, this is an industry faced with the need to make constant advances in product and delivery, as the customers continue to become more educated and aware of the benefits of different types of exercise on both physical and mental health.

Over the last 10 years the main disruption in the UK has been the strong growth of the budget operators, but more recently another storm has hit the industry – in the form of the boutique fitness operators. The development of the boutique sector is potentially much more diverse in its impact than the growth of the budget operators. It is also much more challenging from a funding perspective with the need for specialisation and sustainable differentiation being more important than scale. The following article considers how this sector can attract the necessary funding to make a real impact on the structure of the industry.

What is a boutique operator?

There are three underlying elements that can be used to define a boutique business; a focus on a clearly defined (specialist) product, flexible and/or bespoke delivery of the product and an underlying desire to create a community amongst its customers.

The focus is often on both a style of exercise and also the way in which it is delivered. Some sub-sectors are more developed, such as cycling, and some players, such as Barry’s Bootcamp, are already well on the way to achieving a strong international footprint.

People enjoy the flexibility of boutique classes without having to be tied into a gym membership. Furthermore, with gym memberships it is very easy to find an excuse to go tomorrow, whereas with a class-based product, you book a class at a time and frequency to suit you, making you much more likely to attend, leading to increased commitment and consistency of training.

Another significant differentiator of boutique fitness studios is that they are able to better offer a sense of community. Given the studios are small with a specific timetable of classes, the staff and customers become familiar with each other. This makes the exercise experience more enjoyable and customers are able to identify with the brand, which in itself is a powerful growth tool. The creation of this community spirit further fuels customer’s appetites to attend a workout class at their favourite boutique studio and in turn this helps to build customer retention.

Customers

It would appear that the millennial and generation Z demographics are the drivers behind this new type of exercise; young fitness enthusiasts who view health and fitness as a way of life. They are willing to pay more for a class that is tailored to their specific goals, that is more fun and engaging compared to just a routine gym workout, and for sessions that tend to specialise in one type of exercise with smaller class numbers.

Interestingly, a large portion of customers at boutique fitness classes are women. The Global Boutique Trends Report 2018 found that women made up 83 per cent of classes booked in London. This gender divide is similar in both New York and Los Angeles where women made up 83 and 81 per cent of bookings respectively.

US sector development

The US boutique fitness sector already has some large players such as Barry’s Bootcamp; a brand launched in LA in 1998 which has financial backing from North Castle Partners. After 11 years of operating solely in LA this brand is now developing into a global business with studios across the US and franchises in other major cities around the world. It now has over 50 sites in 9 countries, the latest one being in Australia.

Orangetheory has grown even quicker through franchising, starting in 2010 and now has around 1,000 worldwide units in roughly 20 different countries. Orangetheory has all the typical characteristics of a boutique, its differential niche is the use of heart rate monitors worn by each customer with the objective of working in specific heart rate zones to ensure maximum calorie and fat burning based on scientific knowledge. Throughout the workout all participant’s outputs (heart rate, calories burned etc) are displayed on a main screen in the studio – this helps to drive motivation and competition, maximises output from customers and is another component of the community spirit. The idea of having a differentiated selling point is key for companies trying to gain traction and succeed in this highly competitive industry.

Xponential Fitness on the other hand is a group of boutique brands from across the major categories of boutique fitness (pilates, barre, cycling, rowing, yoga, stretch and dance). The brands are run via franchise models with studios in close proximity to each other, which helps to drive the cross brand offering, however the brands are run independently and do not have shared central services.

Xponential Fitness had much of its initial growth supported by financing from TPG Partners since CEO Anthony Geisler sold Club Pilates to TPG after growing it from 80 to 475 franchise territories. Geisler and his business partner Mark Grabowski (an ex TPG partner) have since bought Xponential Fitness back from TPG Partners.

L Catterton, an established institutional investor with a focus on growing consumer brands, has been very active in the sector. Investments (both past and present) include Peleton, Flywheel, Pure Barre and CorePower Yoga. L Catterton also invests in health and beauty products such as Bliss and in related areas such as healthy food. All of these subsectors have positive market dynamics and there is some convergence as companies look to become more holistic in their approach.

The boutique fitness market has not quite reached IPO level yet; SoulCycle previously filed for an IPO but withdrew and Flywheel considered an IPO but has decided against it for now. However, this is something we could expect to see in the near future from some of the larger operators who have had significant success to date.

However, the US does already appear to be a little crowded in some geographies. For example, New York has numerous brands of fitness studios, e.g. the cycle studio space has the likes of SoulCycle, Flywheel, Peloton, Revolve, Crank, Swerve, Cyc, Syncstudio and so on.

By comparison, London, a city with a similar population size to New York, has a much smaller number of boutique fitness studios, with many operators only having a handful of studios, suggesting there remains significant opportunity in the UK, as well as Europe, where there aren’t as many boutique fitness concepts established as yet and the roll out of existing brands has been on a smaller scale.

