features

Industry trends: Staying on trend

Stephen Tharrett and Mark Williamson of US-based research and consulting firm ClubIntel share the take-home messages from the 2017 International Fitness Industry Trend Report

In business, trends can be considered an essential truth. They inform us of where the market is headed, what competitors are doing, what consumers are embracing, what business leaders are thinking and what opportunities are ripe for the taking. The 2017 International Fitness Industry Trend Report reveals the current trends in the global fitness industry. The new report, which was generated from 1,349 responses and represents over 14,000 fitness facilities around the globe, tracks over 90 industry practices across four key segments: programmes/services, equipment, facilities and technology. The study also explores differences in outcomes according to region: Asia Pacific, Canada, Europe, Latin America and the US.

Overarching Insights

The first key insight unearthed by the report is that high price points are associated with trend setting. Essentially, the higher an operator’s monthly price point, the more likely it is to be a trendsetter. In the majority of cases, fitness businesses with the highest price points – commercial luxury clubs, commercial premium clubs or medical fitness centres – held or shared the top position in respect to the trend practices across programming, equipment, facilities and technology.

The next key insight from the report relates to the impact of fitness programme selection on business operations. The survey findings indicate that the type of fitness programmes a business adopts ultimately dictates the equipment it acquires and the facilities it uses to house those programmes.

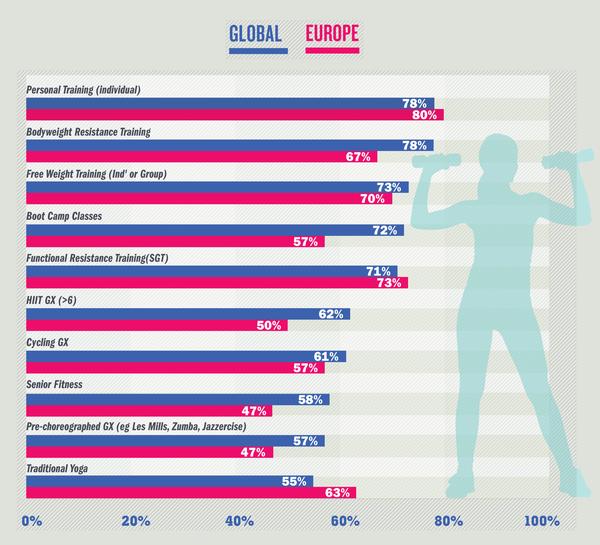

However, programming is not only a crucial influencer of business operations, it also appears to be unique to each region of the globe. Of the top 10 global programming trends for 2017 (see graph: The top 10 global programming trends by level of adoption), yoga, functional resistance training and one-to-one personal training have a marginally better uptake in Europe compared with globally, whereas bodyweight resistance training, pre-choreographed group exercise and senior fitness have noticeably better uptake globally than in Europe.

When observing programming trends by level of adoption, the power of group programming is clear to see. Whether it involves HIIT, cycling, barre, boot camp, yoga, pre-choreographed group exercise or suspension training, exercising in a group setting appears to have become the approach of choice.

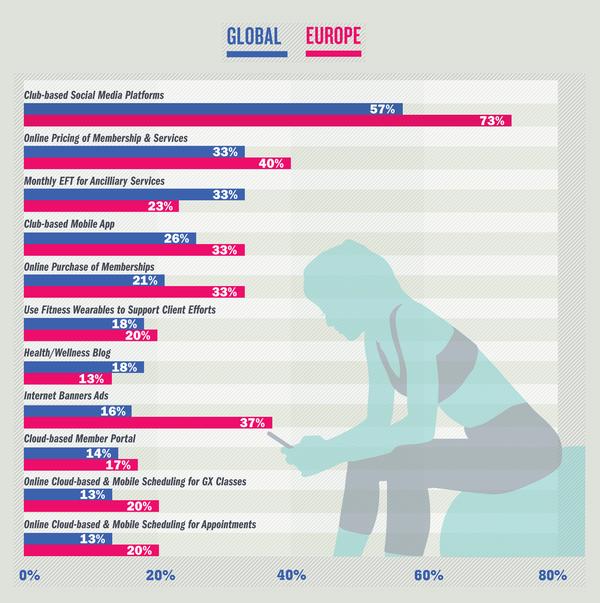

Despite the inescapable influence of mobile technology in society today, the fitness industry remains a surprisingly slow adopter of technology. The survey findings show that other than the use of social media (mostly used to sell and promote products) – which has been adopted by 57 per cent of operators – only three of 13 technology platforms have achieved 30 per cent adoption.

While the global fitness industry leans toward being prehistoric in its approach, European operators show a greater propensity for adopting technology as a tool of the trade (see graph: The top 10 global technology trends by level of adoption). Furthermore, in respect to technology, the report highlights that the majority of operators have adopted technology that helps them sell rather than engage and immerse customers.

Industry firestorms

A firestorm describes a force that is intense and highly destructive in nature. Trends can be firestorms when they experience rapid and exponential growth and, in doing so, change the landscape of a particular industry. In the case of the fitness industry, there are three trends that have experienced enormous growth over the past four years, and their growth has changed how fitness businesses operates:

Barre and HIIT classes

These experienced more growth over the past four years than any other programme – 30 percentage points – as evidenced by the fact that barre and HIIT studios are among the most popular types of boutique studios. Two of the largest fitness studio franchisees in the world are built around these programme formats: Pure Barre with over 450 locations and Orangetheory with over 700 locations.

Non-traditional functional training equipment

This group – comprised of tyres, battle ropes, sandbags, rings, kettlebells and other more recently established pieces of training equipment – experienced the greatest growth of any type of equipment over the past four years, approximately 20 percentage points. In fact, this category of equipment has grown so rapidly that it has turned conventional strength training equipment into a niche product based on its overall level of industry adoption.

Social media and club-based mobile applications

Use of these digital platforms has grown by more than 20 percentage points over the past four years – a significant level of growth when compared with other technologies, like on-demand and live-streamed group exercise classes, or the use of internet middlemen such as ClassPass and PayasUgym.

Applying the lessons

Virtually every player in the fitness industry has much to gain from staying abreast of existing and emerging trends, as such intel can be used to guide the business decisions of companies while helping them to strategically position themselves within the industry. To that end, the ClubIntel 2017 International Fitness Industry Trend Report builds on the overview provided in this article and paints a comprehensive picture of the industry’s areas of opportunity and growth, which stand to benefit operators, developers and suppliers alike.

GRAPH 1

Top ten Global Programming trends by Level of Adoption - Comparison to Europe

GRAPH 2

Top ten Global Technology trends by level of adoption - Comparison to Europe

About the authors

Stephen Tharrett and Mark Williamson are the co-founders of ClubIntel – a US-based research and consulting firm for the health club and fitness industry.

A full copy of the report can be downloaded from ClubIntel at www.club-intel.com