features

IHRSA update: Asia Pacific

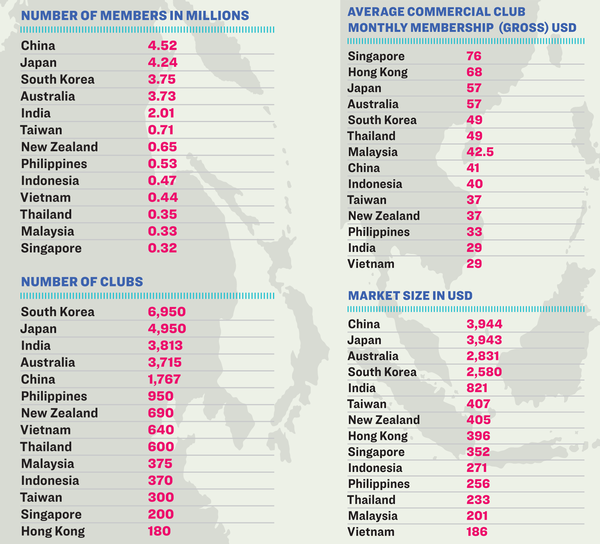

The Asia Pacific health club market is now worth US$16.8 billion, according to an exceptional new report. IHRSA’s Kristen Walsh shares some of the highlights

The second edition of the IHRSA Asia-Pacific Health Club Report was released recently in collaboration with Deloitte.

It demonstrates that the health and fitness industry in the Asia-Pacific region is in good shape – fueled by growing economies and with significant potential for continued growth.

Deloitte says only two markets in the region are considered mature, these being Australia and New Zealand, which have the highest penetration rates at 15.3 per cent and 13.6 per cent, respectively.

While the fitness market shows signs of rapid growth and professionalisation in terms of penetration rates in Hong Kong (5.85 per cent), Singapore (5.8 per cent), and Japan (3.3 per cent), significant opportunities for growth still remain in less developmed markets, such as the Philippines (0.53 per cent), Thailand (0.5 per cent), Indonesia (0.18 per cent) and India (0.15 per cent).

Along with such growth opportunities come challenges. Real estate costs, limited rental availability, infrastructure underdevelopment, lack of professionalised services and increasing competition are just some of the realities club operators face when working in Asia-Pacific markets. However, a favorable economic outlook, along with increasing health awareness and demand for group exercise and personalised training are expected to spur expansion.

“Driven by the momentum of economic prosperity, the fitness market in the Asia-Pacific region has shown steady growth, with a positive outlook going forward,” says Alan MacCharles, partner at Deloitte China. “Overall market penetration is on an upward trajectory, reflecting an increasing awareness of the importance of good health and the role a club membership can play in this.”

According to MacCharles, the region’s fitness market remains stratified due to varying stages of development, which can be categorised into three tiers:

Tier 1: Australia and New Zealand

Market penetration rates

Australia 15.3 per cent

New Zealand 13.6 per cent

These are relatively established markets, with higher penetration rates than their neighbours. However, the mature and professionalised markets in these countries indicate limited growth potential; labor and real estate costs have also constrained growth here.

Tier 2: Hong Kong, Singapore, Japan and Taiwan

Market penetration rates

Hong Kong 5.85 per cent

Singapore 5.8 per cent

Japan 3.3 per cent

Taiwan 3.0 per cent

These locations belong to the fast-expanding and maturing second-tier markets. This segment features gradually professionalising services, expanding consumer bases, and high concentration of leading players.

With room for growth, already fierce competition is expected to continue in the future.

Tier 3: Rest of Asia Pacific

Market penetration rates

Malaysia 1.04 per cent

China’s top 10 cities 0.97 per cent

Philippines 0.53 per cent

Thailand 0.5 per cent

Vietnam 0.5 per cent

Indonesia 0.18 per cent

India 0.15 per cent

The remaining seven Asia Pacific markets assessed by Deloitte are still in a comparatively early stage in their lifecycle, as a result of slower economic development and low awareness of personal health as a priority.

The fitness industry in these countries is typically concentrated in the capital city and also the first-tier cities, where markets are mainly led by the larger, commercial fitness club chains.

The markets in second-tier (and under) cities are dominated by standalone players that are mostly lower-end single site, independently owned operators, due to infrastructure underdevelopment, low purchasing power and low awareness of personalised training.

The underdeveloped regions in these countries demonstrate high growth potential – especially as rapid infrastructure development improves the accessibility and connectivity of these locations.

Impact of Gym Contracts

Laws relating to the way gym contracts are configured have an impact on the way markets develop. For example, in New Zealand, up-front payment for a long-term membership is forbidden by law, while in Singapore, some clubs collect one- and two-year contracts up-front.

Australia

“The Australian fitness market has experienced rapid expansion in the past three years, led primarily by the growth of fitness franchises. F45 has opened 200 new clubs; Anytime Fitness has added 70; Jetts Fitness has added 60; and Plus Fitness has increased by 45 clubs.”

China

“Independent market research indicates that less than 20 per cent of all clubs in China are profitable, while at least 60 per cent are experiencing losses.”India

“Retention rates are low in the Indian fitness club market. From a cultural standpoint, members treat fitness as a goal to be achieved and have yet to see it as a lifestyle to be maintained or to act on this as an aspiration.”Indonesia

“Because the provision of sidewalks is limited in Jakarta, running outdoors is not a fitness option for people in the city, so fitness centres have become lifestyle destinations for people who want to exercise in safety.”Japan

“The ratio of public to commercial gyms is close to 50:50. In spite of this, public gyms are not seen as competitors to commercial gyms and the two co-exist.”Malaysia

“Fitness activities are typically male-focused in Malaysia, largely for cultural reasons. An estimated 60 per cent of fitness members are male in the capital, Kuala Lumpur, while the level is at least 70 per cent elsewhere.”New Zealand

“Growing awareness of the importance of healthy living has led to an increase in the penetration rate, up from 1.38 per cent in 2014 to 13.6 per cent in 2017. 24-hour gyms are the fastest- growing sector.”The Philippines

“The Philippines has achieved one of the highest increases in fitness club penetration over the past three years, due primarily to the rise of affordable gyms which have opened up the market.”Singapore

“Bulky equipment is being replaced by open space and group exercise is becoming popular. A medium to small gym size suits the cost-saving strategy for operators and also better fits customers’ needs.”South Korea

“Due to high rental costs, fitness clubs are generally smaller in size in South Korea compared to most of the counterparts in other Asia Pacific countries, excluding Hong Kong and Japan.”Taiwan

“The top five players claim 77% of the overall market in terms of number of gyms.”Thailand

“Most Thais still prefer to exercise in public parks, at home, or not at all.”Vietnam

“The fitness club market was worth US$186 million in 2017, and is expected to expand rapidly in the next three years as Vietnamese investors start focusing on the industry.”The Asia Pacific health club market

Access the report

The full report is available at a price of US$299 for IHRSA members and US$599 for non-members from ihrsa.org/publications. Contact

[email protected] with questions. Perfect Gym sponsored the report.