Institutional funding and other sources (UK)

Many expect the UK to follow in the footsteps of the US, as it has in other sectors, so we could expect to see increased levels of investment in the coming years. There are a lot of smaller UK boutiques out there with great concepts and rapidly growing customer bases such as TRIB3, Core Collective, KoBox, Psycle, BLOK, Flying Fantastic etc, so there are plenty of opportunities for financial investors either on a single brand basis or through building a brand portfolio.

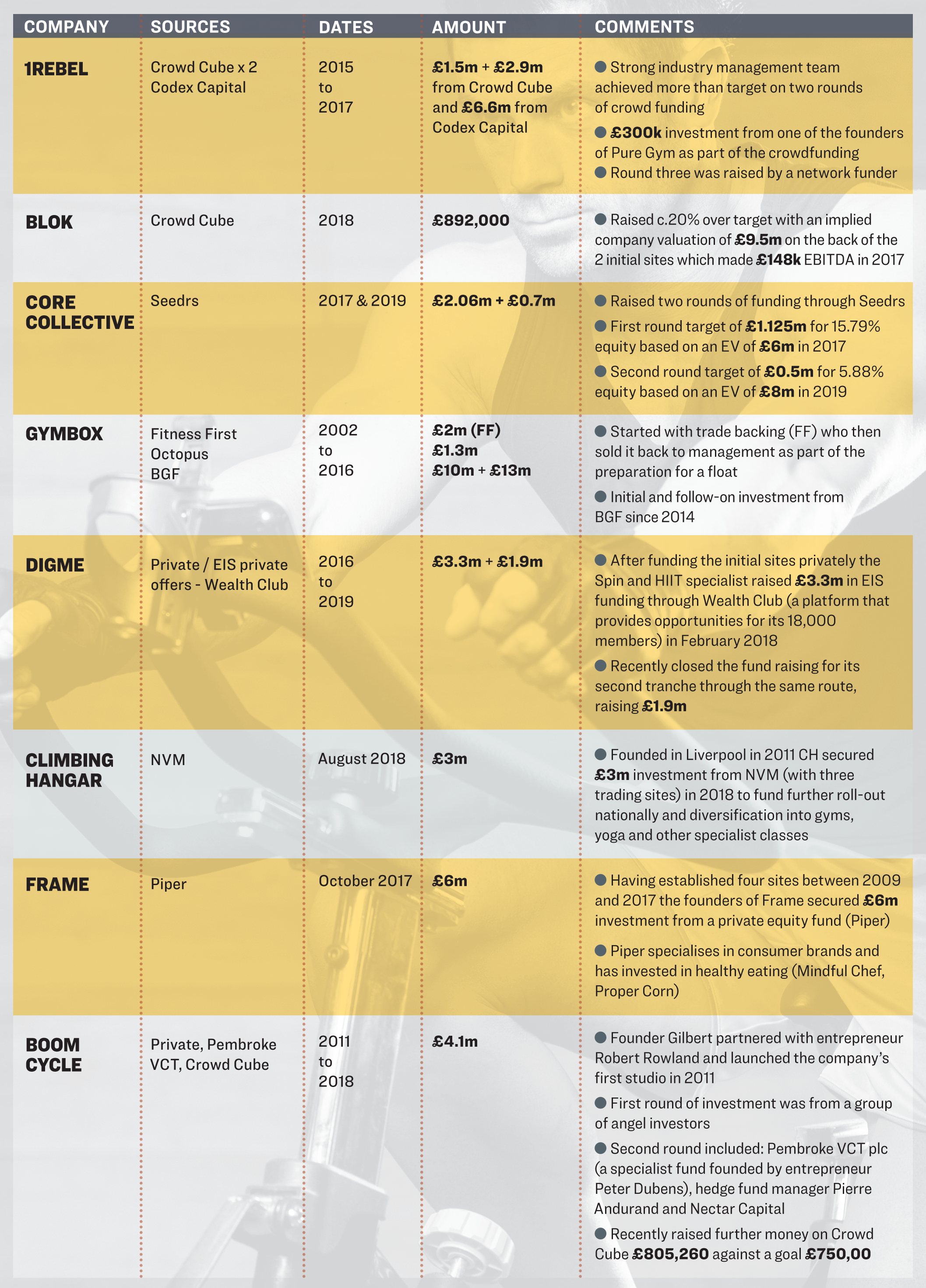

To date there have been a number of successful capital raises from a wide range of sources including:

Crowdfunding – (eg. Crowd Cube, Seedrs) this can be an excellent way of proving out an initial concept before approaching the institutional investors to create scale. Crowdfunding can also assist with marketing and establishing a loyal core of advocates for the brand.

