features

The Wellness Effect on Real Estate

The Wellness Real Estate Report, recently published by Resources for Leisure Assets, explores how spa, wellness and wellbeing activities impact hotel revenues and profits. Roger A Allen shares the key findings

Evaluating the tangible effects of spa, wellness and wellbeing offerings on the financial performance of hotels and resorts has never been more important, as investors and developers are exploring ways to satisfy new customer expectations and boost operational efficiency in a post-COVID era.

Industry stakeholders often face challenges in assessing the intrinsic value of these features, as benchmarking the competitive set of hotels and resorts with a wellness proposition is an increasingly complex process because of the broadening landscape of activities and experiences, including spa, sport, fitness, healthcare, leisure and recreation.

The Wellness Real Estate Report aims to support investors and developers in determining how wellness and wellbeing services and features impact the bottom line of their existing asset or planned project. It uses market data from P&L benchmarking firm, HotStats, on the performance of 3,200 hotels of all classes globally to provide insights into how such activities contribute to revenue and profit.

Shifts in Demand

Real estate markets were greatly affected by new customer expectations and socio-economic factors in recent years, including increasing health-consciousness, which led to more spa visits and higher spend at wellness facilities, and the emergence of new customer groups, such as Gen Zers, who have a heightened focus on self-care and a willingness to pay premium for wellness products.

These trends have been best indicated by key adjustments in the hotel industry. Spas have become essential components in most hotels; thermal and mineral springs grew in popularity due to the rising demand for authentic and natural spa experiences, and wellbeing offerings often became integrated through the entire property rather than focusing only on the spa area.

Focus on health

Widespread concerns related to the COVID-19 pandemic have further strengthened customer focus on health, which translated into an increased demand for wellbeing services. Digital wellness products and remote healthcare solutions became highly popular, which may affect how real estate space can be used efficiently for wellness activities after COVID-19 is subdued.

Revenue Generation

Partially as a result of increased customer demand, spa, wellness and wellbeing activities may positively affect the business performance of hotel and other real estate properties. They offer great opportunities for market differentiation, upselling and diversifying revenue streams through treatments, experiences, food and beverage and retail.

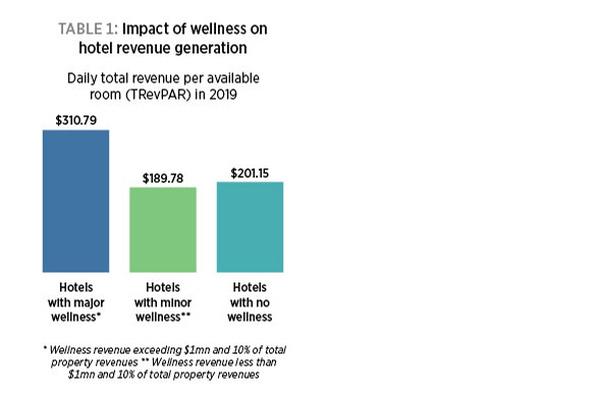

The Wellness Real Estate Report finds that hotels and resorts with major wellness operations – where annual wellness revenues exceeded US$1m and accounted for over 10 per cent of overall property revenue – generated 43 per cent higher total revenues per available room (TrevPAR) in 2019 than their peers with no wellness offerings. The huge difference is partially due to a gap of over 9 per cent in average room rates (ARR), to the advantage of wellness hotels. Higher ARR at hotels and resorts with major wellness offerings certainly reflects that many of these properties operate in the luxury category, where a wellness component is an essential requirement and widely expected by guests.

Discretionary spend is usually higher at luxury properties, which is also reflected in our data about daily food and beverage revenues. On average, guests spent nearly twice as much on food and beverage at hotels and resorts with extensive wellness operations last year than at properties with no wellness services whatsoever.

Hotels with major wellness generated 48 per cent higher TRevPAR than hotels with minor wellness operations, where annual wellness revenues totaled less than US$1m and were below 10 per cent of overall property revenue. Major wellness hotels benefited from nearly 20 per cent higher ARR compared to hotels with relatively small wellness elements.

It is particularly striking that hotels and resorts with minor wellness recorded almost 6 per cent less TRevPAR than those with no wellness, and the difference in average ARR was nearly 11 per cent between these two categories, also to the advantage of regular hotels without wellness.

Although this gap in average room rates is only significant if the context of the wellness investment is addressed, the results do offer statistical evidence that simply adding wellness or wellbeing features doesn’t necessarily translate into higher revenues per room.

Operating Expenses

Hotels and resorts with extensive wellness or wellbeing services normally have higher operating costs compared to standard hotels because of increased energy, utility and staff expenses. Regardless of the wellness and leisure size, it is the labour expenses which represent the highest cost ratio versus revenues.

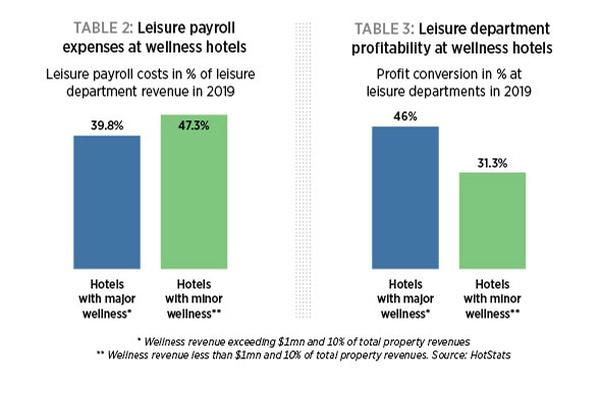

Economies of scale and efficiency may greatly impact operating expenses, data from our report confirm. Payroll expenses at properties with major wellness totaled less than 40 per cent of leisure revenues in 2019 and were about 7.5 percentage points lower than those at hotels with relatively small wellness.

These cost indicators provide an insight into the difference in overall profitability of leisure departments at big wellness hotels compared to hotels with minor wellness. The departmental profit conversion rate at properties with extensive wellness was almost 15 percentage points higher than their smaller rivals.

In other expense lines, like energy and utility costs, there are opportunities for efficiency improvements by adopting new eco-friendly and sustainable solutions, such as LED lighting with sensors, remote systems tracking temperature or humidity, or artificial intelligence solutions helping reduce energy waste.

Factors to Consider

Our results about revenues and operating costs highlight the importance of selecting the right business model for wellness facilities and services (in-house management, partnerships or outsourcing) and also underlines the need to properly determine how much of the real estate should be dedicated to wellness.

One of the many other aspects real estate investors and developers must consider before starting wellness or wellbeing projects include location. City hotels, for example, which have limited availability of space, should be more thorough in defining and measuring how wellness amenities can add value compared to expanding room capacity or introducing other services.

Resorts and hotels need a much more specific wellness and wellbeing proposition to define and differentiate the property. Such differentiators could include a specific approach to products, treatments and facilities – like anti-ageing or lifestyle medicine – and geographical features or natural elements, such as nearby thermal and mineral springs.

Investment Approach

Corresponding the wellness and wellbeing activities to the specific characteristics of the property is important, while understanding the direct internal rate of return (IRR) on investments related to these activities is fundamental.

Wellness and wellbeing within hotels and other real estate projects will continue to be a popular and important attraction. Investments in these features, particularly in the hospitality industry, require the same scrutiny as any other real estate transaction.

For further data and analysis on how wellness and wellbeing impact hotel profitability at the property level, download your free copy of the Wellness Real Estate Report at wellnessrealestatereport.com

Roger A Allan is Group CEO of global advisory firm, Resources for Leisure Assets (RLA) and a member of the International Society of Hospitality Consultants (ISHC).