features

Research: The road to recovery

New research shows that UK public sector health and fitness is on track for recovery, but operators face shifts in their member profiles that mean operators will need to adapt to thrive

In a story now all too familiar, March 2020 saw the temporary closure of the sport, leisure and physical activity industry at the hands of the pandemic. Thousands of facilities were forced to close as the country went into lockdown.

Two months later, with the industry showing signs of life as we got closer to a reopening date, ukactive and 4global – powered by the DataHub and supported by organisations from across the sector – attempted the impossible. Researchers used modelling and analytics to predict the future, providing public sector operators, trusts and national bodies with evidence on which to build their financial and operational plans.

The research

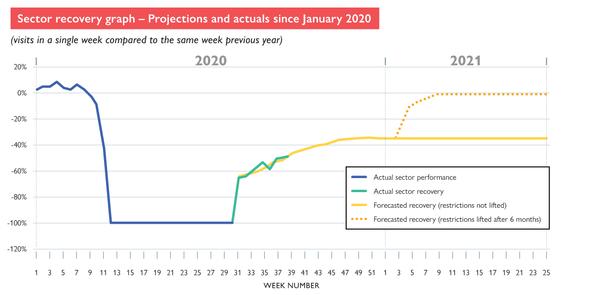

Using member and participation data from pre-lockdown, combined with consumer confidence data from inside and outside the industry, the research team used predictive modelling to map the sector’s expected path out of lockdown.

The calculations considered restrictions on facility capacity, a lower rate of participation by older age groups and a reduced amount of swimming and team sports. It was estimated that if restrictions were lifted six months after opening, the industry would reach -1 per cent (minus 1 per cent) of participation by the end of February 2021, when compared to 2020 figures.

Taking into consideration a steady increase in consumer confidence (the willingness of people to use facilities), and with operators across the UK being required to limit class sizes and gym entry during peak time, calculations for late September 2020 projected that participation at local authority and trust facilities would be 51 per cent of the figure for the same week in 2019.

Is the sector on track?

Against these projections, live participation figures from the DataHub show that the calculations from the research team were exactly right, at an accuracy level above 98 per cent in the first eight weeks of re-opening.

“The projections we made back in May are being realised, as participation across the sector is impacted by consumer confidence and capacity restrictions,” says Utku Toprakseven, partner at 4global Consulting.

Toprakseven led this latest research, which was published almost exactly six months after the UK first faced lockdown.

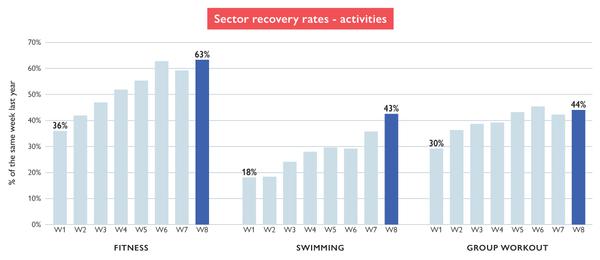

The data, which was taken from over 800 local government and trust sites across the UK, showed the proportion of the industry that was open grew from 48 per cent in the first week post re-opening, to 69 per cent by the end of week eight.

From this representative view, the participation data has been analysed by facility type, focusing on health and fitness, swimming and group exercise.

As shown in Figure 1, fitness has shown a steady increase from 36 per cent in the first week following re-opening, to 63 per cent by the end of week eight, when compared to the previous year.

Group exercise, which has been impacted to a greater extent in terms of capacities and floor space than fitness, has had its participation numbers capped in comparison with last year, but continues to present high occupancy levels and be a driver for returning to centre-based activity – it’s also had the quickest recovery rates and highest demand of the three main activities.

Operating swimming facilities has also been a challenge across the sector, driven by low consumer confidence immediately following lockdown, combined with high running costs and the extensive processes required to run a pool safely.

Among other considerations, pool space has contributed to a difference in recovery journeys between the public and private sector. While the public sector has struggled to make the numbers add up in the absence of swimming lessons and lower overall participation, the private sector has recovered more quickly. Fitness and group workout represent a higher proportion of footfall and revenue for private operators, leading to higher participation figures and greater member recovery.

