features

IHRSA update: Learning from Latin America

A new report provides valuable data on the Latin American market. IHRSA’s Kristen Walsh explains

Last month, IHRSA released The IHRSA Latin American Report (Second Edition), which is sponsored by Hoist Fitness. This research publication, an update to the groundbreaking 2012 report, was produced in collaboration with Mercado Fitness (Argentina) and supported by trade body Fitness Brasil.

A healthy industry

According to the report, the health club industry in Latin America is robust. The 18 Latin American markets analysed generate US$6 billion in revenue from more than 65,000 clubs. Nearly 20 million Latin Americans are members of a health club. Brazil alone accounts for more than half of the health clubs in Latin America with 34,509 facilities. Argentina has the highest penetration rate among all the markets, as 6.8 per cent of Argentineans currently belong to a health club.

“The health club landscape in Latin America is dynamic and has undergone significant developments since 2012,” said Guillermo Velez, editor of the report and director of Mercado Fitness. “In addition to the growth of the low-cost segment, other developments, including economic indicators, increasingly savvy consumers, technology, the boutique phenomenon and professionalisation have all impacted and shaped the industry in Latin America.”

Room for growth

While club operators and industry experts have observed growth amidst market developments in the region, opportunities abound in Latin America. The report shows an average penetration rate of 2.15 per cent, signifying potential for growth. Along with Argentina’s 6.8 per cent, Brazil and Mexico both have member penetration rates exceeding 3 per cent, at 4.6 per cent and 3.2 per cent, respectively.

Highlights from the report

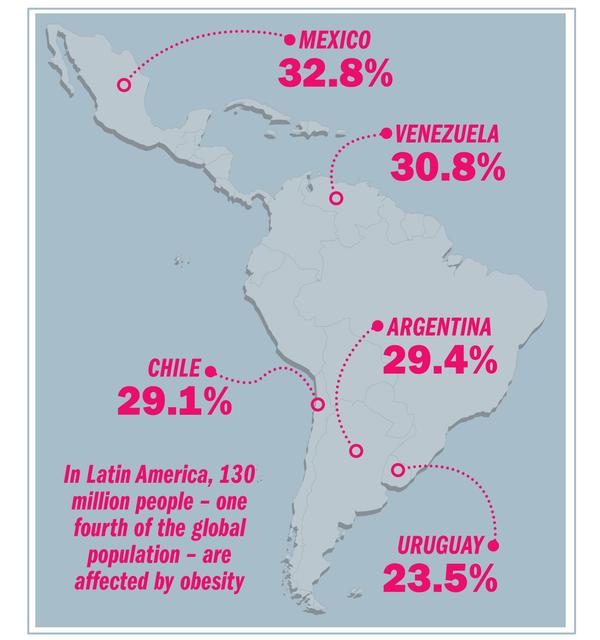

• Overcoming obesity

In Latin America, 130 million people – one fourth of the global population – are affected by obesity. These figures could reach 191 million by 2030. The countries with the highest rates of obesity are Mexico (32.8 per cent), Venezuela (30.8 per cent), Argentina (29.4 per cent), Chile (29.1 per cent) and Uruguay (23.5 per cent).

Obesity is a global pandemic: a person with obesity lives 10 years less than someone with a healthy weight. World Bank reports indicate that if this tendency continues, by 2030 the number of people in Latin America with obesity will reach 30 per cent of the population.

• The problem of inactivity

World Health Organization data points out that in Latin America 60 per cent of the population is sedentary. This same agency indicates that in this region physical inactivity causes one out of every 10 deaths. This is nearly the same impact that smoking has on the population, according to scientists.

• Embracing low cost

When the last regional IHRSA report was published in 2012, there were only two low cost chains in two countries in Latin America. Today, less than five years later, there are at least 23 different brands with a total of 448 gyms (340 of these belong to SmartFit) in 12 countries throughout the region.

Undeniably, this phenomenon has only just begun. As consultant Ray Algar explains, “it’s not only a matter of pricing, but more an all-embracing organisational philosophy”. As far as consumers are concerned, “they know that high costs do not necessarily guarantee quality service and they’re less obsessed with paying more just to prove status – they value their money and are convinced that paying less is more savvy”.

Several specialists agree that the low cost offer stimulates a new demand and does not necessarily encourage less spending. However, they also remark that this model’s growth will affect health clubs in the mid market.

Traditional gyms – full service in theory – must review their value propositions in order to validate higher pricing. “Those who don’t will be less valued and become irrelevant” claims Algar. The market tends to polarise itself and in between poles there will be nothing left.

• A diverse offering

In competitive scenarios, with consumers eager for an enhanced experience, the fitness industry is undergoing a substantial diversification process. While premium health clubs and low cost gyms consolidate opposite poles within the market, boutique fitness studios – also known as Micro Gyms – thrive in Latin America as well as globally.

OBESITY PERCENTAGE RATES IN LATIN AMERICA

“The growth of the low-cost gym market, increasingly savvy consumers, technology, the boutique phenomenon and professionalisation have all shaped the industry in Latin America” - Guillermo Velez

Get the Report

The IHRSA Latin American Report (Second Edition) [77 pages] is available as a PDF at www.ihrsa.org/latin-american-report

ABOUT IHRSA

Founded in 1981, IHRSA – the International Health, Racquet & Sportsclub Association – is the only global trade association, representing more than 10,000 health and fitness facilities and suppliers worldwide.

Locate an IHRSA club at www.healthclubs.com

To learn how IHRSA can help your business thrive, visit www.ihrsa.org