Network funding – (eg. Wealth Club, Codex Capital) there are a number of financial advisors who have an established network of high net worth investors and will help companies present their ideas to this network in order to raise funds. This tends to be second or third round funding, where there is some proof of concept.

Family funds – this sector is becoming more and more active and increasingly structured in its approach as high net worth families look to more independently manage their money. Those who have made money in the health, wellbeing and fitness markets are usually more inclined to invest where they feel they have an edge.

Institutional funds – (eg. NVM, Piper) – increasing interest from this financial community will enable more scale businesses to be built. These institutions typically raise 10 year funds, the benefit of this being that the money is already raised and follow-on capital can be agreed at the board level (as achieved at Gymbox – see table ). Typically these funds would look to invest in businesses with more than £1m EBITDA.

Accessing capital

In boutique sectors it can be harder to attract interest from institutions because of concerns over scale, competition and ‘keyman’ dependency. In approaching the institutional funders and family funds, businesses should focus on being able to answer the following common challenges from investors:

• Over the medium term is it possible to create a scale business?

Institutional investors like to invest in companies that have the potential to continue growing for 10+ years, as this makes it easier to recapitalise the business. For specialists this can be a challenge as the product may have a limited market. As well as creating an effective roll-out model, brands can consider merchandising, franchising, tie-ups with mass market brands, etc. to provide a range of growth levers.

• Does the model work outside London?

The majority of UK expansion is likely to be within metropolitan areas, with a large portion of the UK’s current boutique fitness studios being in and around London. Some have expanded outside the capital, including Barry’s Bootcamp, which recently opened a site in Manchester, and F45 (a company offering 45 minute high-intensity, circuit training workout classes) which has several franchised locations around the UK including Birmingham, Brighton, Chelmsford, Harrogate and Reading, with many more opening soon. So no doubt other companies contemplating national expansion will be keeping a close eye on how these studios perform compared to their London counterparts.

• Can the differentiation be sustained?

Many industry experts believe there is an increasing pool of additional customers alongside the existing fitness industry as millennials place a greater importance on their fitness than previous generations. Appealing to these more ‘intense’ users of health and fitness should be expanding the market. However, with sometimes relatively low barriers to enter and also existing mainstream players who already have the footprint to exploit new concepts, the investors will need to be convinced the growth plan is sustainable.

• ‘Keyman’ dependency

Not a challenge for the more tech-driven products but where the customer experience is largely governed by the people delivering the training, replicating this as a business gets larger can be a major challenge.

Conclusions

One thing is for sure, as more competition comes along in the form of both new concepts as well as new sites for existing companies, the quality of the studios and the classes available will need to be the best in the market in order to succeed.

More mature consumer sectors have a long history of creating new boutique products and we expect the health and fitness sector to continue to throw up new and interesting alternatives to the mainstream. This is a market that has seen rapid growth and will continue to prosper as individuals become more focused on their health and fitness and the different ways to train. If this is the case it becomes a question of consumer preference, which training methods are most favourable and if there is the same level of appetite outside the major cities. These factors will help define which boutiques are successful and can grow significant market share.

There is a lot of growth still to come in this sector, from both new emerging concepts as well as existing concepts taking advantage of the ever increasing empty retail spaces on the high street and expanding into new studios across the country. Private Equity is well placed to support this growth and make the most of an industry that is set to continue to grow as health and fitness becomes a more integral part of consumers’ lives.

Moreover, this growth isn’t just in the fitness space, the increasing focus on ‘wellness’ is extending to nutrition, supplements, clothing and more. Investors have been active in this segment of the market including Lion Capital’s investment in the sports nutrition company Grenade, Piper’s investment in Proper Snacks and Pembroke VCT’s investment in Plenish Cleanse, and there are plenty more nutrition or healthy snacking based companies out there such as Fulfil Nutrition, Eat Natural, Pip & Nut, Rude Health, Pure&Co and many more. Boutiques are well placed to benefit from partnerships with businesses from these other sectors, who are keen to build on the strong customer loyalties experienced in the boutique fitness market.

Additionally, there is a big opportunity for boutiques, as well as their financial investors, to work alongside health organisations, insurance companies, etc., and provide evidence-based fitness programmes to their customers as part of a wider integrated health and wellness programme. By aligning themselves with these types of organisations, boutique brands will gain further exposure to different markets, such as healthcare, and by doing so will cement themselves in the industry as a key player and one that is responsible and sustainable, whilst no doubt a partnership like this would have a significant impact on their growth trajectory.

Overall, the UK boutique fitness market is an exciting space to be with lots more opportunity and growth still to come. With many appealing investment characteristics we believe it is only a matter of time before private equity and other financial investors take a real plunge into this market.

Alicia Whistlecroft is a manager in Deloitte’s M&A Advisory Corporate Finance Department. She sits in its Travel, Hospitality and Leisure sector team and is a keen fitness enthusiast. [email protected]