Changing face of leisure centres

COVID-19 has impacted the traditional leisure facility member base. “The profile of people using leisure facilities is changing,” says 4global’s Ed Hubbard –co-author of the original COVID-19 Impact Report. “Women and girls have returned to facilities more slowly than their male counterparts, while some older people have chosen to exercise at home or outside.”

The data shows that participation for members aged 65+ is falling slightly as a proportion of all visits to leisure facilities, but with only a two per cent swing against figures from 2019. The proportion of participation by children aged 1-15 has also fallen slightly, from 23 per cent of total participation in late September 2019 to 19 per cent at the same point this year – primarily as a result of restriction in school swimming and other courses.

This has been offset by an increase in the proportion of visits by those aged 16-54, a trend which was forecast following early survey data that indicated older adults were less confident returning to health and fitness facilities than their younger counterparts.

The next challenge

In line with projections for the sector, participation has grown steadily since reopening and members have continued to gain confidence in the safety, cleaning and operational processes instated by operators. Now we have the opportunity to look at the challenge the sector faces going forward.

Local and regional restrictions continue to be broadened, with approximately one third of the UK’s population subject to restrictions at the time of writing. This will undoubtedly have an impact on the performance of the sector in these geographical areas, either through mandated closures or reduced consumer confidence.

As member and participation data in these areas of the UK is available and statistically robust, the research team at 4global will continue to monitor sector performance and update future projections accordingly.

Modelling undertaken as part of the COVID-19 Impact Report assumed, as a worst case scenario, that restrictions on capacity and entry to facilities would be lifted at the start of the seventh month following the original re-opening date.

This anticipated that consumer confidence would increase significantly and that a removal of restrictions would allow the sector to get close to full recovery by early 2021. However, if – as implied by government announcements in September 2020 – restrictions are in place beyond March 2021, operators will be unable to reach the predicted figures. Based on current levels of government support for local authority leisure, this would mean the long-term sustainability of many facilities would be under threat without further support.

Analysts had predicted that with more people working from home and work-life balance appearing to become more flexible, the age-old challenge of facilities being too busy in peak hours and not busy enough during off-peak hours would become a thing of the past.

However, the data does not show this to be the case, with people continuing to exercise in the morning before work and in the early evening. Operational challenges around this are exacerbated by entry restrictions and limited facility and class capacity, which has ultimately led to willing gym-goers being turned away or asked to queue to access facilities, with all the challenges that accompany this in terms of customer engagement and retention.

The operators being surveyed have so far failed to persuade customers to exercise during off-peak hours – something that would ease this situation and improve their bottom line.

Re-engaging in autumn

To some extent, the mental health of people in the UK was saved by the warm, dry weather that coincided with lockdown. Participants were able to replace their regular gym workout with outdoor exercise and in some demographics, we saw increasing activity rates, as people were motivated to escape the house and improve their health and wellbeing. For the leisure industry, this created further challenges, as some members cancelled their memberships in favour of a new hybrid of outdoor activity and digital classes.

As autumn arrives across the UK, these new behaviour patterns and habits will be put to the test. Operators will be hopeful that, through a combination of vastly improved digital offers and the promise of a tried and tested membership offer, old and new members will be tempted back into the facility. Only time will tell whether the dark nights will remind people that the motivation of an instructor, class or fitness professional is just what they need to reach their goals and get through a long UK winter.

Monitoring the recovery

If the now customary 5.00pm government news conferences have taught us anything, it is that COVID-19 has brought data and insight to the forefront of everyone’s minds. Whether friends are discussing the change in the R number over their socially distanced picnic, or local newspapers are reporting on the latest increase in case numbers, the need for robust data and a process that people can understand has become of paramount importance.

“As a sector, it’s clear that if we want to build a compelling evidence base about the benefits of physical activity, while ensuring the long-term sustainability of operators, we must use data and insight to support our strategic and operational decision making,” says Toprakseven. “We must be responsive to the changing requirements of our customers, but we must also be proactive in designing facilities, programmes and initiatives that get people active and keep them coming back.”